Instructions For Completing The Eft Authorization Form

ADVERTISEMENT

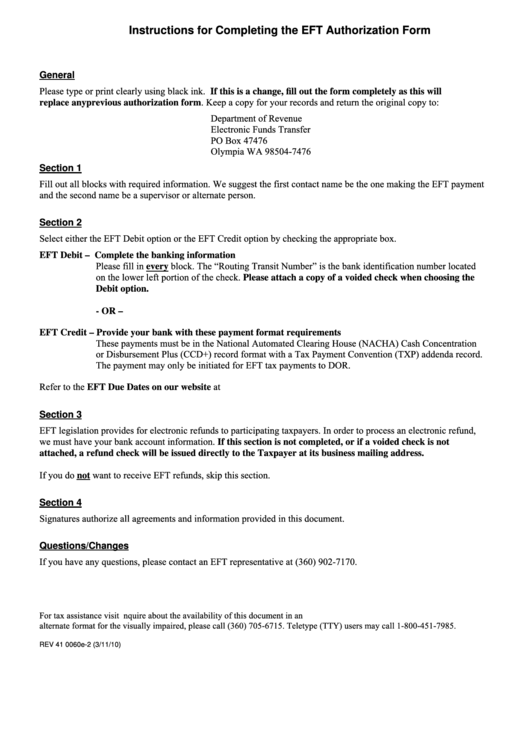

Instructions for Completing the EFT Authorization Form

General

Please type or print clearly using black ink. If this is a change, fill out the form completely as this will

replace any previous authorization form. Keep a copy for your records and return the original copy to:

Department of Revenue

Electronic Funds Transfer

PO Box 47476

Olympia WA 98504-7476

Section 1

Fill out all blocks with required information. We suggest the first contact name be the one making the EFT payment

and the second name be a supervisor or alternate person.

Section 2

Select either the EFT Debit option or the EFT Credit option by checking the appropriate box.

EFT Debit – Complete the banking information

Please fill in every block. The “Routing Transit Number” is the bank identification number located

on the lower left portion of the check. Please attach a copy of a voided check when choosing the

Debit option.

- OR –

EFT Credit – Provide your bank with these payment format requirements

These payments must be in the National Automated Clearing House (NACHA) Cash Concentration

or Disbursement Plus (CCD+) record format with a Tax Payment Convention (TXP) addenda record.

The payment may only be initiated for EFT tax payments to DOR.

Refer to the EFT Due Dates on our website at dor.wa.gov/eft to ensure timely payments for both options.

Section 3

EFT legislation provides for electronic refunds to participating taxpayers. In order to process an electronic refund,

we must have your bank account information. If this section is not completed, or if a voided check is not

attached, a refund check will be issued directly to the Taxpayer at its business mailing address.

If you do not want to receive EFT refunds, skip this section.

Section 4

Signatures authorize all agreements and information provided in this document.

Questions/Changes

If you have any questions, please contact an EFT representative at (360) 902-7170.

For tax assistance visit dor.wa.gov or call 1-800-647-7706. To inquire about the availability of this document in an

alternate format for the visually impaired, please call (360) 705-6715. Teletype (TTY) users may call 1-800-451-7985.

REV 41 0060e-2 (3/11/10)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1