Form Oic-1 - Offer In Compromise Application - 2001 Page 3

ADVERTISEMENT

OIC-1 (Rev 12/01)

Page 3

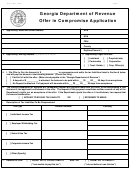

12. TERMS AND CONDITIONS

By submitting this offer and signing below, I/we understand and agree to the Department’s Offer in Compromise

TERMS AND CONDITIONS as follows:

a)

I/we voluntarily submit any payment made with this offer.

b)

The Department will apply any payment made under the terms of this offer according to the best interests of the

State.

c)

If the Department rejects the offer or if the offer is withdrawn, the Department will treat any amount paid with the

offer per my/our direction, as given on Page 1, Item 4, of this application. I/we understand that the Department will

not pay interest on any amount submitted with the offer.

d)

I/we will remain in compliance with all tax return filing provisions of the Georgia Public Revenue Code while this

offer is pending. I/we will comply with these provisions for a period of five (5) years from the date of notification of

acceptance of this offer.

e)

The offer becomes officially acknowledged once written notification of receipt has been made by an authorized

Department official. The offer remains pending until an authorized Department official issues notification of

acceptance or rejection, or until the offer is withdrawn by me/us.

f)

I/we understand that collection activity is normally suspended while an offer is pending; however, such

suspension is not required by law. I/we further understand that collection activity may continue if it is determined

to be in the State’s best interests, or if it is otherwise determined that the filing of the offer has not been made in

good faith.

g)

The Department will retain and apply any payment toward the liability for which this offer is made, if such payment

was received prior to official acknowledgment of the offer. The Department will retain and apply all credits due to

refund offset when such credits are received prior to the full payment of an accepted offer.

h)

I/we understand that the tax I/we owe is, and will remain, a tax liability until I/we meet all the terms and conditions

of this offer. If I/we file bankruptcy before the terms and conditions of this offer are completed, any claim the

Department files in a bankruptcy proceeding will be a tax claim.

i)

If I/we fail to meet the terms and conditions of an accepted offer, the offer will be considered null and void. The

Department will continue to add applicable interest and penalty on the total unpaid balance until paid in full. In

addition, the Department may:

1)

Immediately issue and record any tax fi.fa. necessary to protect the State’s legal interest;

2)

Proceed with enforced collection of the total outstanding liability;

3)

Apply amounts already paid under the offer to the total liability.

I/WE HAVE EXAMINED THIS OFFER, INCLUDING ACCOMPANYING SCHEDULES AND STATEMENTS, AND HEREBY

AFFIRM THAT TO THE BEST OF MY/OUR KNOWLEDGE AND BELIEF IT IS TRUE, CORRECT AND COMPLETE.

APPLICANT’S SIGNATURE

DATE

APPLICANT’S SIGNATURE

DATE

POWER OF ATTORNEY SIGNATURE

DATE

NOTE:

Departmental Forms CD LO-14B (Statement of Financial Condition for Individuals) and/or CD LO-14C

(Statement of Financial Condition for Businesses) must be completed, signed and attached in order for this to be a

complete offer. IRS financial statements Forms 433-A and/or 433-B may be substituted for Forms CD LO-14B and CD

LO-14C, provided the IRS forms were prepared within six months of the date of this offer. Department personnel may

request verification of the financial information provided on these forms and may request additional information.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4