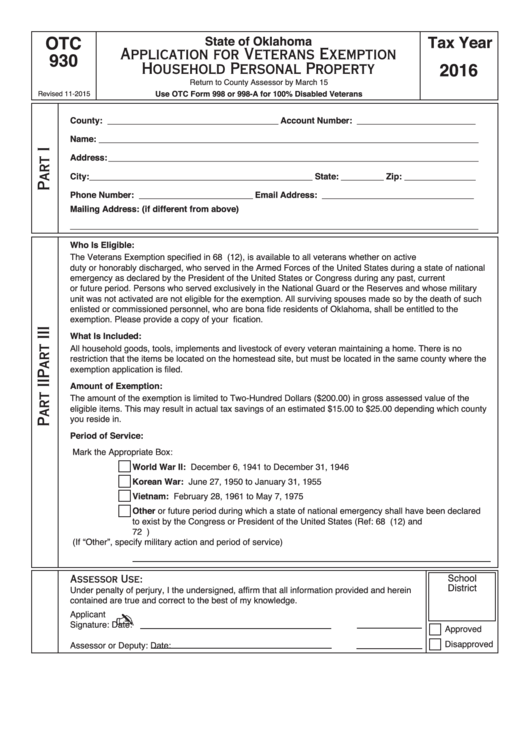

OTC

Tax Year

State of Oklahoma

Application for Veterans Exemption

930

2016

Household Personal Property

Return to County Assessor by March 15

Use OTC Form 998 or 998-A for 100% Disabled Veterans

Revised 11-2015

County: ____________________________________ Account Number: _________________________

Name: ________________________________________________________________________________

Address: ______________________________________________________________________________

City: _______________________________________________ State: _________ Zip: _______________

Phone Number: ________________________

Email Address: ________________________________

Mailing Address: (if different from above)

______________________________________________________________________________________

Who Is Eligible:

The Veterans Exemption specified in 68 O.S. Section 2887(12), is available to all veterans whether on active

duty or honorably discharged, who served in the Armed Forces of the United States during a state of national

emergency as declared by the President of the United States or Congress during any past, current

or future period. Persons who served exclusively in the National Guard or the Reserves and whose military

unit was not activated are not eligible for the exemption. All surviving spouses made so by the death of such

enlisted or commissioned personnel, who are bona fide residents of Oklahoma, shall be entitled to the

exemption. Please provide a copy of your U.S. Military Form DD-214 for verification.

What Is Included:

All household goods, tools, implements and livestock of every veteran maintaining a home. There is no

restriction that the items be located on the homestead site, but must be located in the same county where the

exemption application is filed.

Amount of Exemption:

The amount of the exemption is limited to Two-Hundred Dollars ($200.00) in gross assessed value of the

eligible items. This may result in actual tax savings of an estimated $15.00 to $25.00 depending which county

you reside in.

Period of Service:

Mark the Appropriate Box:

World War II: December 6, 1941 to December 31, 1946

Korean War: June 27, 1950 to January 31, 1955

Vietnam: February 28, 1961 to May 7, 1975

Other or future period during which a state of national emergency shall have been declared

to exist by the Congress or President of the United States (Ref: 68 O.S. Section 2887(12) and

72 O.S. Section 67.13a)

(If “Other”, specify military action and period of service)

School

Assessor Use:

District

Under penalty of perjury, I the undersigned, affirm that all information provided and herein

contained are true and correct to the best of my knowledge.

Applicant

✍

Signature:

Date:

Approved

Disapproved

Assessor or Deputy:

Date:

1

1