Form D-400ez Instructions - North Carolina Department Of Revenue

ADVERTISEMENT

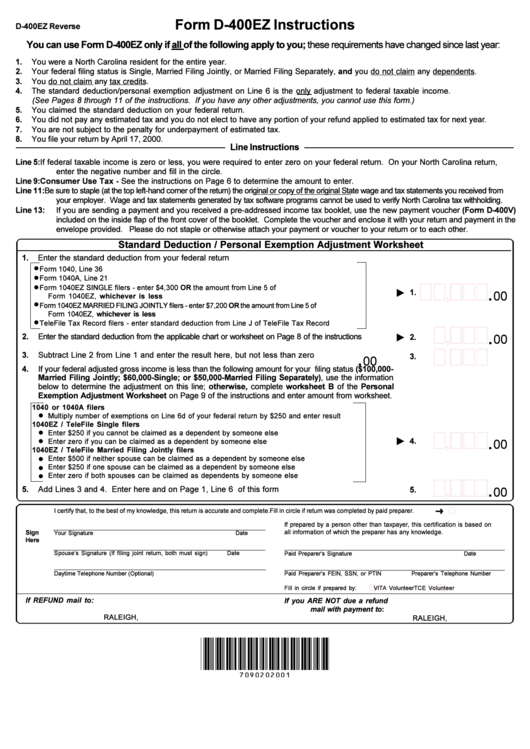

Form D-400EZ Instructions

You can use Form D-400EZ only if all of the following apply to you; these requirements have changed since last year:

(See Pages 8 through 11 of the instructions. If you have any other adjustments, you cannot use this form.)

Line Instructions

Standard Deduction / Personal Exemption Adjustment Worksheet

•

•

•

,

.

OR

00

whichever is less

•

OR

whichever is less

•

,

.

00

,

.

00

1040 or 1040A filers

•

1040EZ / TeleFile Single filers

•

,

.

•

00

1040EZ / TeleFile Married Filing Jointly filers

•

•

•

,

.

00

Ü

I certify that, to the best of my knowledge, this return is accurate and complete.

Fill in circle if return was completed by paid preparer.

If prepared by a person other than taxpayer, this certification is based on

all information of which the preparer has any knowledge.

Sign

Your Signature

D a t e

Here

Spouse’s Signature (If filing joint return, both must sign)

Date

Paid Preparer’s Signature

Date

Daytime Telephone Number (Optional)

Paid Preparer’s FEIN, SSN, or PTIN

Preparer’s Telephone Number

Fill in circle if prepared by:

VITA Volunteer

TCE Volunteer

If REFUND mail to:

If you ARE NOT due a refund

mail with payment to:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1