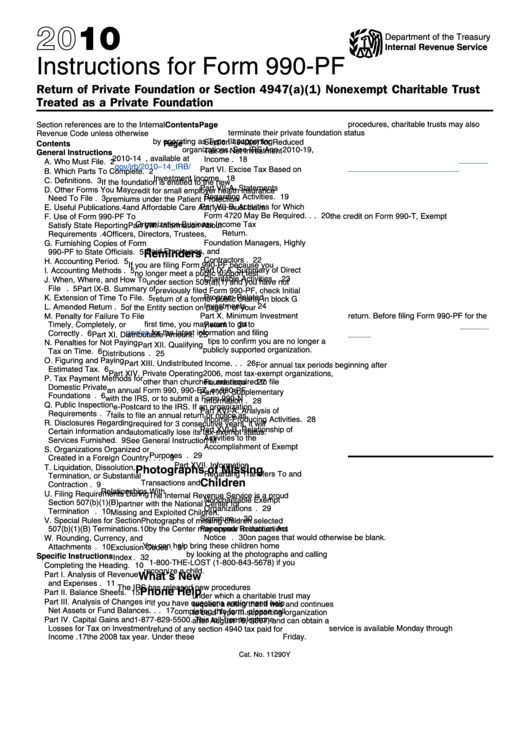

Instructions For Form 990-Pf - Return Of Private Foundation Or Section 4947(A)(1) Nonexempt Charitable Trust Treated As A Private Foundation - Internal Revenue Service - 2010

ADVERTISEMENT

2010

Department of the Treasury

Internal Revenue Service

Instructions for Form 990-PF

Return of Private Foundation or Section 4947(a)(1) Nonexempt Charitable Trust

Treated as a Private Foundation

procedures, charitable trusts may also

Section references are to the Internal

Contents

Page

terminate their private foundation status

Revenue Code unless otherwise noted.

Part V. Qualification Under

by operating as Type III supporting

Section 4940(e) for Reduced

Contents

Page

organizations. See IRS Ann. 2010-19,

Tax on Net Investment

General Instructions

2010-14 I.R.B. 529, available at

Income . . . . . . . . . . . . . . . . . . . . 18

A. Who Must File . . . . . . . . . . . . . . 2

gov/irb/2010 – 14_IRB/ar13.html.

Part VI. Excise Tax Based on

B. Which Parts To Complete . . . . . . 2

Investment Income . . . . . . . . . . . 18

C. Definitions . . . . . . . . . . . . . . . . . 3

If the foundation is entitled to the new

Part VII-A. Statements

D. Other Forms You May

credit for small employer health insurance

Regarding Activities . . . . . . . . . . . 19

Need To File . . . . . . . . . . . . . . . . . 3

premiums under the Patient Protection

Part VII-B. Activities for Which

E. Useful Publications . . . . . . . . . . . 4

and Affordable Care Act, you must claim

Form 4720 May Be Required

. . . 20

the credit on Form 990-T, Exempt

F. Use of Form 990-PF To

Organization Business Income Tax

Satisfy State Reporting

Part VIII. Information About

Return.

Requirements . . . . . . . . . . . . . . . . 4

Officers, Directors, Trustees,

Foundation Managers, Highly

G. Furnishing Copies of Form

Paid Employees, and

Reminders

990-PF to State Officials . . . . . . . . 5

Contractors . . . . . . . . . . . . . . . . . 22

H. Accounting Period . . . . . . . . . . . 5

If you are filing Form 990-PF because you

Part IX-A. Summary of Direct

I. Accounting Methods . . . . . . . . . . . 5

no longer meet a public support test

Charitable Activities . . . . . . . . . . . 23

J. When, Where, and How To

under section 509(a)(1) and you have not

File . . . . . . . . . . . . . . . . . . . . . . . 5

Part IX-B. Summary of

previously filed Form 990-PF, check Initial

K. Extension of Time To File . . . . . . 5

Program-Related

return of a former public charity in block G

Investments . . . . . . . . . . . . . . . . 24

L. Amended Return . . . . . . . . . . . . . 5

of the Entity section on page 1 of your

Part X. Minimum Investment

return. Before filing Form 990-PF for the

M. Penalty for Failure To File

Timely, Completely, or

Return . . . . . . . . . . . . . . . . . . . . 24

first time, you may want to go to

gov/eo

for the latest information and filing

Correctly . . . . . . . . . . . . . . . . . . . . 6

Part XI. Distributable Amount . . . . . 25

tips to confirm you are no longer a

N. Penalties for Not Paying

Part XII. Qualifying

publicly supported organization.

