Delaware Form 300 - Delaware Partnership Return - 2005

ADVERTISEMENT

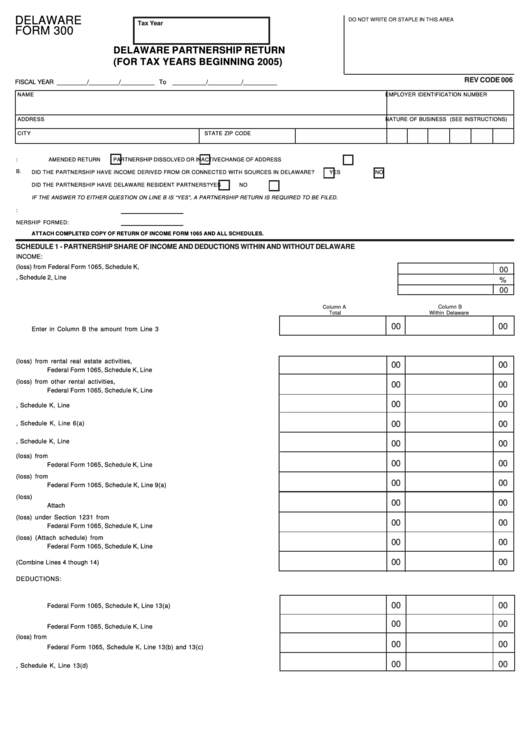

DELAWARE

DO NOT WRITE OR STAPLE IN THIS AREA

Tax Year

FORM 300

DELAWARE PARTNERSHIP RETURN

(FOR TAX YEARS BEGINNING 2005)

REV CODE 006

FISCAL YEAR _________/_________/__________ To __________/__________/__________

NAME

EMPLOYER IDENTIFICATION NUMBER

ADDRESS

NATURE OF BUSINESS (SEE INSTRUCTIONS)

CITY

STATE

ZIP CODE

A.

CHECK APPLICABLE BOX:

AMENDED RETURN

PARTNERSHIP DISSOLVED OR INACTIVE

CHANGE OF ADDRESS

B.

DID THE PARTNERSHIP HAVE INCOME DERIVED FROM OR CONNECTED WITH SOURCES IN DELAWARE?

YES

NO

DID THE PARTNERSHIP HAVE DELAWARE RESIDENT PARTNERS?

YES

NO

IF THE ANSWER TO EITHER QUESTION ON LINE B IS “YES”, A PARTNERSHIP RETURN IS REQUIRED TO BE FILED.

C.

TOTAL NUMBER OF PARTNERS:

D.

YEAR PARTNERSHIP FORMED:

ATTACH COMPLETED COPY OF U.S. PARTNERSHIP RETURN OF INCOME FORM 1065 AND ALL SCHEDULES.

SCHEDULE 1 - PARTNERSHIP SHARE OF INCOME AND DEDUCTIONS WITHIN AND WITHOUT DELAWARE

INCOME:

1.

Ordinary income (loss) from Federal Form 1065, Schedule K, Line1.............................................................................................

00

2.

Apportionment percentage from Delaware Form 300, Schedule 2, Line 16....................................................................................

%

3.

Ordinary income apportioned to Delaware. Multiply Line 1 times Line 2.........................................................................................

00

Column A

Column B

Total

Within Delaware

4.

Enter in Column A the amount from Line 1

00

00

Enter in Column B the amount from Line 3

5.

Net income (loss) from rental real estate activities,

00

00

Federal Form 1065, Schedule K, Line 2.................................................................

6.

Net income (loss) from other rental activities,

00

00

Federal Form 1065, Schedule K, Line 3c...............................................................

00

00

7.

Interest income from Federal Form 1065, Schedule K, Line 5.....................................

00

00

8.

Dividend income from Federal Form 1065, Schedule K, Line 6(a)..............................

9.

Royalty income from Federal Form 1065, Schedule K, Line 7.....................................

00

00

10. Net short term capital gain (loss) from

00

00

Federal Form 1065, Schedule K, Line 8................................................................

11.

Net long term capital gain (loss) from

00

00

Federal Form 1065, Schedule K, Line 9(a)...........................................................

12. Other portfolio income (loss)

00

00

Attach Schedule........................................................................................................

13. Net gain (loss) under Section 1231 from

00

00

Federal Form 1065, Schedule K, Line 10..............................................................

14. Other income (loss) (Attach schedule) from

00

00

Federal Form 1065, Schedule K, Line 11...............................................................

00

00

15. Total Income (Combine Lines 4 though 14)..................................................................

DEDUCTIONS:

16. Charitable contributions from

00

00

Federal Form 1065, Schedule K, Line 13(a)..........................................................

17.

Section 179 expense deduction from

00

00

Federal Form 1065, Schedule K, Line 12..............................................................

18.

Expenses related to portfolio income (loss) from

00

00

Federal Form 1065, Schedule K, Line 13(b) and 13(c)........................................

00

00

19. Other deductions from Federal Form 1065, Schedule K, Line 13(d)...........................

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3