Instructions For Form 941 - Employer'S Quarterly Federal Tax Return - 2002

ADVERTISEMENT

Form 941 (Rev. 1-2002)

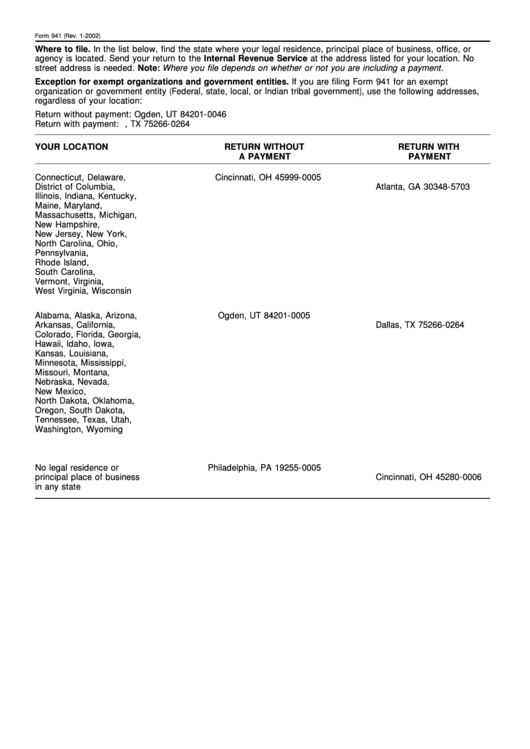

Where to file. In the list below, find the state where your legal residence, principal place of business, office, or

agency is located. Send your return to the Internal Revenue Service at the address listed for your location. No

street address is needed. Note: Where you file depends on whether or not you are including a payment.

Exception for exempt organizations and government entities. If you are filing Form 941 for an exempt

organization or government entity (Federal, state, local, or Indian tribal government), use the following addresses,

regardless of your location:

Return without payment: Ogden, UT 84201-0046

Return with payment: P.O. Box 660264 Dallas, TX 75266-0264

YOUR LOCATION

RETURN WITHOUT

RETURN WITH

A PAYMENT

PAYMENT

Connecticut, Delaware,

Cincinnati, OH 45999-0005

P.O. Box 105703

District of Columbia,

Atlanta, GA 30348-5703

Illinois, Indiana, Kentucky,

Maine, Maryland,

Massachusetts, Michigan,

New Hampshire,

New Jersey, New York,

North Carolina, Ohio,

Pennsylvania,

Rhode Island,

South Carolina,

Vermont, Virginia,

West Virginia, Wisconsin

Alabama, Alaska, Arizona,

Ogden, UT 84201-0005

P.O. Box 660264

Arkansas, California,

Dallas, TX 75266-0264

Colorado, Florida, Georgia,

Hawaii, Idaho, Iowa,

Kansas, Louisiana,

Minnesota, Mississippi,

Missouri, Montana,

Nebraska, Nevada,

New Mexico,

North Dakota, Oklahoma,

Oregon, South Dakota,

Tennessee, Texas, Utah,

Washington, Wyoming

No legal residence or

Philadelphia, PA 19255-0005

P.O. Box 80106

principal place of business

Cincinnati, OH 45280-0006

in any state

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7