Application For Sales And Use Tax License

ADVERTISEMENT

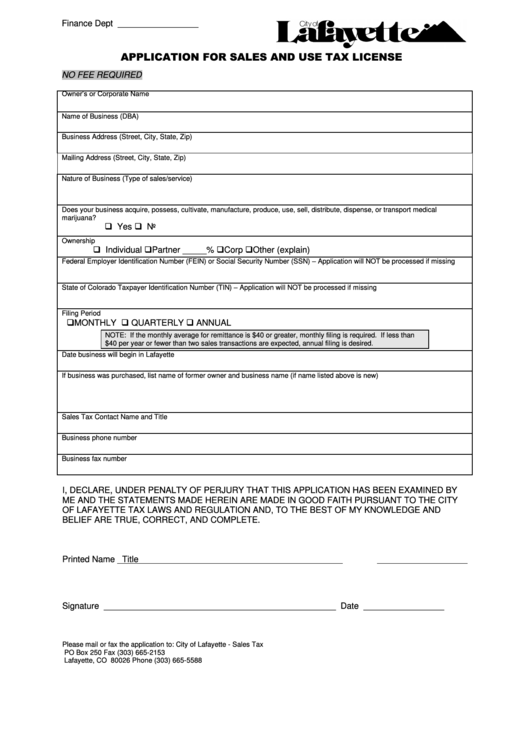

Finance Dept _________________

APPLICATION FOR SALES AND USE TAX LICENSE

NO FEE REQUIRED

Owner’s or Corporate Name

Name of Business (DBA)

Business Address (Street, City, State, Zip)

Mailing Address (Street, City, State, Zip)

Nature of Business (Type of sales/service)

Does your business acquire, possess, cultivate, manufacture, produce, use, sell, distribute, dispense, or transport medical

marijuana?

Yes

No

Ownership

Individual

Partner _____%

Corp

Other (explain)

Federal Employer Identification Number (FEIN) or Social Security Number (SSN) – Application will NOT be processed if missing

State of Colorado Taxpayer Identification Number (TIN) – Application will NOT be processed if missing

Filing Period

MONTHLY

QUARTERLY

ANNUAL

NOTE: If the monthly average for remittance is $40 or greater, monthly filing is required. If less than

$40 per year or fewer than two sales transactions are expected, annual filing is desired.

Date business will begin in Lafayette

If business was purchased, list name of former owner and business name (if name listed above is new)

Sales Tax Contact Name and Title

Business phone number

Business fax number

I, DECLARE, UNDER PENALTY OF PERJURY THAT THIS APPLICATION HAS BEEN EXAMINED BY

ME AND THE STATEMENTS MADE HEREIN ARE MADE IN GOOD FAITH PURSUANT TO THE CITY

OF LAFAYETTE TAX LAWS AND REGULATION AND, TO THE BEST OF MY KNOWLEDGE AND

BELIEF ARE TRUE, CORRECT, AND COMPLETE.

Printed Name

Title

Signature _________________________________________________

Date _________________

Please mail or fax the application to:

City of Lafayette - Sales Tax

PO Box 250

Fax

(303) 665-2153

Lafayette, CO 80026

Phone

(303) 665-5588

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1