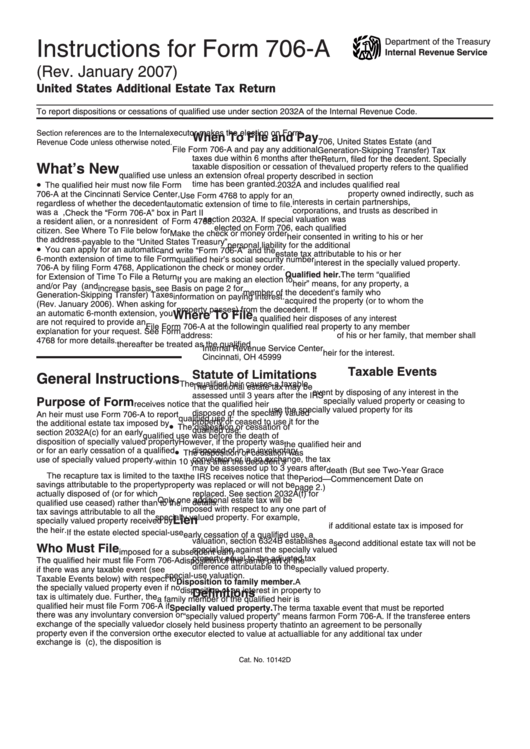

Instructions For Form 706-A - United States Additional Estate Tax Return - Internal Revenue Service - 2007

ADVERTISEMENT

Department of the Treasury

Instructions for Form 706-A

Internal Revenue Service

(Rev. January 2007)

United States Additional Estate Tax Return

To report dispositions or cessations of qualified use under section 2032A of the Internal Revenue Code.

executor makes the election on Form

Section references are to the Internal

When To File and Pay

706, United States Estate (and

Revenue Code unless otherwise noted.

File Form 706-A and pay any additional

Generation-Skipping Transfer) Tax

taxes due within 6 months after the

Return, filed for the decedent. Specially

What’s New

taxable disposition or cessation of the

valued property refers to the qualified

qualified use unless an extension of

real property described in section

•

time has been granted.

The qualified heir must now file Form

2032A and includes qualified real

property owned indirectly, such as

706-A at the Cincinnati Service Center,

Use Form 4768 to apply for an

interests in certain partnerships,

regardless of whether the decedent

automatic extension of time to file.

corporations, and trusts as described in

was a U.S. citizen residing in the U.S.,

Check the “Form 706-A” box in Part II

section 2032A. If special valuation was

a resident alien, or a nonresident U.S.

of Form 4768.

elected on Form 706, each qualified

citizen. See Where To File below for

Make the check or money order

heir consented in writing to his or her

the address.

payable to the “United States Treasury”

personal liability for the additional

•

You can apply for an automatic

and write “Form 706-A” and the

estate tax attributable to his or her

6-month extension of time to file Form

qualified heir’s social security number

interest in the specially valued property.

706-A by filing Form 4768, Application

on the check or money order.

Qualified heir. The term “qualified

for Extension of Time To File a Return

If you are making an election to

heir” means, for any property, a

and/or Pay U.S. Estate (and

increase basis, see Basis on page 2 for

member of the decedent’s family who

Generation-Skipping Transfer) Taxes

information on paying interest.

acquired the property (or to whom the

(Rev. January 2006). When asking for

property passes) from the decedent. If

an automatic 6-month extension, you

Where To File

a qualified heir disposes of any interest

are not required to provide an

File Form 706-A at the following

in qualified real property to any member

explanation for your request. See Form

address:

of his or her family, that member shall

4768 for more details.

thereafter be treated as the qualified

Internal Revenue Service Center

heir for the interest.

Cincinnati, OH 45999

Taxable Events

Statute of Limitations

General Instructions

The qualified heir causes a taxable

The additional estate tax may be

event by disposing of any interest in the

assessed until 3 years after the IRS

Purpose of Form

specially valued property or ceasing to

receives notice that the qualified heir

use the specially valued property for its

disposed of the specially valued

An heir must use Form 706-A to report

qualified use if:

property or ceased to use it for the

the additional estate tax imposed by

•

The disposition or cessation of

qualified use.

section 2032A(c) for an early

qualified use was before the death of

disposition of specially valued property

However, if the property was

the qualified heir and

•

or for an early cessation of a qualified

disposed of in an involuntary

The disposition or cessation was

conversion or in an exchange, the tax

use of specially valued property.

within 10 years after the decedent’s

may be assessed up to 3 years after

death (But see Two-Year Grace

The recapture tax is limited to the tax

the IRS receives notice that the

Period — Commencement Date on

savings attributable to the property

property was replaced or will not be

page 2.)

actually disposed of (or for which

replaced. See section 2032A(f) for

Only one additional estate tax will be

details.

qualified use ceased) rather than to the

imposed with respect to any one part of

tax savings attributable to all the

specially valued property. For example,

Lien

specially valued property received by

if additional estate tax is imposed for

the heir.

If the estate elected special-use

early cessation of a qualified use, a

valuation, section 6324B establishes a

second additional estate tax will not be

Who Must File

special lien against the specially valued

imposed for a subsequent early

property equal to the adjusted tax

The qualified heir must file Form 706-A

disposition of the same part of the

difference attributable to the

if there was any taxable event (see

specially valued property.

special-use valuation.

Taxable Events below) with respect to

Disposition to family member. A

the specially valued property even if no

disposition of an interest in property to

Definitions

tax is ultimately due. Further, the

a family member of the qualified heir is

qualified heir must file Form 706-A if

Specially valued property. The term

a taxable event that must be reported

there was any involuntary conversion or

“specially valued property” means farm

on Form 706-A. If the transferee enters

exchange of the specially valued

or closely held business property that

into an agreement to be personally

property even if the conversion or

the executor elected to value at actual

liable for any additional tax under

exchange is nontaxable.

use rather than fair market value. The

section 2032A(c), the disposition is

Cat. No. 10142D

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4