California Form 541-Es - Estimated Tax For Fiduciaries Wit Instructions - 2010

ADVERTISEMENT

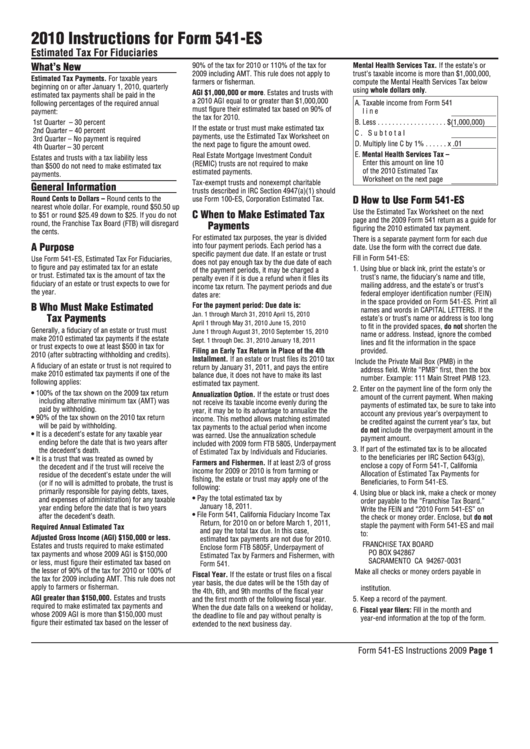

2010 Instructions for Form 541-ES

Estimated Tax For Fiduciaries

What’s New

90% of the tax for 2010 or 110% of the tax for

Mental Health Services Tax. If the estate’s or

2009 including AMT. This rule does not apply to

trust’s taxable income is more than $1,000,000,

Estimated Tax Payments. For taxable years

farmers or fisherman.

compute the Mental Health Services Tax below

beginning on or after January 1, 2010, quarterly

using whole dollars only.

AGI $,000,000 or more. Estates and trusts with

estimated tax payments shall be paid in the

a 2010 AGI equal to or greater than $1,000,000

following percentages of the required annual

A. Taxable income from Form 541

must figure their estimated tax based on 90% of

line 20. . . . . . . . . . . . . . . . . .

payment:

the tax for 2010.

1st Quarter – 30 percent

B. Less . . . . . . . . . . . . . . . . . . .

$(1,000,000)

If the estate or trust must make estimated tax

2nd Quarter – 40 percent

C. Subtotal . . . . . . . . . . . . . . . .

payments, use the Estimated Tax Worksheet on

3rd Quarter – No payment is required

D. Multiply line C by 1% . . . . . .

x .01

the next page to figure the amount owed.

4th Quarter – 30 percent

E. Mental Health Services Tax –

Real Estate Mortgage Investment Conduit

Estates and trusts with a tax liability less

Enter this amount on line 10

(REMIC) trusts are not required to make

than $500 do not need to make estimated tax

of the 2010 Estimated Tax

estimated payments.

payments.

Worksheet on the next page

Tax-exempt trusts and nonexempt charitable

General Information

trusts described in IRC Section 4947(a)(1) should

D How to Use Form 541-ES

Round Cents to Dollars – Round cents to the

use Form 100-ES, Corporation Estimated Tax.

nearest whole dollar. For example, round $50.50 up

Use the Estimated Tax Worksheet on the next

C When to Make Estimated Tax

to $51 or round $25.49 down to $25. If you do not

page and the 2009 Form 541 return as a guide for

round, the Franchise Tax Board (FTB) will disregard

Payments

figuring the 2010 estimated tax payment.

the cents.

For estimated tax purposes, the year is divided

There is a separate payment form for each due

A Purpose

into four payment periods. Each period has a

date. Use the form with the correct due date.

specific payment due date. If an estate or trust

Fill in Form 541-ES:

Use Form 541-ES, Estimated Tax For Fiduciaries,

does not pay enough tax by the due date of each

to figure and pay estimated tax for an estate

1. Using blue or black ink, print the estate’s or

of the payment periods, it may be charged a

or trust. Estimated tax is the amount of tax the

trust’s name, the fiduciary’s name and title,

penalty even if it is due a refund when it files its

fiduciary of an estate or trust expects to owe for

mailing address, and the estate’s or trust’s

income tax return. The payment periods and due

the year.

federal employer identification number (FEIN)

dates are:

in the space provided on Form 541-ES. Print all

B Who Must Make Estimated

For the payment period:

