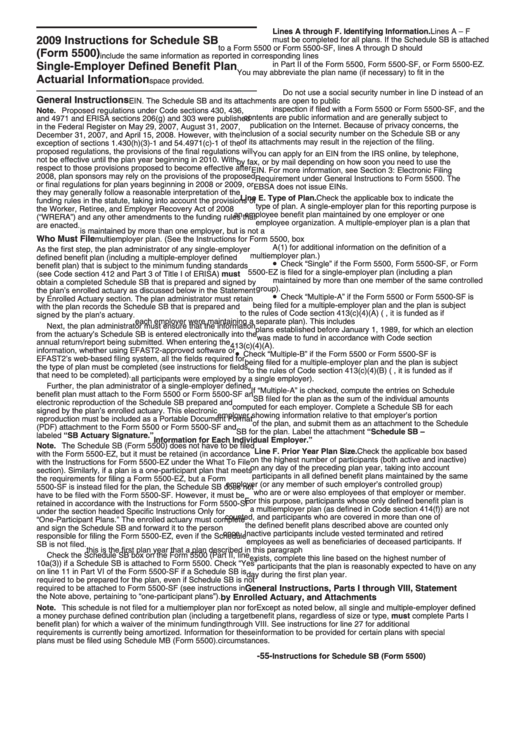

2009 Instructions For Schedule Sb (Form 5500) Single-Employer Defined Benefit Plan Actuarial Information

ADVERTISEMENT

Lines A through F. Identifying Information. Lines A – F

2009 Instructions for Schedule SB

must be completed for all plans. If the Schedule SB is attached

to a Form 5500 or Form 5500-SF, lines A through D should

(Form 5500)

include the same information as reported in corresponding lines

in Part II of the Form 5500, Form 5500-SF, or Form 5500-EZ.

Single-Employer Defined Benefit Plan

You may abbreviate the plan name (if necessary) to fit in the

Actuarial Information

space provided.

Do not use a social security number in line D instead of an

General Instructions

EIN. The Schedule SB and its attachments are open to public

inspection if filed with a Form 5500 or Form 5500-SF, and the

Note. Proposed regulations under Code sections 430, 436,

contents are public information and are generally subject to

and 4971 and ERISA sections 206(g) and 303 were published

publication on the Internet. Because of privacy concerns, the

in the Federal Register on May 29, 2007, August 31, 2007,

inclusion of a social security number on the Schedule SB or any

December 31, 2007, and April 15, 2008. However, with the

of its attachments may result in the rejection of the filing.

exception of sections 1.430(h)(3)-1 and 54.4971(c)-1 of the

proposed regulations, the provisions of the final regulations will

You can apply for an EIN from the IRS online, by telephone,

not be effective until the plan year beginning in 2010. With

by fax, or by mail depending on how soon you need to use the

respect to those provisions proposed to become effective after

EIN. For more information, see Section 3: Electronic Filing

2008, plan sponsors may rely on the provisions of the proposed

Requirement under General Instructions to Form 5500. The

or final regulations for plan years beginning in 2008 or 2009, or

EBSA does not issue EINs.

they may generally follow a reasonable interpretation of the

Line E. Type of Plan. Check the applicable box to indicate the

funding rules in the statute, taking into account the provisions of

type of plan. A single-employer plan for this reporting purpose is

the Worker, Retiree, and Employer Recovery Act of 2008

an employee benefit plan maintained by one employer or one

(“WRERA”) and any other amendments to the funding rules that

employee organization. A multiple-employer plan is a plan that

are enacted.

is maintained by more than one employer, but is not a

Who Must File

multiemployer plan. (See the Instructions for Form 5500, box

A(1) for additional information on the definition of a

As the first step, the plan administrator of any single-employer

multiemployer plan.)

defined benefit plan (including a multiple-employer defined

•

Check “Single” if the Form 5500, Form 5500-SF, or Form

benefit plan) that is subject to the minimum funding standards

5500-EZ is filed for a single-employer plan (including a plan

(see Code section 412 and Part 3 of Title I of ERISA) must

maintained by more than one member of the same controlled

obtain a completed Schedule SB that is prepared and signed by

group).

