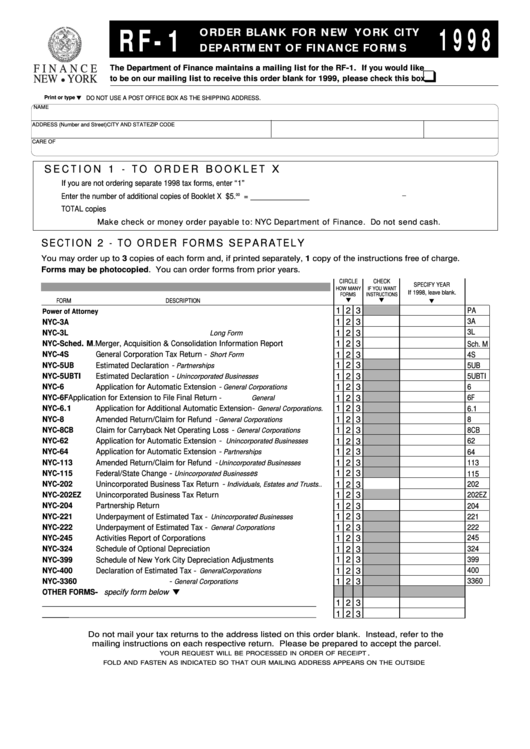

1998

R F - 1

ORDER BLANK FOR NEW YORK CITY

DEPARTMENT OF FINANCE FORMS

F I N A N C E

The Department of Finance maintains a mailing list for the RF-1. If you would like

q

NEW

YORK

to be on our mailing list to receive this order blank for 1999, please check this box

.................

l

Print or type t

DO NOT USE A POST OFFICE BOX AS THE SHIPPING ADDRESS.

NAME

ADDRESS (Number and Street)

CITY AND STATE

ZIP CODE

CARE OF

S E C T I O N 1 - T O O R D E R B O O K L E T X

If you are not ordering separate 1998 tax forms, enter “1” .................................._______________

Enter the number of additional copies of Booklet X .............................................. _______________ X $5.

00

= ______________

TOTAL copies ....................................................................................................... _______________

Make check or money order payable to: NYC Department of Finance. Do not send cash.

S E C T I O N 2 - T O O R D E R F O R M S S E PA R AT E LY

You may order up to 3 copies of each form and, if printed separately, 1 copy of the instructions free of charge.

Forms may be photocopied. You can order forms from prior years.

CIRCLE

CHECK

SPECIFY YEAR

HOW MANY

IF YOU WANT

If 1998, leave blank.

FORMS

INSTRUCTIONS

t

t

t

FORM

DESCRIPTION

PA

1 2 3

Power of Attorney ......................................................................................................................

3A

NYC-3A ............Combined General Corporation Tax Return

1 2 3

............................................

3L

NYC-3L ............General Corporation Tax Return -

Long Form ..........................................

1 2 3

NYC-Sched. M.Merger, Acquisition & Consolidation Information Report

1 2 3

....................

Sch. M

NYC-4S ............ General Corporation Tax Return -

Short Form .........................................

1 2 3

4S

NYC-5UB .......... Estimated Declaration -

1 2 3

5UB

Partnerships .........................................................

NYC-5UBTI ...... Estimated Declaration -

1 2 3

5UBTI

Unincorporated Businesses .................................

NYC-6 .............. Application for Automatic Extension -

1 2 3

General Corporations ..................

6

NYC-6F

Application for Extension to File Final Return

6F

..............

- General Corporations....

1 2 3

NYC-6.1 ........... Application for Additional Automatic Extension -

1 2 3

6.1

General Corporations.

NYC-8 .............. Amended Return/Claim for Refund -

8

General Corporations .....................

1 2 3

NYC-8CB .......... Claim for Carryback Net Operating Loss -

1 2 3

8CB

General Corporations ............

NYC-62 ............ Application for Automatic Extension -

1 2 3

62

Unincorporated Businesses .......

NYC-64 ............ Application for Automatic Extension -

1 2 3

64

Partnerships ................................

NYC-113 .......... Amended Return/Claim for Refund -

113

Unincorporated Businesses ...........

1 2 3

NYC-115 .......... Federal/State Change -

es ..............................

1 2 3

Unincorporated Business

115

NYC-202 .......... Unincorporated Business Tax Return -

202

Individuals, Estates and Trusts ..

1 2 3

NYC-202EZ ...... Unincorporated Business Tax Return

1 2 3

202EZ

......................................................

NYC-204 .......... Partnership Return

1 2 3

204

.....................................................................................

NYC-221 .......... Underpayment of Estimated Tax -

1 2 3

221

Unincorporated Businesses ...............

NYC-222 .......... Underpayment of Estimated Tax -

1 2 3

222

General Corporations .........................

NYC-245 .......... Activities Report of Corporations

1 2 3

245

.............................................................

324

NYC-324 .......... Schedule of Optional Depreciation

...........................................................

1 2 3

NYC-399 .......... Schedule of New York City Depreciation Adjustments

399

1 2 3

.........................

NYC-400 .......... Declaration of Estimated Tax -

400

General Corporations ..............................

1 2 3

3360

NYC-3360 ........Federal/State Change -

1 2 3

General Corporations ............................................

t

OTHER FORMS - specify form below

______________________________________________________________

1 2 3

.......

______________________________________________________________

.......

1 2 3

Do not mail your tax returns to the address listed on this order blank. Instead, refer to the

mailing instructions on each respective return. Please be prepared to accept the parcel.

.

YOUR REQUEST WILL BE PROCESSED IN ORDER OF RECEIPT

FOLD AND FASTEN AS INDICATED SO THAT OUR MAILING ADDRESS APPEARS ON THE OUTSIDE

1

1 2

2