Tax Information: Sales Tax - City Of Streamboat Springs

ADVERTISEMENT

Sales Tax Department

th

137 10

Street

PO Box 772869

Steamboat Springs, CO 80477

Phone: (970) 879-2060

Fax: (970) 879-8851

Tax Information: Sales Tax

General Information

accommodation rentals within the LMD. It is important

to contact the City to find out if any of your short-term

The City of Steamboat Springs imposes a sales tax on

accommodation rental properties are located within the

tangible personal property or taxable services that are

LMD.

purchased, sold, leased or rented in the City of Steam-

boat Springs. The term “In the City of Steamboat

Sales Tax License

To obtain a

, contact the Sales Tax

Springs” includes any tangible personal property or tax-

able service that is provided or delivered to the pur-

Department for an application. No fees or deposits are

chaser within the City limits.

Steamboat Springs’ tax

required for a standard sales tax license. After your ap-

rate is 4.5% of the retail purchase price of the tangible

plication is received and processed, you will be desig-

personal property or taxable services being purchased,

nated as a monthly, quarterly or yearly filer, and a sales

sold, leased or rented.

tax license and tax returns will be mailed to you.

Who Needs a Sales Tax License?

Please note that there is a $50.00 deposit and a special

Special Event Sales Tax License

application for a

.

Retailers

– businesses or individuals engaged in the

business of making retail sales.

Due Dates

th

for sales taxes and returns the 20

of the

Lessors

– businesses or individuals renting or leasing

month following the tax period. For example, Septem-

th

tangible personal property. Examples include ski rent-

ber’s return and payment are due October 20

. Quar-

th

als, DVDs, vehicles, and construction equipment.

terly returns are due the 20

of the month after the

th

quarter ends, and annual returns are due January 20

.

Accommodation Rentals

Returns must be filed even if there is no tax due.

– businesses or individuals

renting or leasing lodging, banquet halls or other meet-

Mail Returns and Payments to

ing spaces for less than 30 consecutive days. Examples

include hotels, motels, bed & breakfasts, apartments,

City of Steamboat Springs

condos, houses, and campgrounds.

Sales Tax Department

PO Box 772869

Peddlers, Transient Sales and Special Events

–

Steamboat Springs, CO 80477-2869

businesses or individuals engaged in temporary sales

within the City limits.

Penalty

for late filing is the greater of $15.00 or 10%

of the taxes due.

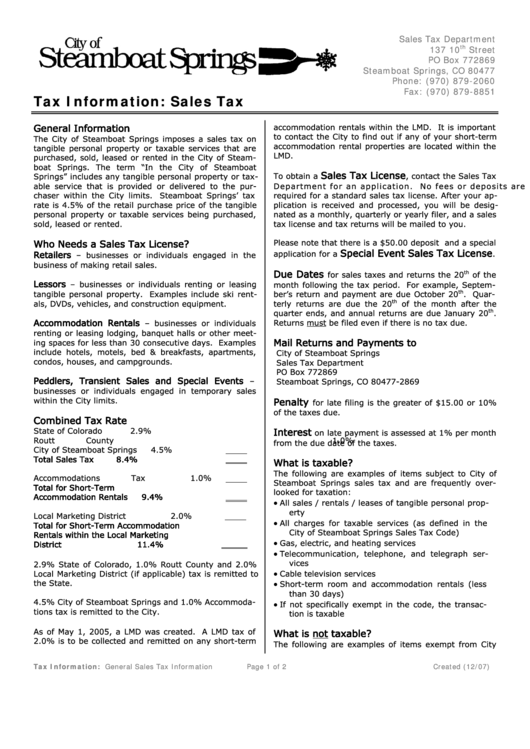

Combined Tax Rate

State of Colorado

2.9%

Interest

on late payment is assessed at 1% per month

Routt County

1.0%

from the due date of the taxes.

City of Steamboat Springs

4.5%

Total Sales Tax

8.4%

What is taxable?

The following are examples of items subject to City of

Accommodations Tax

1.0%

Steamboat Springs sales tax and are frequently over-

Total for Short-Term

looked for taxation:

Accommodation Rentals

9.4%

•

All sales / rentals / leases of tangible personal prop-

erty

Local Marketing District

2.0%

•

All charges for taxable services (as defined in the

Total for Short-Term Accommodation

City of Steamboat Springs Sales Tax Code)

Rentals within the Local Marketing

•

Gas, electric, and heating services

District

11.4%

•

Telecommunication, telephone, and telegraph ser-

vices

2.9% State of Colorado, 1.0% Routt County and 2.0%

•

Cable television services

Local Marketing District (if applicable) tax is remitted to

the State.

•

Short-term room and accommodation rentals (less

than 30 days)

4.5% City of Steamboat Springs and 1.0% Accommoda-

•

If not specifically exempt in the code, the transac-

tions tax is remitted to the City.

tion is taxable

As of May 1, 2005, a LMD was created. A LMD tax of

What is not taxable?

2.0% is to be collected and remitted on any short-term

The following are examples of items exempt from City

Tax Information: General Sales Tax Information

Page 1 of 2

Created (12/07)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2