Instructions For Schedule H (Form 5500) - Financial Information - 2009

ADVERTISEMENT

under the terms of the plan by a trustee or a named fiduciary,

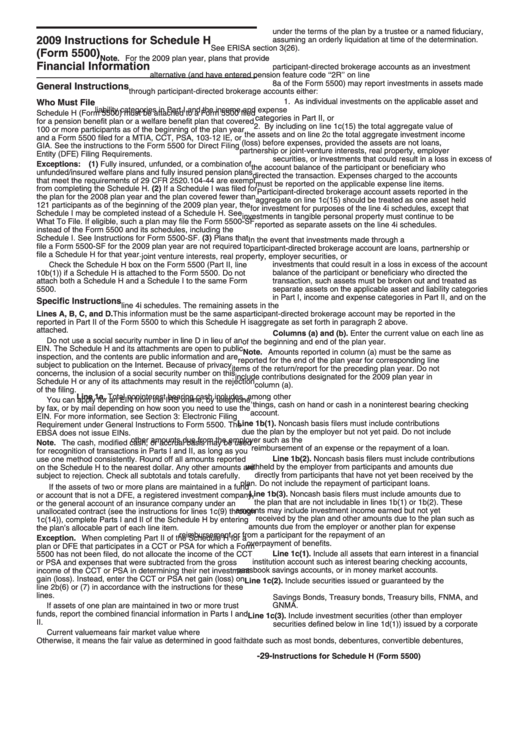

2009 Instructions for Schedule H

assuming an orderly liquidation at time of the determination.

See ERISA section 3(26).

(Form 5500)

Note. For the 2009 plan year, plans that provide

Financial Information

participant-directed brokerage accounts as an investment

alternative (and have entered pension feature code ‘‘2R’’ on line

8a of the Form 5500) may report investments in assets made

General Instructions

through participant-directed brokerage accounts either:

1. As individual investments on the applicable asset and

Who Must File

liability categories in Part I and the income and expense

Schedule H (Form 5500) must be attached to a Form 5500 filed

categories in Part II, or

for a pension benefit plan or a welfare benefit plan that covered

2. By including on line 1c(15) the total aggregate value of

100 or more participants as of the beginning of the plan year

the assets and on line 2c the total aggregate investment income

and a Form 5500 filed for a MTIA, CCT, PSA, 103-12 IE, or

(loss) before expenses, provided the assets are not loans,

GIA. See the instructions to the Form 5500 for Direct Filing

partnership or joint-venture interests, real property, employer

Entity (DFE) Filing Requirements.

securities, or investments that could result in a loss in excess of

Exceptions: (1) Fully insured, unfunded, or a combination of

the account balance of the participant or beneficiary who

unfunded/insured welfare plans and fully insured pension plans

directed the transaction. Expenses charged to the accounts

that meet the requirements of 29 CFR 2520.104-44 are exempt

must be reported on the applicable expense line items.

from completing the Schedule H. (2) If a Schedule I was filed for

Participant-directed brokerage account assets reported in the

the plan for the 2008 plan year and the plan covered fewer than

aggregate on line 1c(15) should be treated as one asset held

121 participants as of the beginning of the 2009 plan year, the

for investment for purposes of the line 4i schedules, except that

Schedule I may be completed instead of a Schedule H. See

investments in tangible personal property must continue to be

What To File. If eligible, such a plan may file the Form 5500-SF

reported as separate assets on the line 4i schedules.

instead of the Form 5500 and its schedules, including the

Schedule I. See Instructions for Form 5500-SF. (3) Plans that

In the event that investments made through a

file a Form 5500-SF for the 2009 plan year are not required to

participant-directed brokerage account are loans, partnership or

file a Schedule H for that year.

joint venture interests, real property, employer securities, or

Check the Schedule H box on the Form 5500 (Part II, line

investments that could result in a loss in excess of the account

10b(1)) if a Schedule H is attached to the Form 5500. Do not

balance of the participant or beneficiary who directed the

attach both a Schedule H and a Schedule I to the same Form

transaction, such assets must be broken out and treated as

5500.

separate assets on the applicable asset and liability categories

in Part I, income and expense categories in Part II, and on the

Specific Instructions

line 4i schedules. The remaining assets in the

Lines A, B, C, and D. This information must be the same as

participant-directed brokerage account may be reported in the

reported in Part II of the Form 5500 to which this Schedule H is

aggregate as set forth in paragraph 2 above.

attached.

