Working Family Child Care Credit Sheet - 2004

ADVERTISEMENT

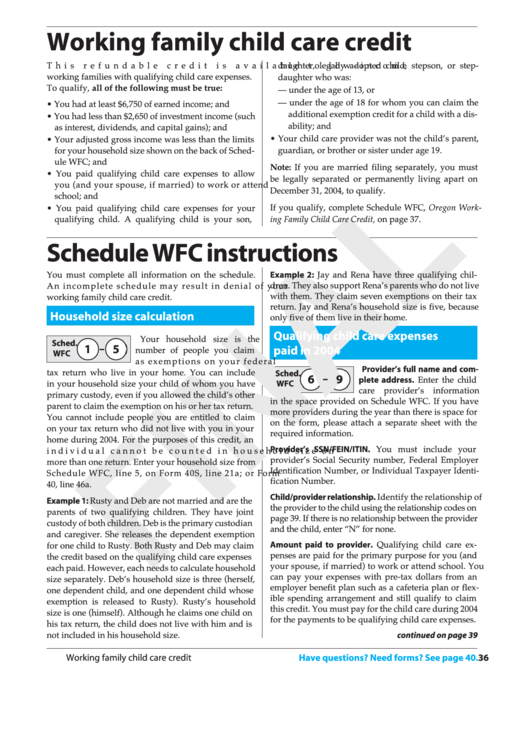

Working family child care credit

This refundable credit is available to low-income

daughter, legally adopted child, stepson, or step-

working families with qualifying child care expenses.

daughter who was:

To qualify, all of the following must be true:

— under the age of 13, or

— under the age of 18 for whom you can claim the

• You had at least $6,750 of earned income; and

additional exemption credit for a child with a dis-

• You had less than $2,650 of investment income (such

ability; and

as interest, dividends, and capital gains); and

• Your child care provider was not the child’s parent,

• Your adjusted gross income was less than the limits

for your household size shown on the back of Sched-

guardian, or brother or sister under age 19.

ule WFC; and

Note: If you are married filing separately, you must

• You paid qualifying child care expenses to allow

be legally separated or permanently living apart on

you (and your spouse, if married) to work or attend

December 31, 2004, to qualify.

school; and

If you qualify, complete Schedule WFC, Oregon Work-

• You paid qualifying child care expenses for your

qualifying child. A qualifying child is your son,

ing Family Child Care Credit, on page 37.

Schedule WFC instructions

You must complete all information on the schedule.

Example 2: Jay and Rena have three qualifying chil-

dren. They also support Rena’s parents who do not live

An incomplete schedule may result in denial of your

with them. They claim seven exemptions on their tax

working family child care credit.

return. Jay and Rena’s household size is five, because

Household size calculation

only five of them live in their home.

Qualifying child care expenses

Your household size is the

Sched.

1

–

5

number of people you claim

paid in 2004

WFC

as exemptions on your federal

Provider’s full name and com-

tax return who live in your home. You can include

Sched.

6

–

9

plete address. Enter the child

in your household size your child of whom you have

WFC

care provider’s information

primary custody, even if you allowed the child’s other

in the space provided on Schedule WFC. If you have

parent to claim the exemption on his or her tax return.

more providers during the year than there is space for

You cannot include people you are entitled to claim

on the form, please attach a separate sheet with the

on your tax return who did not live with you in your

required information.

home during 2004. For the purposes of this credit, an

Provider’s SSN/FEIN/ITIN. You must include your

individual cannot be counted in household size on

provider’s Social Security number, Federal Employer

more than one return. Enter your household size from

Identification Number, or Individual Taxpayer Identi-

Schedule WFC, line 5, on Form 40S, line 21a; or Form

fication Number.

40, line 46a.

Child/provider relationship. Identify the relationship of

Example 1: Rusty and Deb are not married and are the

the provider to the child using the relationship codes on

parents of two qualifying children. They have joint

page 39. If there is no relationship between the provider

custody of both children. Deb is the primary custodian

and the child, enter “N” for none.

and caregiver. She releases the dependent exemption

Amount paid to provider. Qualifying child care ex-

for one child to Rusty. Both Rusty and Deb may claim

penses are paid for the primary purpose for you (and

the credit based on the qualifying child care expenses

your spouse, if married) to work or attend school. You

each paid. However, each needs to calculate household

can pay your expenses with pre-tax dollars from an

size separately. Deb’s household size is three (herself,

employer benefit plan such as a cafeteria plan or flex-

one dependent child, and one dependent child whose

ible spending arrangement and still qualify to claim

exemption is released to Rusty). Rusty’s household

this credit. You must pay for the child care during 2004

size is one (himself). Although he claims one child on

for the payments to be qualifying child care expenses.

his tax return, the child does not live with him and is

not included in his household size.

continued on page 39

36

Working family child care credit

Have questions? Need forms? See page 40.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5