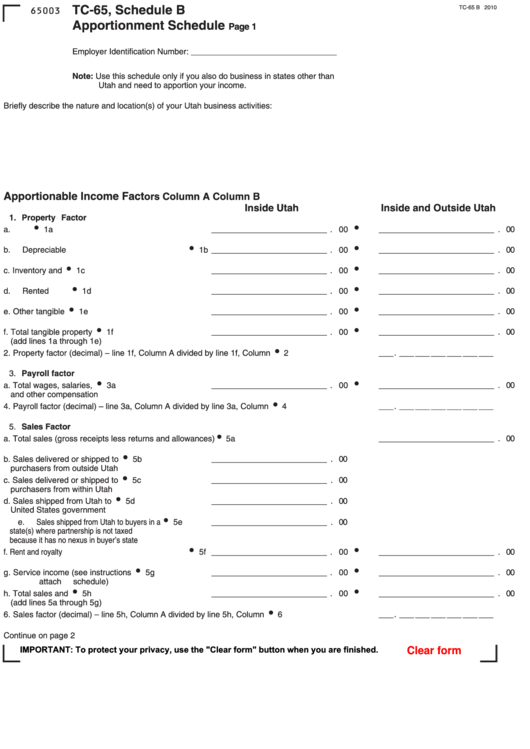

TC-65, Schedule B

TC-65 B 2010

65003

Apportionment Schedule

Page 1

Employer Identification Number: _ _____________ __ __ _

Note: Use this schedule only if you also do business in states other than

Utah and need to apportion your income.

Briefly describe the nature and location(s) of your Utah business activities:

Apportionable Income Fact

ors

Column A

Column B

Inside Utah

Inside and Outside Utah

1. Property Factor

a. Land ........................................................

1a __________ __ __ _ . 00

__ __ __ __ _ _ _ _ _ _ _ . 00

b. Depreciable assets..................................

1b ___________ __ __ . 00

_ __ __ __ __ _ _ _ _ _ _ . 00

c. Inventory and supplies ............................

1c ___________ __ __ . 00

_ __ __ __ __ _ _ _ _ _ _ . 00

d. Rented property......................................

1d ___________ __ __ . 00

__ __ ___ __ _ _ _ _ _ _ . 00

e. Other tangible property ...........................

1e ___________ __ __ . 00

__ __ ___ __ _ _ _ _ _ _ . 00

f.

Total tangible property ............................

1f ___________ __ __ . 00

_ __ __ __ _ _ _ _ _ _ _ _ . 00

(add lines 1a through 1e)

2. Property factor (decimal) – line 1f, Column A divided by line 1f, Column B...........................

2 __ . __ __ __ __ __ __

3. Payroll factor

a. Total wages, salaries, commissions ........

3a ___________ __ __ . 00

__ __ __ __ _ _ _ _ _ _ _ . 00

and other compensation

4. Payroll factor (decimal) – line 3a, Column A divided by line 3a, Column B............................

4 __ . __ __ __ __ __ __

5. Sales Factor

a. Total sales (gross receipts less returns and allowances) .................................................

5a __ __ __ __ _ _ _ _ _ _ _ . 00

b. Sales delivered or shipped to Utah .........

5b ___________ __ __ . 00

purchasers from outside Utah

c. Sales delivered or shipped to Utah .........

5c ___________ __ __ . 00

purchasers from within Utah

d. Sales shipped from Utah to the...............

5d ___________ __ __ . 00

United States government

e. Sales shipped from Utah to buyers in a .........

5e __________ __ __ _ . 00

state(s) where partnership is not taxed

because it has no nexus in buyer’s state

f.

Rent and royalty income...................................

5f __________ __ __ _ . 00

__ __ __ __ _ _ _ _ _ _ _ . 00

g. Service income (see instructions and .....

5g __________ __ __ _ . 00

__ __ __ __ _ _ _ _ _ _ _ . 00

attach schedule)

h. Total sales and services..........................

5h ___________ __ __ . 00

_ __ __ __ __ _ _ _ _ _ _ . 00

(add lines 5a through 5g)

6. Sales factor (decimal) – line 5h, Column A divided by line 5h, Column B .............................

6 __ . __ __ __ __ __ __

Continue on page 2

IMPORTANT: To protect your privacy, use the "Clear form" button when you are finished.

Clear form

1

1 2

2