Columns (a) and (b). Enter the current value on each line as

Do not use a social security number in line D in lieu of an

of the beginning and end of the plan year.

EIN. The Schedule H and its attachments are open to public

Note. Amounts reported in column (a) must be the same as

inspection, and the contents are public information and are

reported for the end of the plan year for corresponding line

subject to publication on the Internet. Because of privacy

items of the return/report for the preceding plan year. Do not

concerns, the inclusion of a social security number on this

include contributions designated for the 2009 plan year in

Schedule H or any of its attachments may result in the rejection

column (a).

of the filing.

Line 1a. Total noninterest bearing cash includes, among other

You can apply for an EIN from the IRS online, by telephone,

things, cash on hand or cash in a noninterest bearing checking

by fax, or by mail depending on how soon you need to use the

account.

EIN. For more information, see Section 3: Electronic Filing

Line 1b(1). Noncash basis filers must include contributions

Requirement under General Instructions to Form 5500. The

due the plan by the employer but not yet paid. Do not include

EBSA does not issue EINs.

other amounts due from the employer such as the

Note. The cash, modified cash, or accrual basis may be used

reimbursement of an expense or the repayment of a loan.

for recognition of transactions in Parts I and II, as long as you

Line 1b(2). Noncash basis filers must include contributions

use one method consistently. Round off all amounts reported

withheld by the employer from participants and amounts due

on the Schedule H to the nearest dollar. Any other amounts are

directly from participants that have not yet been received by the

subject to rejection. Check all subtotals and totals carefully.

plan. Do not include the repayment of participant loans.

If the assets of two or more plans are maintained in a fund

Line 1b(3). Noncash basis filers must include amounts due to

or account that is not a DFE, a registered investment company,

the plan that are not includable in lines 1b(1) or 1b(2). These

or the general account of an insurance company under an

amounts may include investment income earned but not yet

unallocated contract (see the instructions for lines 1c(9) through

received by the plan and other amounts due to the plan such as

1c(14)), complete Parts I and II of the Schedule H by entering

amounts due from the employer or another plan for expense

the plan’s allocable part of each line item.

reimbursement or from a participant for the repayment of an

Exception. When completing Part II of the Schedule H for a

overpayment of benefits.

plan or DFE that participates in a CCT or PSA for which a Form

Line 1c(1). Include all assets that earn interest in a financial

5500 has not been filed, do not allocate the income of the CCT

institution account such as interest bearing checking accounts,

or PSA and expenses that were subtracted from the gross

passbook savings accounts, or in money market accounts.

income of the CCT or PSA in determining their net investment

gain (loss). Instead, enter the CCT or PSA net gain (loss) on

Line 1c(2). Include securities issued or guaranteed by the

line 2b(6) or (7) in accordance with the instructions for these

U.S. Government or its designated agencies such as U.S.

lines.

Savings Bonds, Treasury bonds, Treasury bills, FNMA, and

GNMA.

If assets of one plan are maintained in two or more trust

funds, report the combined financial information in Parts I and

Line 1c(3). Include investment securities (other than employer

II.

securities defined below in line 1d(1)) issued by a corporate

Current value means fair market value where available.

entity at a stated interest rate repayable on a particular future

Otherwise, it means the fair value as determined in good faith

date such as most bonds, debentures, convertible debentures,

-29-

Instructions for Schedule H (Form 5500)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9