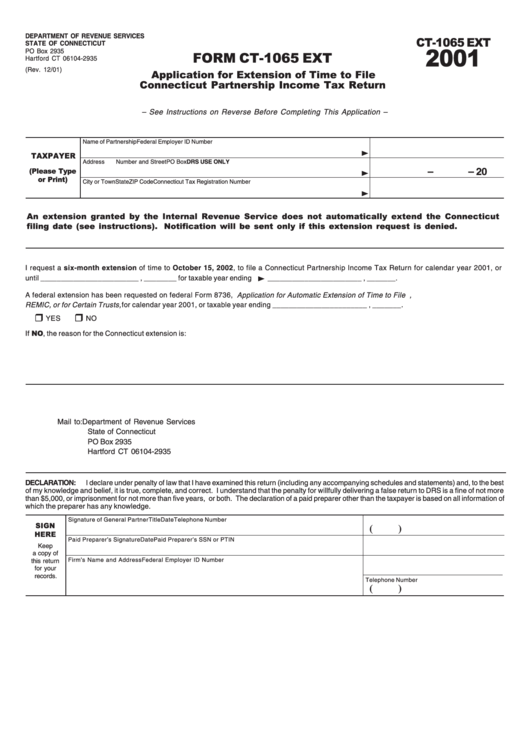

Form Ct-1065 Ext - Application For Extension Of Time To File Connecticut Partnership Income Tax Return 2001

ADVERTISEMENT

DEPARTMENT OF REVENUE SERVICES

CT-1065 EXT

2001

STATE OF CONNECTICUT

FORM CT-1065 EXT

PO Box 2935

Hartford CT 06104-2935

(Rev. 12/01)

Application for Extension of Time to File

Connecticut Partnership Income Tax Return

– See Instructions on Reverse Before Completing This Application –

Name of Partnership

Federal Employer ID Number

TAXPAYER

Address

Number and Street

PO Box

DRS USE ONLY

(Please Type

–

– 20

or Print)

City or Town

State

ZIP Code

Connecticut Tax Registration Number

An extension granted by the Internal Revenue Service does not automatically extend the Connecticut

filing date (see instructions). Notification will be sent only if this extension request is denied.

I request a six-month extension of time to October 15, 2002, to file a Connecticut Partnership Income Tax Return for calendar year 2001, or

until ________________________ , ________ for taxable year ending

_______________________ , _______.

A federal extension has been requested on federal Form 8736, Application for Automatic Extension of Time to File U.S. Return for a Partnership,

REMIC, or for Certain Trusts, for calendar year 2001, or taxable year ending _______________________ , _______.

YES

NO

If NO, the reason for the Connecticut extension is: ...................................................................................................................................................

................................................................................................................................................................................................................................

................................................................................................................................................................................................................................

................................................................................................................................................................................................................................

Mail to: Department of Revenue Services

State of Connecticut

PO Box 2935

Hartford CT 06104-2935

DECLARATION:

I declare under penalty of law that I have examined this return (including any accompanying schedules and statements) and, to the best

of my knowledge and belief, it is true, complete, and correct. I understand that the penalty for willfully delivering a false return to DRS is a fine of not more

than $5,000, or imprisonment for not more than five years, or both. The declaration of a paid preparer other than the taxpayer is based on all information of

which the preparer has any knowledge.

Signature of General Partner

Title

Date

Telephone Number

SIGN

(

)

HERE

Paid Preparer’s Signature

Date

Paid Preparer’s SSN or PTIN

Keep

a copy of

Firm’s Name and Address

Federal Employer ID Number

this return

for your

records.

Telephone Number

(

)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1