Form Sdd - Surety Deposits For Non-Minnesota Contractors Form - Minnesota Revenue

ADVERTISEMENT

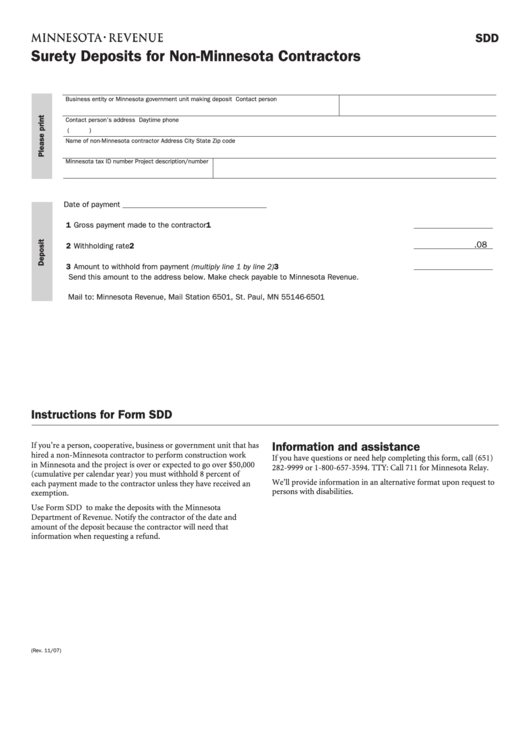

SDD

Surety Deposits for Non-Minnesota Contractors

Business entity or Minnesota government unit making deposit

Contact person

Contact person’s address

Daytime phone

(

)

Name of non-Minnesota contractor

Address

City

State

Zip code

Minnesota tax ID number

Project description/number

Date of payment _____________________________________

1 Gross payment made to the contractor . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

.08

2 Withholding rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Amount to withhold from payment (multiply line 1 by line 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

Send this amount to the address below . Make check payable to Minnesota Revenue .

Mail to: Minnesota Revenue, Mail Station 6501, St . Paul, MN 55146-6501

Instructions for Form SDD

Information and assistance

If you’re a person, cooperative, business or government unit that has

hired a non-Minnesota contractor to perform construction work

If you have questions or need help completing this form, call (651)

in Minnesota and the project is over or expected to go over $50,000

282-9999 or 1-800-657-3594. TTY: Call 711 for Minnesota Relay.

(cumulative per calendar year) you must withhold 8 percent of

We’ll provide information in an alternative format upon request to

each payment made to the contractor unless they have received an

persons with disabilities.

exemption.

Use Form SDD to make the deposits with the Minnesota

Department of Revenue. Notify the contractor of the date and

amount of the deposit because the contractor will need that

information when requesting a refund.

(Rev . 11/07)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1