Monthly Sales Return Form - City Of Lakewood

ADVERTISEMENT

City of Lakewood

Please mail this return along with

a check or money order to:

REVENUE DIVISION

REVENUE DIVISION

PO BOX 17479

PO BOX 17479

DENVER, CO 80217

DENVER, CO 80217

Tax Sales

Account

Letter

Period

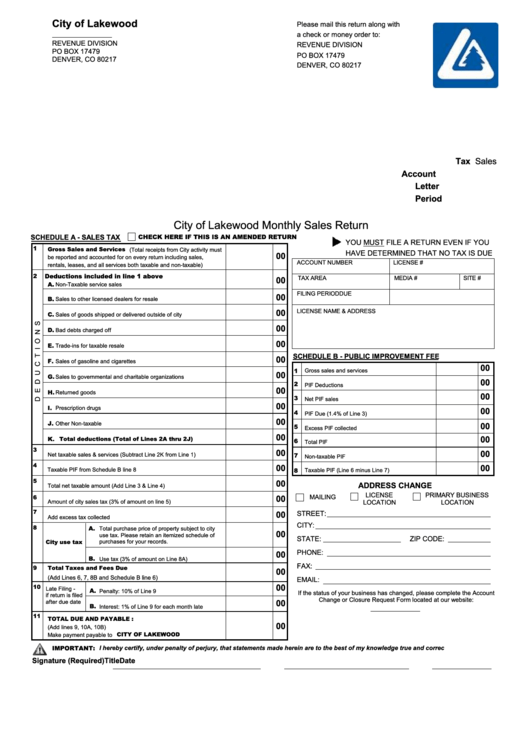

City of Lakewood Monthly Sales Return

SCHEDULE A - SALES TAX

CHECK HERE IF THIS IS AN AMENDED RETURN

YOU MUST FILE A RETURN EVEN IF YOU

1

Gross Sales and Services (Total receipts from City activity must

HAVE DETERMINED THAT NO TAX IS DUE

00

be reported and accounted for on every return including sales,

ACCOUNT NUMBER

LICENSE #

rentals, leases, and all services both taxable and non-taxable)

Deductions included in line 1 above

2

TAX AREA

MEDIA #

SITE #

00

A.

Non-Taxable service sales

FILING PERIOD

DUE

00

B.

Sales to other licensed dealers for resale

LICENSE NAME & ADDRESS

00

C.

Sales of goods shipped or delivered outside of city

00

D.

Bad debts charged off

00

E.

Trade-ins for taxable resale

SCHEDULE B - PUBLIC IMPROVEMENT FEE

00

F.

Sales of gasoline and cigarettes

00

1

Gross sales and services

00

G.

Sales to governmental and charitable organizations

00

2

PIF Deductions

00

H.

Returned goods

00

3

Net PIF sales

00

I.

Prescription drugs

00

4

PIF Due (1.4% of Line 3)

00

J.

Other Non-taxable

00

5

Excess PIF collected

00

00

K.

Total deductions (Total of Lines 2A thru 2J)

6

Total PIF

3

00

00

Net taxable sales & services (Subtract Line 2K from Line 1)

7

Non-taxable PIF

4

00

00

Taxable PIF from Schedule B line 8

8

Taxable PIF (Line 6 minus Line 7)

5

00

ADDRESS CHANGE

Total net taxable amount (Add Line 3 & Line 4)

LICENSE

PRIMARY BUSINESS

MAILING

6

00

Amount of city sales tax (3% of amount on line 5)

LOCATION

LOCATION

7

00

STREET:

Add excess tax collected

CITY:

8

A.

Total purchase price of property subject to city

00

use tax. Please retain an itemized schedule of

STATE:

ZIP CODE:

City use tax

purchases for your records.

PHONE:

00

B.

Use tax (3% of amount on Line 8A)

FAX:

9

Total Taxes and Fees Due

00

(Add Lines 6, 7, 8B and Schedule B line 6)

EMAIL:

00

10

Late Filing -

A.

Penalty: 10% of Line 9

If the status of your business has changed, please complete the Account

if return is filed

Change or Closure Request Form located at our website:

after due date

00

B.

Interest: 1% of Line 9 for each month late

11

TOTAL DUE AND PAYABLE :

00

(Add lines 9, 10A, 10B)

Make payment payable to CITY OF LAKEWOOD

IMPORTANT:

I hereby certify, under penalty of perjury, that statements made herein are to the best of my knowledge true and correct.

Signature (Required)

Title

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1