Instructions For Form 941-Ss - Employer'S Quarterly Federal Tax Returnamerican Samoa, Guam, The Commonwealth Of The Northern Mariana Islands, And The U.s. Virgin Islands - 2006

ADVERTISEMENT

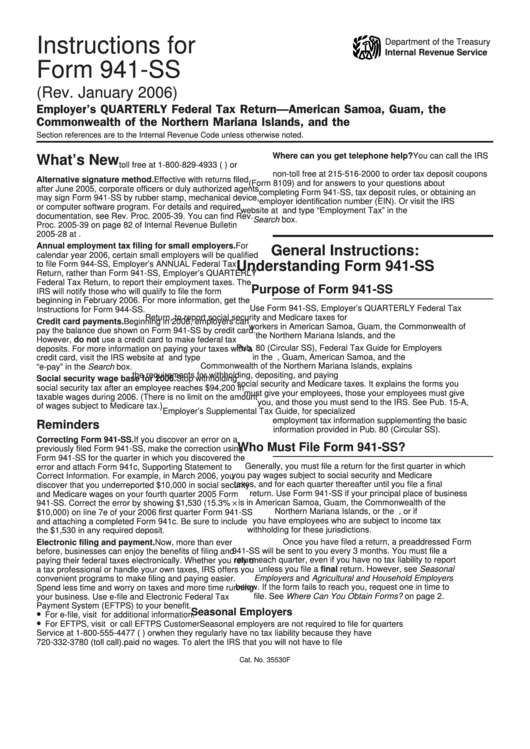

Instructions for

Department of the Treasury

Internal Revenue Service

Form 941-SS

(Rev. January 2006)

Employer’s QUARTERLY Federal Tax Return—American Samoa, Guam, the

Commonwealth of the Northern Mariana Islands, and the U.S. Virgin Islands

Section references are to the Internal Revenue Code unless otherwise noted.

Where can you get telephone help? You can call the IRS

What’s New

toll free at 1-800-829-4933 (U.S. Virgin Islands only) or

non-toll free at 215-516-2000 to order tax deposit coupons

Alternative signature method. Effective with returns filed

(Form 8109) and for answers to your questions about

after June 2005, corporate officers or duly authorized agents

completing Form 941-SS, tax deposit rules, or obtaining an

may sign Form 941-SS by rubber stamp, mechanical device,

employer identification number (EIN). Or visit the IRS

or computer software program. For details and required

website at and type “Employment Tax” in the

documentation, see Rev. Proc. 2005-39. You can find Rev.

Search box.

Proc. 2005-39 on page 82 of Internal Revenue Bulletin

2005-28 at /pub/irs-irbs/irb05-28.pdf.

Annual employment tax filing for small employers. For

General Instructions:

calendar year 2006, certain small employers will be qualified

Understanding Form 941-SS

to file Form 944-SS, Employer’s ANNUAL Federal Tax

Return, rather than Form 941-SS, Employer’s QUARTERLY

Federal Tax Return, to report their employment taxes. The

Purpose of Form 941-SS

IRS will notify those who will qualify to file the form

beginning in February 2006. For more information, get the

Use Form 941-SS, Employer’s QUARTERLY Federal Tax

Instructions for Form 944-SS.

Return, to report social security and Medicare taxes for

Credit card payments. Beginning in 2006, employers can

workers in American Samoa, Guam, the Commonwealth of

pay the balance due shown on Form 941-SS by credit card.

the Northern Mariana Islands, and the U.S. Virgin Islands.

However, do not use a credit card to make federal tax

Pub. 80 (Circular SS), Federal Tax Guide for Employers

deposits. For more information on paying your taxes with a

in the U.S. Virgin Islands, Guam, American Samoa, and the

credit card, visit the IRS website at and type

Commonwealth of the Northern Mariana Islands, explains

“e-pay” in the Search box.

the requirements for withholding, depositing, and paying

Social security wage base for 2006. Stop withholding

social security and Medicare taxes. It explains the forms you

social security tax after an employee reaches $94,200 in

must give your employees, those your employees must give

taxable wages during 2006. (There is no limit on the amount

you, and those you must send to the IRS. See Pub. 15-A,

of wages subject to Medicare tax.)

Employer’s Supplemental Tax Guide, for specialized

employment tax information supplementing the basic

Reminders

information provided in Pub. 80 (Circular SS).

Correcting Form 941-SS. If you discover an error on a

Who Must File Form 941-SS?

previously filed Form 941-SS, make the correction using

Form 941-SS for the quarter in which you discovered the

Generally, you must file a return for the first quarter in which

error and attach Form 941c, Supporting Statement to

you pay wages subject to social security and Medicare

Correct Information. For example, in March 2006, you

taxes, and for each quarter thereafter until you file a final

discover that you underreported $10,000 in social security

return. Use Form 941-SS if your principal place of business

and Medicare wages on your fourth quarter 2005 Form

941-SS. Correct the error by showing $1,530 (15.3% ×

is in American Samoa, Guam, the Commonwealth of the

Northern Mariana Islands, or the U.S. Virgin Islands, or if

$10,000) on line 7e of your 2006 first quarter Form 941-SS

you have employees who are subject to income tax

and attaching a completed Form 941c. Be sure to include

withholding for these jurisdictions.

the $1,530 in any required deposit.

Once you have filed a return, a preaddressed Form

Electronic filing and payment. Now, more than ever

941-SS will be sent to you every 3 months. You must file a

before, businesses can enjoy the benefits of filing and

return each quarter, even if you have no tax liability to report

paying their federal taxes electronically. Whether you rely on

unless you file a final return. However, see Seasonal

a tax professional or handle your own taxes, IRS offers you

Employers and Agricultural and Household Employers

convenient programs to make filing and paying easier.

below. If the form fails to reach you, request one in time to

Spend less time and worry on taxes and more time running

file. See Where Can You Obtain Forms? on page 2.

your business. Use e-file and Electronic Federal Tax

Payment System (EFTPS) to your benefit.

•

Seasonal Employers

For e-file, visit for additional information.

•

For EFTPS, visit or call EFTPS Customer

Seasonal employers are not required to file for quarters

Service at 1-800-555-4477 (U.S. Virgin Islands only) or

when they regularly have no tax liability because they have

720-332-3780 (toll call).

paid no wages. To alert the IRS that you will not have to file

Cat. No. 35530F

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7