Form N-1 - Declaration Estimated Norwood Income Tax

ADVERTISEMENT

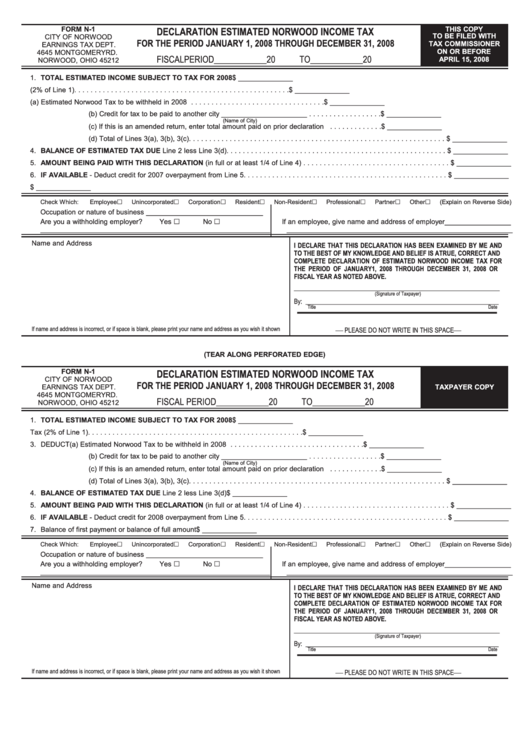

FORM N-1

THIS COPY

DECLARATION ESTIMATED NORWOOD INCOME TAX

TO BE FILED WITH

CITY OF NORWOOD

FOR THE PERIOD JANUARY 1, 2008 THROUGH DECEMBER 31, 2008

TAX COMMISSIONER

EARNINGS TAX DEPT.

ON OR BEFORE

4645 MONTGOMERY RD.

FISCAL PERIOD____________20

TO____________20

APRIL 15, 2008

NORWOOD, OHIO 45212

1. TOTAL ESTIMATED INCOME SUBJECT TO TAX FOR 2008 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ ______________

2. Estimated Tax (2% of Line 1)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ ______________

3. DEDUCT

(a) Estimated Norwood Tax to be withheld in 2008 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ ______________

(b) Credit for tax to be paid to another city ______________________ . . . . . . . . . . . . . . . . . . $ ______________

(Name of City)

(c) If this is an amended return, enter total amount paid on prior declaration . . . . . . . . . . . . . $ ______________

(d) Total of Lines 3(a), 3(b), 3(c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ ______________

4. BALANCE OF ESTIMATED TAX DUE Line 2 less Line 3(d) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ ______________

5. AMOUNT BEING PAID WITH THIS DECLARATION (in full or at least 1/4 of Line 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ ______________

6. IF AVAILABLE - Deduct credit for 2007 overpayment from Line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ ______________

7. Balance of first payment or balance of full amount . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ ______________

Check Which:

Employee£

Unincorporated£

Corporation£

Resident£

Non-Resident£

Professional£

Partner£

Other£

(Explain on Reverse Side)

Occupation or nature of business ______________________________

S.S. NO. or FED. ID. _______________________ Tel. No. ___________

Are you a withholding employer?

Yes £

No £

If an employee, give name and address of employer _________________

___________________________________________________________

__________________________________________________________

Name and Address

I DECLARE THAT THIS DECLARATION HAS BEEN EXAMINED BY ME AND

TO THE BEST OF MY KNOWLEDGE AND BELIEF IS A TRUE, CORRECT AND

COMPLETE DECLARATION OF ESTIMATED NORWOOD INCOME TAX FOR

THE PERIOD OF JANUARY 1, 2008 THROUGH DECEMBER 31, 2008 OR

FISCAL YEAR AS NOTED ABOVE.

______________

_________________________________________________________________

(Signature of Taxpayer)

By: _____________________________________________________________

Title

Date

If name and address is incorrect, or if space is blank, please print your name and address as you wish it shown

¾ PLEASE DO NOT WRITE IN THIS SPACE¾

(TEAR ALONG PERFORATED EDGE)

FORM N-1

DECLARATION ESTIMATED NORWOOD INCOME TAX

CITY OF NORWOOD

FOR THE PERIOD JANUARY 1, 2008 THROUGH DECEMBER 31, 2008

EARNINGS TAX DEPT.

TAXPAYER COPY

4645 MONTGOMERY RD.

FISCAL PERIOD____________20

TO____________20

NORWOOD, OHIO 45212

1. TOTAL ESTIMATED INCOME SUBJECT TO TAX FOR 2008 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ ______________

2. Estimated Tax (2% of Line 1)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ ______________

3. DEDUCT

(a) Estimated Norwood Tax to be withheld in 2008 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ ______________

(b) Credit for tax to be paid to another city ______________________ . . . . . . . . . . . . . . . . . . $ ______________

(Name of City)

(c) If this is an amended return, enter total amount paid on prior declaration . . . . . . . . . . . . . $ ______________

(d) Total of Lines 3(a), 3(b), 3(c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ ______________

4. BALANCE OF ESTIMATED TAX DUE Line 2 less Line 3(d) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ ______________

5. AMOUNT BEING PAID WITH THIS DECLARATION (in full or at least 1/4 of Line 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ ______________

6. IF AVAILABLE - Deduct credit for 2008 overpayment from Line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ ______________

7. Balance of first payment or balance of full amount . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ ______________

Check Which:

Employee£

Unincorporated£

Corporation£

Resident£

Non-Resident£

Professional£

Partner£

Other£

(Explain on Reverse Side)

Occupation or nature of business ______________________________

S.S. NO. or FED. ID. _______________________ Tel. No. ___________

Are you a withholding employer?

Yes £

No £

If an employee, give name and address of employer _________________

___________________________________________________________

__________________________________________________________

Name and Address

I DECLARE THAT THIS DECLARATION HAS BEEN EXAMINED BY ME AND

TO THE BEST OF MY KNOWLEDGE AND BELIEF IS A TRUE, CORRECT AND

COMPLETE DECLARATION OF ESTIMATED NORWOOD INCOME TAX FOR

THE PERIOD OF JANUARY 1, 2008 THROUGH DECEMBER 31, 2008 OR

FISCAL YEAR AS NOTED ABOVE.

______________

_________________________________________________________________

(Signature of Taxpayer)

By: _____________________________________________________________

Title

Date

If name and address is incorrect, or if space is blank, please print your name and address as you wish it shown

¾ PLEASE DO NOT WRITE IN THIS SPACE¾

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1