Instructions For Form 940-Ez - Employer'S Annual Federal Unemployment (Futa) Tax Return - Internal Revenue Service - 2001

ADVERTISEMENT

01

2 0

Department of the Treasury

Internal Revenue Service

Instructions for

Form 940-EZ

Employer’s Annual Federal Unemployment

(FUTA) Tax Return

Section references are to the Internal Revenue Code unless otherwise noted.

using the Electronic Federal Tax Payment System

General Instructions

(EFTPS) in 2002 if:

•

The total deposits of such taxes in 2000 were more

Who May Use Form 940-EZ

than $200,000 or

•

You were required to use EFTPS in 2001.

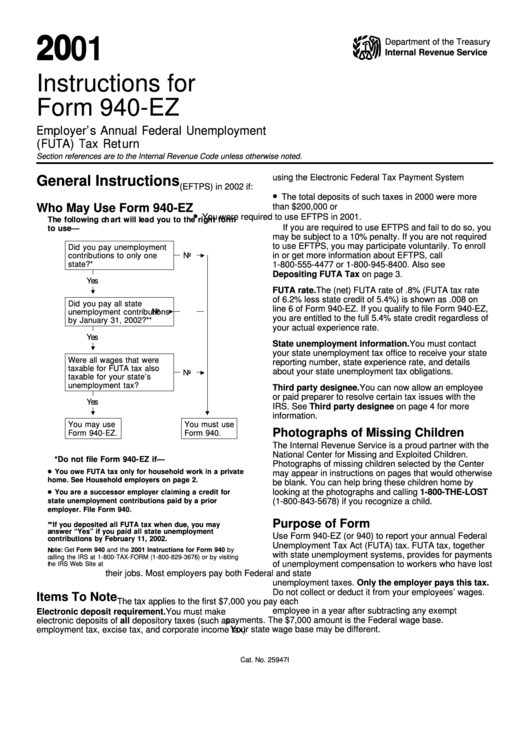

The following chart will lead you to the right form

If you are required to use EFTPS and fail to do so, you

to use—

may be subject to a 10% penalty. If you are not required

to use EFTPS, you may participate voluntarily. To enroll

Did you pay unemployment

in or get more information about EFTPS, call

contributions to only one

No

state?*

1-800-555-4477 or 1-800-945-8400. Also see

Depositing FUTA Tax on page 3.

Yes

FUTA rate. The (net) FUTA rate of .8% (FUTA tax rate

of 6.2% less state credit of 5.4%) is shown as .008 on

Did you pay all state

line 6 of Form 940-EZ. If you qualify to file Form 940-EZ,

No

unemployment contributions

you are entitled to the full 5.4% state credit regardless of

by January 31, 2002?**

your actual experience rate.

Yes

State unemployment information. You must contact

your state unemployment tax office to receive your state

Were all wages that were

reporting number, state experience rate, and details

taxable for FUTA tax also

about your state unemployment tax obligations.

No

taxable for your state’s

unemployment tax?

Third party designee. You can now allow an employee

or paid preparer to resolve certain tax issues with the

Yes

IRS. See Third party designee on page 4 for more

information.

You may use

You must use

Photographs of Missing Children

Form 940-EZ.

Form 940.

The Internal Revenue Service is a proud partner with the

National Center for Missing and Exploited Children.

*Do not file Form 940-EZ if—

Photographs of missing children selected by the Center

● You owe FUTA tax only for household work in a private

may appear in instructions on pages that would otherwise

home. See Household employers on page 2.

be blank. You can help bring these children home by

● You are a successor employer claiming a credit for

looking at the photographs and calling 1-800-THE-LOST

state unemployment contributions paid by a prior

(1-800-843-5678) if you recognize a child.

employer. File Form 940.

Purpose of Form

**If you deposited all FUTA tax when due, you may

answer “Yes” if you paid all state unemployment

Use Form 940-EZ (or 940) to report your annual Federal

contributions by February 11, 2002.

Unemployment Tax Act (FUTA) tax. FUTA tax, together

Note: Get Form 940 and the 2001 Instructions for Form 940 by

with state unemployment systems, provides for payments

calling the IRS at 1-800-TAX-FORM (1-800-829-3676) or by visiting

of unemployment compensation to workers who have lost

the IRS Web Site at

their jobs. Most employers pay both Federal and state

unemployment taxes. Only the employer pays this tax.

Do not collect or deduct it from your employees’ wages.

Items To Note

The tax applies to the first $7,000 you pay each

employee in a year after subtracting any exempt

Electronic deposit requirement. You must make

payments. The $7,000 amount is the Federal wage base.

electronic deposits of all depository taxes (such as

employment tax, excise tax, and corporate income tax)

Your state wage base may be different.

Cat. No. 25947I

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6