Tax on Time . . . . . . . . . . . . . . . . . 6

Distributions . . . . . . . . . . . . . . . . 25

O. Figuring and Paying

Part XIII. Undistributed Income . . . 26

For annual tax periods beginning after

Estimated Tax . . . . . . . . . . . . . . . . 6

Part XIV. Private Operating

2006, most tax-exempt organizations,

P. Tax Payment Methods for

Foundations . . . . . . . . . . . . . . . . 27

other than churches, are required to file

Domestic Private

an annual Form 990, 990-EZ, or 990-PF

Part XV. Supplementary

Foundations . . . . . . . . . . . . . . . . . 6

with the IRS, or to submit a Form 990-N

Information . . . . . . . . . . . . . . . . . 28

Q. Public Inspection

e-Postcard to the IRS. If an organization

Part XVI-A. Analysis of

Requirements . . . . . . . . . . . . . . . . 7

fails to file an annual return or notice as

Income-Producing Activities . . . . . 28

R. Disclosures Regarding

required for 3 consecutive years, it will

Part XVI-B. Relationship of

Certain Information and

automatically lose its tax-exempt status.

Activities to the

Services Furnished . . . . . . . . . . . . 9

See General Instruction M.

Accomplishment of Exempt

S. Organizations Organized or

Purposes . . . . . . . . . . . . . . . . . . 29

Created in a Foreign Country . . . . 9

Part XVII. Information

Photographs of Missing

T. Liquidation, Dissolution,

Regarding Transfers To and

Termination, or Substantial

Children

Transactions and

Contraction . . . . . . . . . . . . . . . . . . 9

Relationships With

U. Filing Requirements During

The Internal Revenue Service is a proud

Noncharitable Exempt

Section 507(b)(1)(B)

partner with the National Center for

Organizations . . . . . . . . . . . . . . . 29

Termination . . . . . . . . . . . . . . . . 10

Missing and Exploited Children.

Signature . . . . . . . . . . . . . . . . . . . 30

V. Special Rules for Section

Photographs of missing children selected

Paperwork Reduction Act

507(b)(1)(B) Terminations . . . . . . 10

by the Center may appear in instructions

Notice . . . . . . . . . . . . . . . . . . . . 30

on pages that would otherwise be blank.

W. Rounding, Currency, and

You can help bring these children home

Attachments . . . . . . . . . . . . . . . . 10

Exclusion Codes . . . . . . . . . . . . . . 31

by looking at the photographs and calling

Specific Instructions

Index . . . . . . . . . . . . . . . . . . . . . . . . 32

1-800-THE-LOST (1-800-843-5678) if you

Completing the Heading . . . . . . . . 10

recognize a child.

What’s New

Part I. Analysis of Revenue

and Expenses . . . . . . . . . . . . . . . 11

The IRS has released new procedures

Phone Help

Part II. Balance Sheets . . . . . . . . . 15

under which a charitable trust may

Part III. Analysis of Changes in

If you have questions and/or need help

request a ruling that it was and continues

Net Assets or Fund Balances . . . 17

completing this form, please call

to be a Type III supporting organization

Part IV. Capital Gains and

1-877-829-5500. This toll-free telephone

after August 16, 2007, and can obtain a

Losses for Tax on Investment

service is available Monday through

refund of any section 4940 tax paid for

Friday.

Income . . . . . . . . . . . . . . . . . . . . 17

the 2008 tax year. Under these

Cat. No. 11290Y

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32