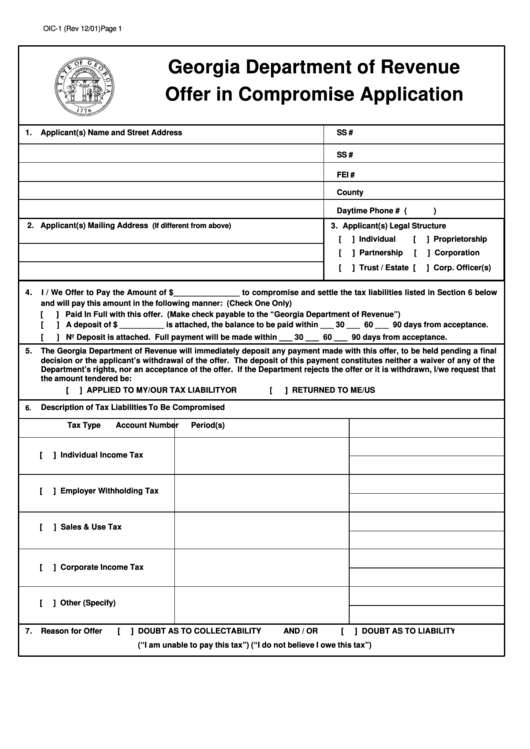

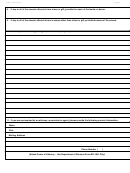

Form Oic-1 - Offer In Compromise Application - 2001

ADVERTISEMENT

OIC-1 (Rev 12/01)

Page 1

Georgia Department of Revenue

Offer in Compromise Application

1.

Applicant(s) Name and Street Address

SS #

SS #

FEI #

County

Daytime Phone # (

)

2. Applicant(s) Mailing Address

3. Applicant(s) Legal Structure

(If different from above)

[

] Individual

[

] Proprietorship

[

] Partnership

[

] Corporation

[

] Trust / Estate [

] Corp. Officer(s)

4.

I / We Offer to Pay the Amount of $_______________ to compromise and settle the tax liabilities listed in Section 6 below

and will pay this amount in the following manner: (Check One Only)

[

] Paid In Full with this offer. (Make check payable to the “Georgia Department of Revenue”)

[

] A deposit of $ __________ is attached, the balance to be paid within ___ 30 ___ 60 ___ 90 days from acceptance.

[

] No Deposit is attached. Full payment will be made within ___ 30 ___ 60 ___ 90 days from acceptance.

5.

The Georgia Department of Revenue will immediately deposit any payment made with this offer, to be held pending a final

decision or the applicant’s withdrawal of the offer. The deposit of this payment constitutes neither a waiver of any of the

Department’s rights, nor an acceptance of the offer. If the Department rejects the offer or it is withdrawn, I/we request that

the amount tendered be:

[

] APPLIED TO MY/OUR TAX LIABILITY

OR

[

] RETURNED TO ME/US

Description of Tax Liabilities To Be Compromised

6.

Tax Type

Account Number

Period(s)

[

] Individual Income Tax

[

] Employer Withholding Tax

[

] Sales & Use Tax

[

] Corporate Income Tax

[

] Other (Specify)

7.

Reason for Offer

[

] DOUBT AS TO COLLECTABILITY

AND / OR

[

] DOUBT AS TO LIABILITY

(“I am unable to pay this tax”)

(“I do not believe I owe this tax”)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4