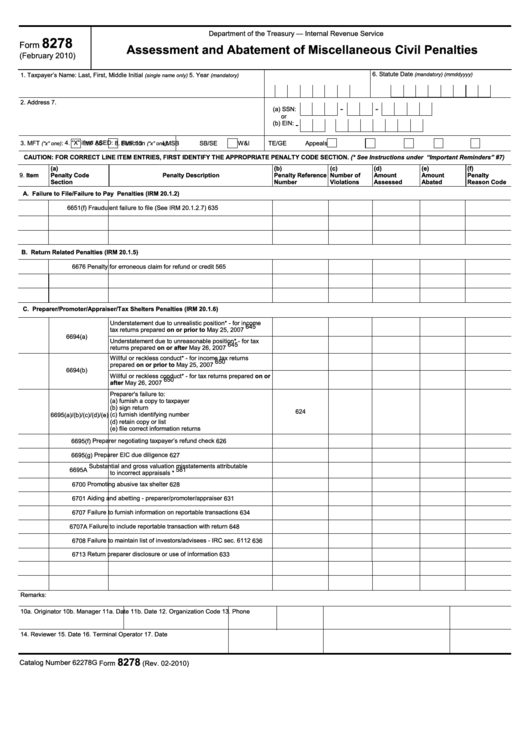

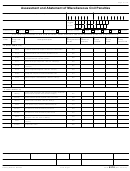

Department of the Treasury — Internal Revenue Service

8278

Form

Assessment and Abatement of Miscellaneous Civil Penalties

(February 2010)

6. Statute Date

1. Taxpayer’s Name: Last, First, Middle Initial

5. Year

(mandatory) (mmddyyyy)

(single name only)

(mandatory)

2. Address

7.

-

-

(a) SSN:

or

(b) EIN:

-

4. “X” if no ASED:

3. MFT

:

IMF 55

BMF 13

8. Function

:

LMSB

SB/SE

W&I

TE/GE

Appeals

("x" one)

(“x” one)

CAUTION: FOR CORRECT LINE ITEM ENTRIES, FIRST IDENTIFY THE APPROPRIATE PENALTY CODE SECTION. (* See Instructions under “Important Reminders” #7)

(a)

(b)

(c)

(d)

(e)

(f)

9. Item

Penalty Code

Penalty Description

Penalty Reference

Number of

Amount

Amount

Penalty

Section

Number

Violations

Assessed

Abated

Reason Code

A. Failure to File/Failure to Pay Penalties (IRM 20.1.2)

6651(f)

Fraudulent failure to file (See IRM 20.1.2.7)

635

B. Return Related Penalties (IRM 20.1.5)

6676

Penalty for erroneous claim for refund or credit

565

C. Preparer/Promoter/Appraiser/Tax Shelters Penalties (IRM 20.1.6)

Understatement due to unrealistic position* - for income

645

tax returns prepared on or prior to May 25, 2007

6694(a)

Understatement due to unreasonable position* - for tax

645

returns prepared on or after May 26, 2007

Willful or reckless conduct* - for income tax returns

650

prepared on or prior to May 25, 2007

6694(b)

Willful or reckless conduct* - for tax returns prepared on or

650

after May 26, 2007

Preparer's failure to:

(a) furnish a copy to taxpayer

(b) sign return

624

(c) furnish identifying number

6695(a)/(b)/(c)/(d)/(e)

(d) retain copy or list

(e) file correct information returns

Preparer negotiating taxpayer’s refund check

6695(f)

626

Preparer EIC due diligence

6695(g)

627

Substantial and gross valuation misstatements attributable

6695A

581

to incorrect appraisals *

Promoting abusive tax shelter

6700

628

Aiding and abetting - preparer/promoter/appraiser

6701

631

6707

Failure to furnish information on reportable transactions

634

6707A

Failure to include reportable transaction with return

648

Failure to maintain list of investors/advisees - IRC sec. 6112

6708

636

6713

Return preparer disclosure or use of information

633

Remarks:

10a. Originator

10b. Manager

11a. Date

11b. Date

12. Organization Code

13. Phone

14. Reviewer

15. Date

16. Terminal Operator

17. Date

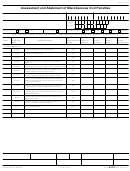

8278

Catalog Number 62278G

Form

(Rev. 02-2010)

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8