•

RESET FORM

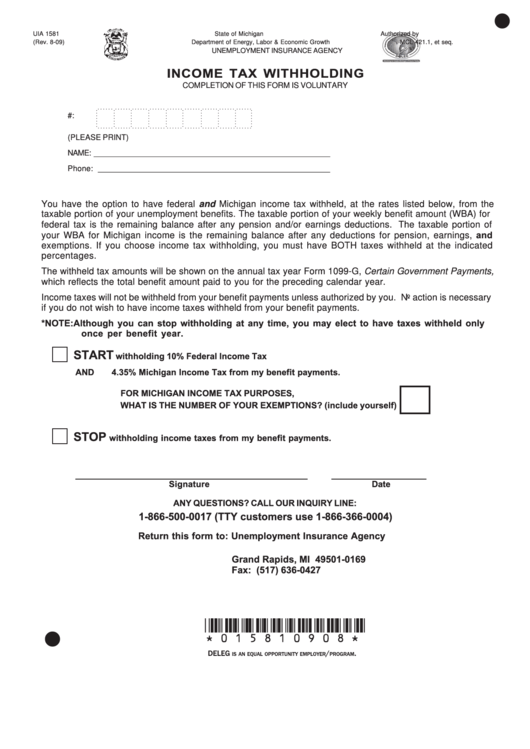

UIA 1581

State of Michigan

Authorized by

(Rev. 8-09)

Department of Energy, Labor & Economic Growth

MCL 421.1, et seq.

UNEMPLOYMENT INSURANCE AGENCY

INCOME TAX WITHHOLDING

COMPLETION OF THIS FORM IS VOLUNTARY

. . . . . .

. . . . . .

. . . . . .

. . . . . .

. . . . . .

. . . . . .

. . . . . .

. . . . . .

. . . . . .

S.S. #:

. . . . . .

. . . . . .

. . . . . .

. . . . . .

. . . . . .

. . . . . .

. . . . . .

. . . . . .

. . . . . .

(PLEASE PRINT)

NAME: ______________________________________________________

Phone: _____________________________________________________

You have the option to have federal and Michigan income tax withheld, at the rates listed below, from the

taxable portion of your unemployment benefits. The taxable portion of your weekly benefit amount (WBA) for

federal tax is the remaining balance after any pension and/or earnings deductions. The taxable portion of

your WBA for Michigan income is the remaining balance after any deductions for pension, earnings, and

exemptions. If you choose income tax withholding, you must have BOTH taxes withheld at the indicated

percentages.

The withheld tax amounts will be shown on the annual tax year Form 1099-G, Certain Government Payments,

which reflects the total benefit amount paid to you for the preceding calendar year.

Income taxes will not be withheld from your benefit payments unless authorized by you. No action is necessary

if you do not wish to have income taxes withheld from your benefit payments.

* NOTE: Although you can stop withholding at any time, you may elect to have taxes withheld only

once per benefit year.

START

withholding 10% Federal Income Tax

AND

4.35% Michigan Income Tax from my benefit payments.

FOR MICHIGAN INCOME TAX PURPOSES,

WHAT IS THE NUMBER OF YOUR EXEMPTIONS? (include yourself)

STOP

withholding income taxes from my benefit payments.

_________________________________________________

____________________

Signature

Date

ANY QUESTIONS? CALL OUR INQUIRY LINE:

1-866-500-0017 (TTY customers use 1-866-366-0004)

Return this form to: Unemployment Insurance Agency

P.O. Box 169

Grand Rapids, MI 49501-0169

Fax: (517) 636-0427

•

*015810908*

DELEG

/

.

IS AN EQUAL OPPORTUNITY EMPLOYER

PROGRAM

1

1 2

2