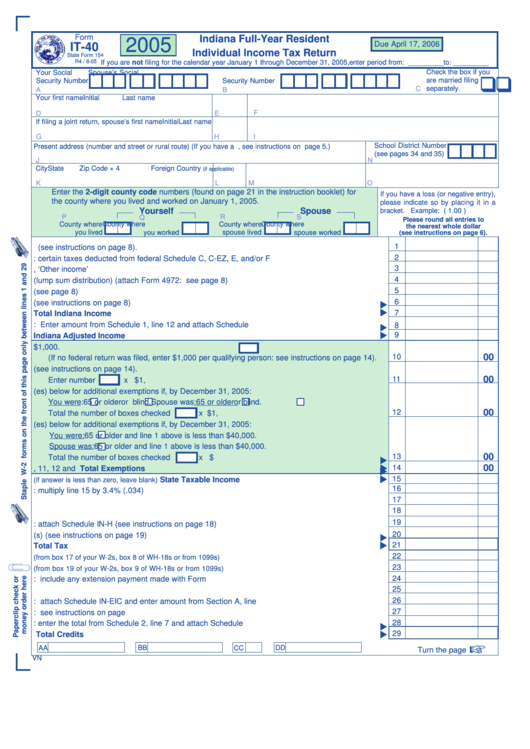

Form It-40 - Individual Income Tax Return - 2005

ADVERTISEMENT

Form

Indiana Full-Year Resident

2005

Due April 17, 2006

IT-40

Individual Income Tax Return

State Form 154

R4 / 8-05

If you are not filing for the calendar year January 1 through December 31, 2005,enter period from: _________to: _________

Check the box if you

Your Social

Spouse’s Social

are married filing

Security Number

Security Number

C

separately.

A

B

Your first name

Initial

Last name

F

D

E

If filing a joint return, spouse’s first name

Initial

Last name

G

H

I

School District Number

Present address (number and street or rural route) (If you have a P.O. box, see instructions on page 5.)

(see pages 34 and 35)

N

J

City

State

Zip Code + 4

Foreign Country

(if applicable)

L

M

O

K

Enter the 2-digit county code numbers (found on page 21 in the instruction booklet) for

If you have a loss (or negative entry),

the county where you lived and worked on January 1, 2005.

please indicate so by placing it in a

Yourself

Spouse

bracket. Example: ( 1.00 )

P

Q

R

S

Please round all entries to

County where

County where

County where

County where

the nearest whole dollar

you lived

you worked

spouse lived

spouse worked

(see instructions on page 6).

1

1. Enter your federal adjusted gross income from your federal return (see instructions on page 8).

2

2. Tax add-back: certain taxes deducted from federal Schedule C, C-EZ, E, and/or F .....................

3

3. Net operating loss carryforward from federal Form 1040, ‘Other income’ line ..............................

4

4. Income taxed on federal Form 4972 (lump sum distribution) (attach Form 4972: see page 8) ....

5

5. Domestic production activities add-back (see page 8) ..................................................................

6

6. Other (see instructions on page 8) .................................................................................................

7

7. Add lines 1 through 6 ................................................................................Total Indiana Income

8. Indiana deductions: Enter amount from Schedule 1, line 12 and attach Schedule 1 ...................

8

9

9. Line 7 minus line 8 ............................................................................ Indiana Adjusted Income

10. Number of exemptions claimed on your federal return

x $1,000.

00

10

(If no federal return was filed, enter $1,000 per qualifying person: see instructions on page 14).

11. Additional exemption for certain dependent children (see instructions on page 14).

00

11

Enter number

x $1,500 .....................................................................................................

12. Check box(es) below for additional exemptions if, by December 31, 2005:

You were:

65 or older

or blind. Spouse was:

65 or older

or blind.

00

12

Total the number of boxes checked

x $1,000 ..................................................................

13. Check box(es) below for additional exemptions if, by December 31, 2005:

You were:

65 or older and line 1 above is less than $40,000.

Spouse was:

65 or older and line 1 above is less than $40,000.

00

13

Total the number of boxes checked

x $500 ....................................................................

00

14

14. Add lines 10, 11, 12 and 13..............................................................................Total Exemptions

15

15. Line 9 minus line 14

....................... State Taxable Income

(if answer is less than zero, leave blank)

16

16. State adjusted gross income tax: multiply line 15 by 3.4% (.034) .................................................

17

17. County income tax. See instructions on page 15 .........................................................................

18

18. Use tax due on out-of-state purchases. See instructions on page 18 ..........................................

19

19. Household employment taxes: attach Schedule IN-H (see instructions on page 18) ...................

20

20. Indiana advance earned income credit payments from W-2(s) (see instructions on page 19) .....

21

21. Add lines 16 through 20. Enter here and on line 30 on the back ................................ Total Tax

22

22. Indiana state tax withheld

........................

(from box 17 of your W-2s, box 8 of WH-18s or from 1099s)

23

23. Indiana county tax withheld

(from box 19 of your W-2s, box 9 of WH-18s or from 1099s) ......................

24

24. Estimated tax paid for 2005: include any extension payment made with Form IT-9 ....................

25

25. Unified tax credit for the elderly. See instructions on page 19 ...............................................

26

26. Earned income credit: attach Schedule IN-EIC and enter amount from Section A, line A-2 ........

27

27. Lake County residential income tax credit: see instructions on page 20 ......................................

28

28. Indiana credits: enter the total from Schedule 2, line 7 and attach Schedule 2 ............................

29

29. Add lines 22 through 28. Enter here and on line 31 on the back ........................... Total Credits

AA

BB

CC

DD

Turn the page

VN

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4