Form 958 - Idaho Income Tax Withholding Return

ADVERTISEMENT

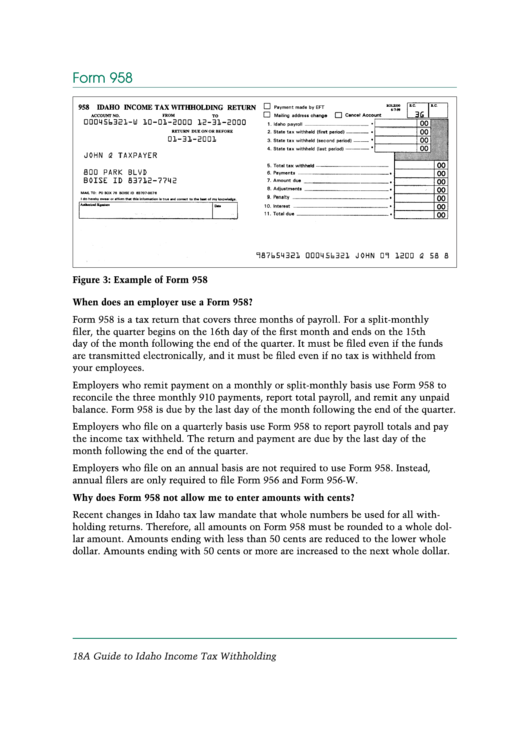

Form 958

Figure 3: Example of Form 958

When does an employer use a Form 958?

Form 958 is a tax return that covers three months of payroll. For a split-monthly

filer, the quarter begins on the 16th day of the first month and ends on the 15th

day of the month following the end of the quarter. It must be filed even if the funds

are transmitted electronically, and it must be filed even if no tax is withheld from

your employees.

Employers who remit payment on a monthly or split-monthly basis use Form 958 to

reconcile the three monthly 910 payments, report total payroll, and remit any unpaid

balance. Form 958 is due by the last day of the month following the end of the quarter.

Employers who file on a quarterly basis use Form 958 to report payroll totals and pay

the income tax withheld. The return and payment are due by the last day of the

month following the end of the quarter.

Employers who file on an annual basis are not required to use Form 958. Instead,

annual filers are only required to file Form 956 and Form 956-W.

Why does Form 958 not allow me to enter amounts with cents?

Recent changes in Idaho tax law mandate that whole numbers be used for all with-

holding returns. Therefore, all amounts on Form 958 must be rounded to a whole dol-

lar amount. Amounts ending with less than 50 cents are reduced to the lower whole

dollar. Amounts ending with 50 cents or more are increased to the next whole dollar.

18

A Guide to Idaho Income Tax Withholding

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3