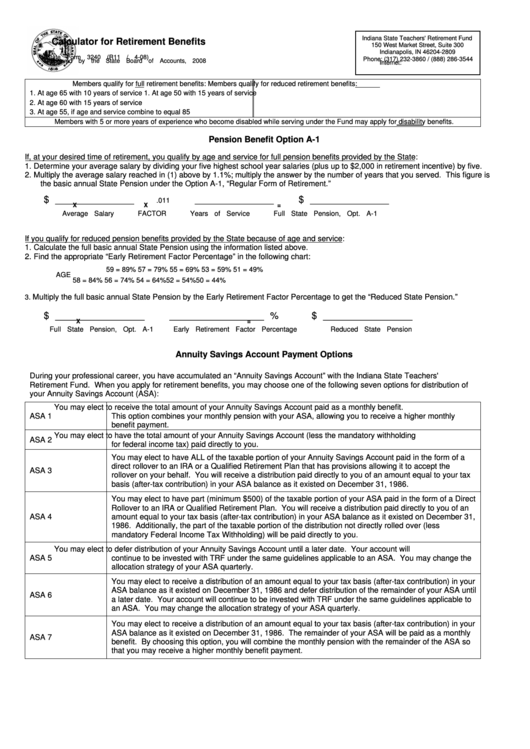

State Form 3240 - Calculator For Retirement Benefits

ADVERTISEMENT

Indiana State Teachers' Retirement Fund

Calculator for Retirement Benefits

150 West Market Street, Suite 300

Indianapolis, IN 46204-2809

State Form 3240 (R11 / 4-08)

Phone: (317) 232-3860 / (888) 286-3544

Approved by the State Board of Accounts, 2008

Internet:

Members qualify for full retirement benefits:

Members qualify for reduced retirement benefits:

1. At age 65 with 10 years of service

1. At age 50 with 15 years of service

2. At age 60 with 15 years of service

3. At age 55, if age and service combine to equal 85

Members with 5 or more years of experience who become disabled while serving under the Fund may apply for disability benefits.

Pension Benefit Option A-1

If, at your desired time of retirement, you qualify by age and service for full pension benefits provided by the State:

1.

Determine your average salary by dividing your five highest school year salaries (plus up to $2,000 in retirement incentive) by five.

2.

Multiply the average salary reached in (1) above by 1.1%; multiply the answer by the number of years that you served. This figure is

the basic annual State Pension under the Option A-1, “Regular Form of Retirement.”

$ _______________

_______________

$ _______________

.011

X

X

=

Average Salary

FACTOR

Years of Service

Full State Pension, Opt. A-1

If you qualify for reduced pension benefits provided by the State because of age and service:

1.

Calculate the full basic annual State Pension using the information listed above.

2.

Find the appropriate “Early Retirement Factor Percentage” in the following chart:

59 = 89%

57 = 79%

55 = 69%

53 = 59%

51 = 49%

AGE

58 = 84%

56 = 74%

54 = 64%

52 = 54%

50 = 44%

Multiply the full basic annual State Pension by the Early Retirement Factor Percentage to get the “Reduced State Pension.”

3.

$ _________________

__________________ %

$ _________________

X

=

Full State Pension, Opt. A-1

Early Retirement Factor Percentage

Reduced State Pension

Annuity Savings Account Payment Options

During your professional career, you have accumulated an “Annuity Savings Account” with the Indiana State Teachers'

Retirement Fund. When you apply for retirement benefits, you may choose one of the following seven options for distribution of

your Annuity Savings Account (ASA):

You may elect to receive the total amount of your Annuity Savings Account paid as a monthly benefit.

ASA 1

This option combines your monthly pension with your ASA, allowing you to receive a higher monthly

benefit payment.

You may elect to have the total amount of your Annuity Savings Account (less the mandatory withholding

ASA 2

for federal income tax) paid directly to you.

You may elect to have ALL of the taxable portion of your Annuity Savings Account paid in the form of a

direct rollover to an IRA or a Qualified Retirement Plan that has provisions allowing it to accept the

ASA 3

rollover on your behalf. You will receive a distribution paid directly to you of an amount equal to your tax

basis (after-tax contribution) in your ASA balance as it existed on December 31, 1986.

You may elect to have part (minimum $500) of the taxable portion of your ASA paid in the form of a Direct

Rollover to an IRA or Qualified Retirement Plan. You will receive a distribution paid directly to you of an

ASA 4

amount equal to your tax basis (after-tax contribution) in your ASA balance as it existed on December 31,

1986. Additionally, the part of the taxable portion of the distribution not directly rolled over (less

mandatory Federal Income Tax Withholding) will be paid directly to you.

You may elect to defer distribution of your Annuity Savings Account until a later date. Your account will

ASA 5

continue to be invested with TRF under the same guidelines applicable to an ASA. You may change the

allocation strategy of your ASA quarterly.

You may elect to receive a distribution of an amount equal to your tax basis (after-tax contribution) in your

ASA balance as it existed on December 31, 1986 and defer distribution of the remainder of your ASA until

ASA 6

a later date. Your account will continue to be invested with TRF under the same guidelines applicable to

an ASA. You may change the allocation strategy of your ASA quarterly.

You may elect to receive a distribution of an amount equal to your tax basis (after-tax contribution) in your

ASA balance as it existed on December 31, 1986. The remainder of your ASA will be paid as a monthly

ASA 7

benefit. By choosing this option, you will combine the monthly pension with the remainder of the ASA so

that you may receive a higher monthly benefit payment.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2