S

B

TATE

OARD

O

E

F

QUALIZATION

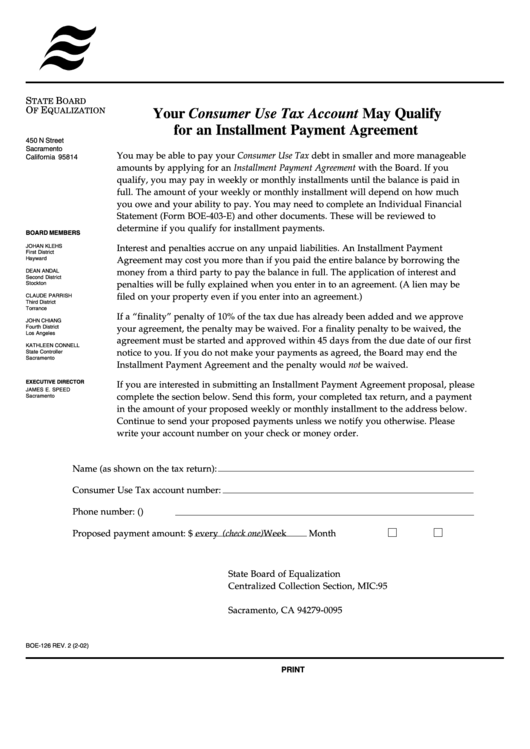

Your Consumer Use Tax Account May Qualify

for an Installment Payment Agreement

450 N Street

Sacramento

You may be able to pay your Consumer Use Tax debt in smaller and more manageable

California 95814

amounts by applying for an Installment Payment Agreement with the Board. If you

qualify, you may pay in weekly or monthly installments until the balance is paid in

full. The amount of your weekly or monthly installment will depend on how much

you owe and your ability to pay. You may need to complete an Individual Financial

Statement (Form BOE-403-E) and other documents. These will be reviewed to

determine if you qualify for installment payments.

BOARD MEMBERS

JOHAN KLEHS

Interest and penalties accrue on any unpaid liabilities. An Installment Payment

First District

Agreement may cost you more than if you paid the entire balance by borrowing the

Hayward

DEAN ANDAL

money from a third party to pay the balance in full. The application of interest and

Second District

penalties will be fully explained when you enter in to an agreement. (A lien may be

Stockton

filed on your property even if you enter into an agreement.)

CLAUDE PARRISH

Third District

Torrance

If a “finality” penalty of 10% of the tax due has already been added and we approve

JOHN CHIANG

Fourth District

your agreement, the penalty may be waived. For a finality penalty to be waived, the

Los Angeles

agreement must be started and approved within 45 days from the due date of our first

KATHLEEN CONNELL

notice to you. If you do not make your payments as agreed, the Board may end the

State Controller

Sacramento

Installment Payment Agreement and the penalty would not be waived.

EXECUTIVE DIRECTOR

If you are interested in submitting an Installment Payment Agreement proposal, please

JAMES E. SPEED

complete the section below. Send this form, your completed tax return, and a payment

Sacramento

in the amount of your proposed weekly or monthly installment to the address below.

Continue to send your proposed payments unless we notify you otherwise. Please

write your account number on your check or money order.

Name (as shown on the tax return):

Consumer Use Tax account number:

Phone number: (

)

Proposed payment amount: $

every (check one)

Week

Month

State Board of Equalization

Centralized Collection Section, MIC:95

P.O. Box 942879

Sacramento, CA 94279-0095

BOE-126 REV. 2 (2-02)

CLEAR

PRINT

1

1