Maine Income Tax Withholding Percentage Method - 2008

ADVERTISEMENT

SUPPLEMENT TO WITHHOLDING TABLES BOOKLET

2008 MAINE INCOME TAX WITHHOLDING

PERCENTAGE METHOD

Following are percentage method instructions and rate schedules for weekly, biweekly,

semimonthly, monthly, and daily or miscellaneous payroll periods.

Step 1 - Multiply amount from table below by the number of allowances the employee claims:

Payroll Period

Amount Per Withholding Allowance

Weekly

$ 54.81

Biweekly

$109.62

Semimonthly

$118.75

Monthly

$237.50

Daily or Miscellaneous

$ 10.96

Step 2 - Subtract the result of Step 1 from the employee's gross wage.

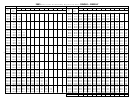

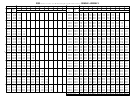

Step 3 - Compute the withholding amount using the following tax rate schedule for the appropriate

payroll period and marital status.

Rev. 10/07

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3