Form Sdr - Refund Of Surety Deposits For Non-Minnesota Contractors - Minnesota Revenue

ADVERTISEMENT

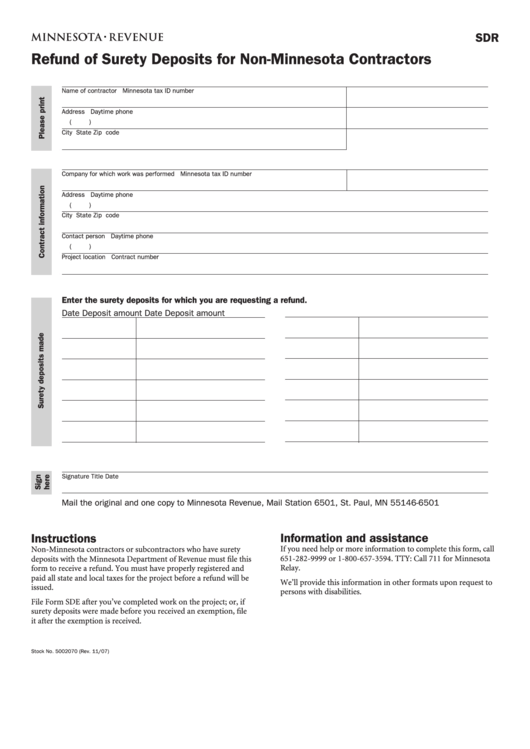

SDR

Refund of Surety Deposits for Non-Minnesota Contractors

Name of contractor

Minnesota tax ID number

Address

Daytime phone

(

)

City

State

Zip code

Company for which work was performed

Minnesota tax ID number

Address

Daytime phone

(

)

City

State

Zip code

Contact person

Daytime phone

(

)

Project location

Contract number

Enter the surety deposits for which you are requesting a refund.

Date

Deposit amount

Date

Deposit amount

Signature

Title

Date

Mail the original and one copy to Minnesota Revenue, Mail Station 6501, St. Paul, MN 55146-6501

Information and assistance

Instructions

Non-Minnesota contractors or subcontractors who have surety

If you need help or more information to complete this form, call

deposits with the Minnesota Department of Revenue must file this

651-282-9999 or 1-800-657-3594. TTY: Call 711 for Minnesota

form to receive a refund. You must have properly registered and

Relay.

paid all state and local taxes for the project before a refund will be

We’ll provide this information in other formats upon request to

issued.

persons with disabilities.

File Form SDE after you’ve completed work on the project; or, if

surety deposits were made before you received an exemption, file

it after the exemption is received.

Stock No. 5002070 (Rev. 11/07)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1