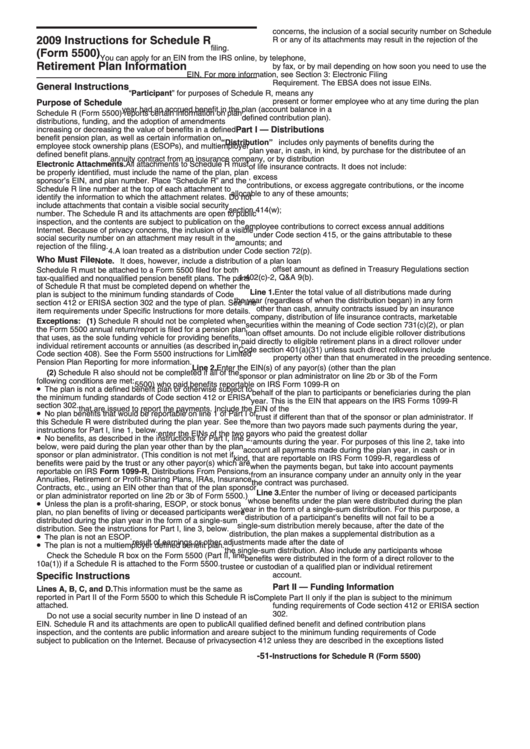

2009 Instructions For Schedule R (Form 5500) Retirement Plan Information

ADVERTISEMENT

concerns, the inclusion of a social security number on Schedule

2009 Instructions for Schedule R

R or any of its attachments may result in the rejection of the

filing.

(Form 5500)

You can apply for an EIN from the IRS online, by telephone,

Retirement Plan Information

by fax, or by mail depending on how soon you need to use the

EIN. For more information, see Section 3: Electronic Filing

Requirement. The EBSA does not issue EINs.

General Instructions

“Participant” for purposes of Schedule R, means any

present or former employee who at any time during the plan

Purpose of Schedule

year had an accrued benefit in the plan (account balance in a

Schedule R (Form 5500) reports certain information on plan

defined contribution plan).

distributions, funding, and the adoption of amendments

Part I — Distributions

increasing or decreasing the value of benefits in a defined

benefit pension plan, as well as certain information on

“Distribution” includes only payments of benefits during the

employee stock ownership plans (ESOPs), and multiemployer

plan year, in cash, in kind, by purchase for the distributee of an

defined benefit plans.

annuity contract from an insurance company, or by distribution

Electronic Attachments. All attachments to Schedule R must

of life insurance contracts. It does not include:

be properly identified, must include the name of the plan, plan

1. Corrective distributions of excess deferrals, excess

sponsor’s EIN, and plan number. Place “Schedule R” and the

contributions, or excess aggregate contributions, or the income

Schedule R line number at the top of each attachment to

allocable to any of these amounts;

identify the information to which the attachment relates. Do not

2. Distributions of automatic contributions pursuant to Code

include attachments that contain a visible social security

section 414(w);

number. The Schedule R and its attachments are open to public

3. The distribution of elective deferrals or the return of

inspection, and the contents are subject to publication on the

employee contributions to correct excess annual additions

Internet. Because of privacy concerns, the inclusion of a visible

under Code section 415, or the gains attributable to these

social security number on an attachment may result in the

amounts; and

rejection of the filing.

4. A loan treated as a distribution under Code section 72(p).

Who Must File

Note. It does, however, include a distribution of a plan loan

offset amount as defined in Treasury Regulations section

Schedule R must be attached to a Form 5500 filed for both

1.402(c)-2, Q&A 9(b).

tax-qualified and nonqualified pension benefit plans. The parts

of Schedule R that must be completed depend on whether the

Line 1. Enter the total value of all distributions made during

plan is subject to the minimum funding standards of Code

the year (regardless of when the distribution began) in any form

section 412 or ERISA section 302 and the type of plan. See line

other than cash, annuity contracts issued by an insurance

item requirements under Specific Instructions for more details.

company, distribution of life insurance contracts, marketable

Exceptions: (1) Schedule R should not be completed when

securities within the meaning of Code section 731(c)(2), or plan

the Form 5500 annual return/report is filed for a pension plan

loan offset amounts. Do not include eligible rollover distributions

that uses, as the sole funding vehicle for providing benefits,

paid directly to eligible retirement plans in a direct rollover under

individual retirement accounts or annuities (as described in

Code section 401(a)(31) unless such direct rollovers include

Code section 408). See the Form 5500 instructions for Limited

property other than that enumerated in the preceding sentence.

Pension Plan Reporting for more information.

Line 2. Enter the EIN(s) of any payor(s) (other than the plan

(2) Schedule R also should not be completed if all of the

sponsor or plan administrator on line 2b or 3b of the Form

following conditions are met:

5500) who paid benefits reportable on IRS Form 1099-R on

•

The plan is not a defined benefit plan or otherwise subject to

behalf of the plan to participants or beneficiaries during the plan

the minimum funding standards of Code section 412 or ERISA

year. This is the EIN that appears on the IRS Forms 1099-R

section 302.

that are issued to report the payments. Include the EIN of the

•

No plan benefits that would be reportable on line 1 of Part I of

trust if different than that of the sponsor or plan administrator. If

this Schedule R were distributed during the plan year. See the

more than two payors made such payments during the year,

instructions for Part I, line 1, below.

enter the EINs of the two payors who paid the greatest dollar

•

No benefits, as described in the instructions for Part I, line 2,

amounts during the year. For purposes of this line 2, take into

below, were paid during the plan year other than by the plan

account all payments made during the plan year, in cash or in

sponsor or plan administrator. (This condition is not met if

kind, that are reportable on IRS Form 1099-R, regardless of

benefits were paid by the trust or any other payor(s) which are

when the payments began, but take into account payments

reportable on IRS Form 1099-R, Distributions From Pensions,

from an insurance company under an annuity only in the year

Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance

the contract was purchased.

Contracts, etc., using an EIN other than that of the plan sponsor

Line 3. Enter the number of living or deceased participants

or plan administrator reported on line 2b or 3b of Form 5500.)

•

whose benefits under the plan were distributed during the plan

Unless the plan is a profit-sharing, ESOP, or stock bonus

year in the form of a single-sum distribution. For this purpose, a

plan, no plan benefits of living or deceased participants were

distribution of a participant’s benefits will not fail to be a

distributed during the plan year in the form of a single-sum

single-sum distribution merely because, after the date of the

distribution. See the instructions for Part I, line 3, below.

•

distribution, the plan makes a supplemental distribution as a

The plan is not an ESOP.

•

result of earnings or other adjustments made after the date of

The plan is not a multiemployer defined benefit plan.

the single-sum distribution. Also include any participants whose

Check the Schedule R box on the Form 5500 (Part II, line

benefits were distributed in the form of a direct rollover to the

10a(1)) if a Schedule R is attached to the Form 5500.

trustee or custodian of a qualified plan or individual retirement

account.

Specific Instructions

Part II — Funding Information

Lines A, B, C, and D. This information must be the same as

reported in Part II of the Form 5500 to which this Schedule R is

Complete Part II only if the plan is subject to the minimum

attached.

funding requirements of Code section 412 or ERISA section

302.

Do not use a social security number in line D instead of an

EIN. Schedule R and its attachments are open to public

All qualified defined benefit and defined contribution plans

inspection, and the contents are public information and are

are subject to the minimum funding requirements of Code

subject to publication on the Internet. Because of privacy

section 412 unless they are described in the exceptions listed

-51-

Instructions for Schedule R (Form 5500)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4