Due date is:

names and words in CAPITAL LETTERS. If the

Jan. 1 through March 31, 2010

April 15, 2010

Tax Payments

estate’s or trust’s name or address is too long

April 1 through May 31, 2010

June 15, 2010

to fit in the provided spaces, do not shorten the

Generally, a fiduciary of an estate or trust must

June 1 through August 31, 2010

September 15, 2010

name or address. Instead, ignore the combed

make 2010 estimated tax payments if the estate

Sept. 1 through Dec. 31, 2010

January 18, 2011

lines and fit the information in the space

or trust expects to owe at least $500 in tax for

Filing an Early Tax Return in Place of the 4th

provided.

2010 (after subtracting withholding and credits).

Installment. If an estate or trust files its 2010 tax

Include the Private Mail Box (PMB) in the

A fiduciary of an estate or trust is not required to

return by January 31, 2011, and pays the entire

address field. Write “PMB” first, then the box

make 2010 estimated tax payments if one of the

balance due, it does not have to make its last

number. Example: 111 Main Street PMB 123.

following applies:

estimated tax payment.

2. Enter on the payment line of the form only the

• 100% of the tax shown on the 2009 tax return

Annualization Option. If the estate or trust does

amount of the current payment. When making

including alternative minimum tax (AMT) was

not receive its taxable income evenly during the

payments of estimated tax, be sure to take into

paid by withholding.

year, it may be to its advantage to annualize the

account any previous year’s overpayment to

• 90% of the tax shown on the 2010 tax return

income. This method allows matching estimated

be credited against the current year’s tax, but

will be paid by withholding.

tax payments to the actual period when income

do not include the overpayment amount in the

• It is a decedent’s estate for any taxable year

was earned. Use the annualization schedule

payment amount.

ending before the date that is two years after

included with 2009 form FTB 5805, Underpayment

3. If part of the estimated tax is to be allocated

the decedent’s death.

of Estimated Tax by Individuals and Fiduciaries.

to the beneficiaries per IRC Section 643(g),

• It is a trust that was treated as owned by

Farmers and Fishermen. If at least 2/3 of gross

enclose a copy of Form 541-T, California

the decedent and if the trust will receive the

income for 2009 or 2010 is from farming or

Allocation of Estimated Tax Payments for

residue of the decedent’s estate under the will

fishing, the estate or trust may apply one of the

Beneficiaries, to Form 541-ES.

(or if no will is admitted to probate, the trust is

following:

primarily responsible for paying debts, taxes,

4. Using blue or black ink, make a check or money

• Pay the total estimated tax by

and expenses of administration) for any taxable

order payable to the “Franchise Tax Board.”

January 18, 2011.

year ending before the date that is two years

Write the FEIN and “2010 Form 541-ES” on

• File Form 541, California Fiduciary Income Tax

after the decedent’s death.

the check or money order. Enclose, but do not

Return, for 2010 on or before March 1, 2011,

staple the payment with Form 541-ES and mail

Required Annual Estimated Tax

and pay the total tax due. In this case,

to:

Adjusted Gross Income (AGI) $50,000 or less.

estimated tax payments are not due for 2010.

FRANCHISE TAX BOARD

Estates and trusts required to make estimated

Enclose form FTB 5805F, Underpayment of

PO BOX 942867

tax payments and whose 2009 AGI is $150,000

Estimated Tax by Farmers and Fishermen, with

SACRAMENTO CA 94267-0031

or less, must figure their estimated tax based on

Form 541.

the lesser of 90% of the tax for 2010 or 100% of

Make all checks or money orders payable in

Fiscal Year. If the estate or trust files on a fiscal

the tax for 2009 including AMT. This rule does not

U.S. dollars and drawn against a U.S. financial

year basis, the due dates will be the 15th day of

apply to farmers or fisherman.

institution.

the 4th, 6th, and 9th months of the fiscal year

AGI greater than $50,000. Estates and trusts

and the first month of the following fiscal year.

5. Keep a record of the payment.

required to make estimated tax payments and

When the due date falls on a weekend or holiday,

6. Fiscal year filers: Fill in the month and

whose 2009 AGI is more than $150,000 must

the deadline to file and pay without penalty is

year-end information at the top of the form.

figure their estimated tax based on the lesser of

extended to the next business day.

Form 541-ES Instructions 2009 Page

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2