Form 115-C - Establishment Of Certain Notice Filing Fees Under The Corporate Securities Law Of 1968 (2004)

ADVERTISEMENT

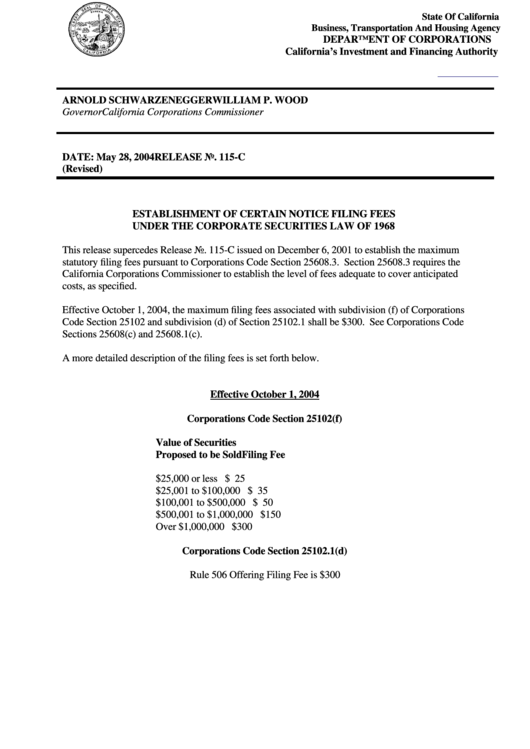

State Of California

Business, Transportation And Housing Agency

DEPARTMENT OF CORPORATIONS

California’s Investment and Financing Authority

ARNOLD SCHWARZENEGGER

WILLIAM P. WOOD

Governor

California Corporations Commissioner

DATE: May 28, 2004

RELEASE No. 115-C

(Revised)

ESTABLISHMENT OF CERTAIN NOTICE FILING FEES

UNDER THE CORPORATE SECURITIES LAW OF 1968

This release supercedes Release No. 115-C issued on December 6, 2001 to establish the maximum

statutory filing fees pursuant to Corporations Code Section 25608.3. Section 25608.3 requires the

California Corporations Commissioner to establish the level of fees adequate to cover anticipated

costs, as specified.

Effective October 1, 2004, the maximum filing fees associated with subdivision (f) of Corporations

Code Section 25102 and subdivision (d) of Section 25102.1 shall be $300. See Corporations Code

Sections 25608(c) and 25608.1(c).

A more detailed description of the filing fees is set forth below.

Effective October 1, 2004

Corporations Code Section 25102(f)

Value of Securities

Proposed to be Sold

Filing Fee

$25,000 or less

$ 25

$25,001 to $100,000

$ 35

$100,001 to $500,000

$ 50

$500,001 to $1,000,000

$150

Over $1,000,000

$300

Corporations Code Section 25102.1(d)

Rule 506 Offering Filing Fee is $300

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4