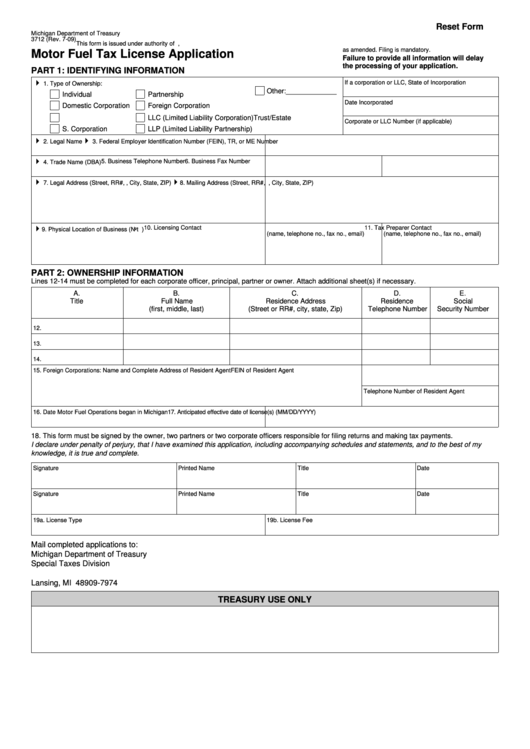

Reset Form

Michigan Department of Treasury

3712 (Rev. 7-09)

This form is issued under authority of P.A. 403 of 2000,

as amended. Filing is mandatory.

Motor Fuel Tax License Application

Failure to provide all information will delay

the processing of your application.

PART 1: IDENTIFYING INFORMATION

If a corporation or LLC, State of Incorporation

1. Type of Ownership:

Other:_____________

Individual

Partnership

Date Incorporated

Domestic Corporation

Foreign Corporation

Trust/Estate

LLC (Limited Liability Corporation)

Corporate or LLC Number (if applicable)

S. Corporation

LLP (Limited Liability Partnership)

2. Legal Name

3. Federal Employer Identification Number (FEIN), TR, or ME Number

5. Business Telephone Number

6. Business Fax Number

4. Trade Name (DBA)

7. Legal Address (Street, RR#, P.O. Box, City, State, ZIP)

8. Mailing Address (Street, RR#, P.O. Box, City, State, ZIP)

10. Licensing Contact

11. Tax Preparer Contact

9. Physical Location of Business (Not P.O. Box)

(name, telephone no., fax no., email)

(name, telephone no., fax no., email)

PART 2: OWNERSHIP INFORMATION

Lines 12-14 must be completed for each corporate officer, principal, partner or owner. Attach additional sheet(s) if necessary.

A.

B.

C.

D.

E.

Title

Full Name

Residence Address

Residence

Social

(first, middle, last)

(Street or RR#, city, state, Zip)

Telephone Number

Security Number

12.

13.

14.

15. Foreign Corporations: Name and Complete Address of Resident Agent

FEIN of Resident Agent

Telephone Number of Resident Agent

16. Date Motor Fuel Operations began in Michigan

17. Anticipated effective date of license(s) (MM/DD/YYYY)

18. This form must be signed by the owner, two partners or two corporate officers responsible for filing returns and making tax payments.

I declare under penalty of perjury, that I have examined this application, including accompanying schedules and statements, and to the best of my

knowledge, it is true and complete.

Signature

Printed Name

Title

Date

Signature

Printed Name

Title

Date

19a. License Type

19b. License Fee

Mail completed applications to:

Michigan Department of Treasury

Special Taxes Division

P.O. Box 30474

Lansing, MI 48909-7974

TREASURY USE ONLY

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8