the plan’s enrolled actuary as discussed below in the Statement

•

Check “Multiple-A” if the Form 5500 or Form 5500-SF is

by Enrolled Actuary section. The plan administrator must retain

being filed for a multiple-employer plan and the plan is subject

with the plan records the Schedule SB that is prepared and

to the rules of Code section 413(c)(4)(A) (i.e., it is funded as if

signed by the plan’s actuary.

each employer were maintaining a separate plan). This includes

Next, the plan administrator must ensure that the information

plans established before January 1, 1989, for which an election

from the actuary’s Schedule SB is entered electronically into the

was made to fund in accordance with Code section

annual return/report being submitted. When entering the

413(c)(4)(A).

information, whether using EFAST2-approved software or

•

Check “Multiple-B” if the Form 5500 or Form 5500-SF is

EFAST2’s web-based filing system, all the fields required for

being filed for a multiple-employer plan and the plan is subject

the type of plan must be completed (see instructions for fields

to the rules of Code section 413(c)(4)(B) (i.e., it is funded as if

that need to be completed).

all participants were employed by a single employer).

Further, the plan administrator of a single-employer defined

If “Multiple-A” is checked, compute the entries on Schedule

benefit plan must attach to the Form 5500 or Form 5500-SF an

SB filed for the plan as the sum of the individual amounts

electronic reproduction of the Schedule SB prepared and

computed for each employer. Complete a Schedule SB for each

signed by the plan’s enrolled actuary. This electronic

employer showing information relative to that employer’s portion

reproduction must be included as a Portable Document Format

of the plan, and submit them as an attachment to the Schedule

(PDF) attachment to the Form 5500 or Form 5500-SF and

SB for the plan. Label the attachment “Schedule SB –

labeled “SB Actuary Signature.”

Information for Each Individual Employer.”

Note. The Schedule SB (Form 5500) does not have to be filed

Line F. Prior Year Plan Size. Check the applicable box based

with the Form 5500-EZ, but it must be retained (in accordance

on the highest number of participants (both active and inactive)

with the Instructions for Form 5500-EZ under the What To File

on any day of the preceding plan year, taking into account

section). Similarly, if a plan is a one-participant plan that meets

participants in all defined benefit plans maintained by the same

the requirements for filing a Form 5500-EZ, but a Form

employer (or any member of such employer’s controlled group)

5500-SF is instead filed for the plan, the Schedule SB does not

who are or were also employees of that employer or member.

have to be filed with the Form 5500-SF. However, it must be

For this purpose, participants whose only defined benefit plan is

retained in accordance with the Instructions for Form 5500-SF

a multiemployer plan (as defined in Code section 414(f)) are not

under the section headed Specific Instructions Only for

counted, and participants who are covered in more than one of

“One-Participant Plans.” The enrolled actuary must complete

the defined benefit plans described above are counted only

and sign the Schedule SB and forward it to the person

once. Inactive participants include vested terminated and retired

responsible for filing the Form 5500-EZ, even if the Schedule

employees as well as beneficiaries of deceased participants. If

SB is not filed.

this is the first plan year that a plan described in this paragraph

Check the Schedule SB box on the Form 5500 (Part II, line

exists, complete this line based on the highest number of

10a(3)) if a Schedule SB is attached to Form 5500. Check “Yes”

participants that the plan is reasonably expected to have on any

on line 11 in Part VI of the Form 5500-SF if a Schedule SB is

day during the first plan year.

required to be prepared for the plan, even if Schedule SB is not

required to be attached to Form 5500-SF (see instructions in

General Instructions, Parts I through VIII, Statement

the Note above, pertaining to “one-participant plans”).

by Enrolled Actuary, and Attachments

Note. This schedule is not filed for a multiemployer plan nor for

Except as noted below, all single and multiple-employer defined

a money purchase defined contribution plan (including a target

benefit plans, regardless of size or type, must complete Parts I

benefit plan) for which a waiver of the minimum funding

through VIII. See instructions for line 27 for additional

requirements is currently being amortized. Information for these

information to be provided for certain plans with special

plans must be filed using Schedule MB (Form 5500).

circumstances.

-55-

Instructions for Schedule SB (Form 5500)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11