Form 2793 - 2010 24 And 12 Month Sales Ratio Study For Determining The 2011 Starting Base

ADVERTISEMENT

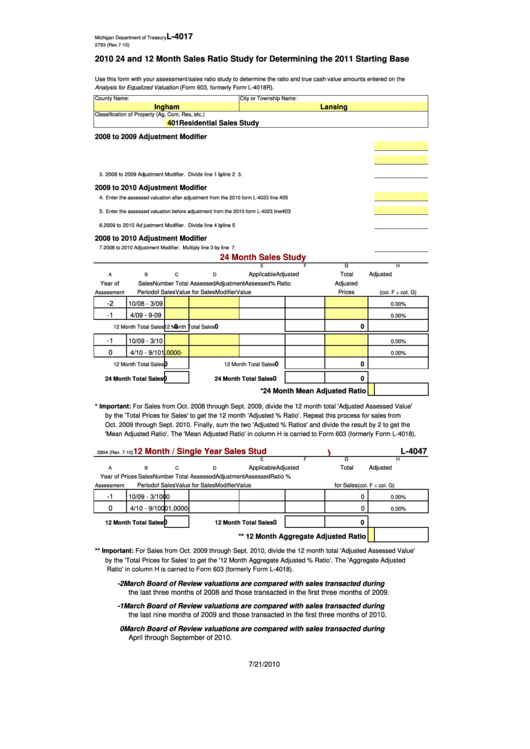

L-4017

Michigan Department of Treasury

2793 (Rev.7-10)

2010 24 and 12 Month Sales Ratio Study for Determining the 2011 Starting Base

Use this form with your assessment/sales ratio study to determine the ratio and true cash value amounts entered on the

Analysis for Equalized Valuation (Form 603, formerly Form L-4018R).

County Name:

City or Township Name:

Ingham

Lansing

Classification of Property (Ag, Com, Res, etc.)

4 01

Residential Sales Study

2008 to 2009 Adjustment Modifier

1. Enter the assessed valuation after adjustment from the 2009 form L-4023 line

4 05 ................... 1.

2. Enter the assessed valuation before adjustment from the 2009 form L-4023 line

4 03 ................... 2.

3. 2008 to 2009 Adjustment Modifier. Divide line 1 by line 2 .......................................................................................... 3.

2009 to 2010 Adjustment Modifier

4. Enter the assessed valuation after adjustment from the 2010 form L-4023 line

4 05 .................. 4.

5. Enter the assessed valuation before adjustment from the 2010 form L-4023 line

4 03 .................. 5.

6. 2009 to 2010 Adjustment Modifier. Divide line 4 by line 5 .......................................................................................... 6.

2008 to 2010 Adjustment Modifier

7. 2008 to 2010 Adjustment Modifier. Multiply line 3 by line 6................................................................................................ 7.

24 Month Sales Study

E

F

G

H

Applicable

Adjusted

Total

Adjusted

A

B

C

D

Year of

Sales

Number

Total Assessed

Adjustment

Assessed

Adjusted

% Ratio

Period

of Sales

Value for Sales

Modifier

Value

Prices

Assessment

(col. F ÷ col. G)

-2

10/08 - 3/09

0.00%

-1

4/09 - 9-09

0.00%

0

0

0

12 Month Total Sales

12 Month Total Sales

-1

10/09 - 3/10

0.00%

0

4/10 - 9/10

1.0000

-

0.00%

0

0

0

12 Month Total Sales

12 Month Total Sales

24 Month Total Sales

0

24 Month Total Sales

0

0

*24 Month Mean Adjusted Ratio

* Important: For Sales from Oct. 2008 through Sept. 2009, divide the 12 month total 'Adjusted Assessed Value'

by the 'Total Prices for Sales' to get the 12 month 'Adjusted % Ratio'. Repeat this process for sales from

Oct. 2009 through Sept. 2010. Finally, sum the two 'Adjusted % Ratios' and divide the result by 2 to get the

'Mean Adjusted Ratio'. The 'Mean Adjusted Ratio' in column H is carried to Form 603 (formerly Form L-4018).

12 Month / Single Year Sales Study

L-4047

2804 (Rev. 7-10)

E

F

G

H

Applicable

Adjusted

Total

Adjusted

A

B

C

D

Year of

Sales

Number

Total Assessed

Adjustment

Assessed

Prices

Ratio %

Period

of Sales

Value for Sales

Modifier

Value

for Sales

Assessment

(col. F ÷ col. G)

-1

10/09 - 3/10

0

0

0

0.00%

0

4/10 - 9/10

0

0

1.0000

-

0

0.00%

0

0

0

12 Month Total Sales

12 Month Total Sales

** 12 Month Aggregate Adjusted Ratio

** Important: For Sales from Oct. 2009 through Sept. 2010, divide the 12 month total 'Adjusted Assessed Value'

by the 'Total Prices for Sales' to get the '12 Month Aggregate Adjusted % Ratio'. The 'Aggregate Adjusted

Ratio' in column H is carried to Form 603 (formerly Form L-4018).

-2 March Board of Review valuations are compared with sales transacted during

the last three months of 2008 and those transacted in the first three months of 2009.

-1 March Board of Review valuations are compared with sales transacted during

the last nine months of 2009 and those transacted in the first three months of 2010.

0 March Board of Review valuations are compared with sales transacted during

April through September of 2010.

7/21/2010

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1