Form It-140nrc - Nrc Tax Credit Recap

ADVERTISEMENT

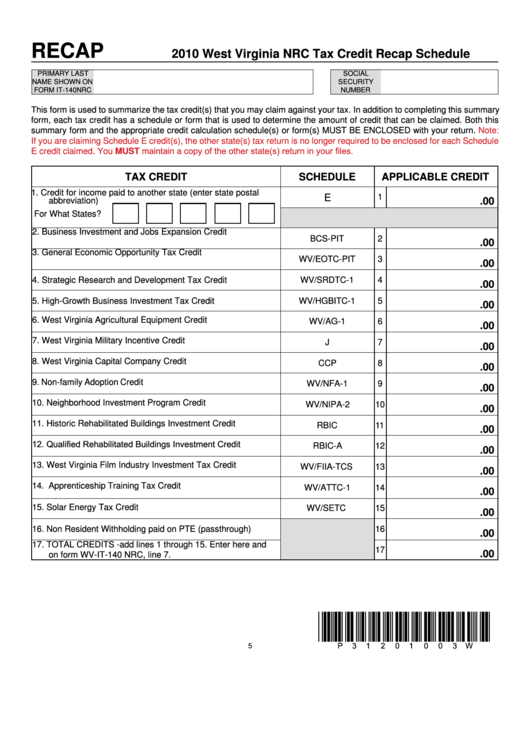

RECAP

2010 West Virginia NRC Tax Credit Recap Schedule

PRIMARY LAST

SOCIAL

NAME SHOWN ON

SECURITY

FORM IT-140NRC

NUMBER

This form is used to summarize the tax credit(s) that you may claim against your tax. In addition to completing this summary

form, each tax credit has a schedule or form that is used to determine the amount of credit that can be claimed. Both this

summary form and the appropriate credit calculation schedule(s) or form(s) MUST BE ENCLOSED with your return.

Note:

If you are claiming Schedule E credit(s), the other state(s) tax return is no longer required to be enclosed for each Schedule

E credit claimed. You MUST maintain a copy of the other state(s) return in your files.

TAX CREDIT

SCHEDULE

APPLICABLE CREDIT

1.

Credit for income paid to another state (enter state postal

E

1

.00

abbreviation)

For What States?

2.

Business Investment and Jobs Expansion Credit

BCS-PIT

2

.00

3.

General Economic Opportunity Tax Credit

WV/EOTC-PIT

3

.00

4.

Strategic Research and Development Tax Credit

WV/SRDTC-1

4

.00

5.

High-Growth Business Investment Tax Credit

WV/HGBITC-1

5

.00

6.

West Virginia Agricultural Equipment Credit

WV/AG-1

6

.00

7.

West Virginia Military Incentive Credit

J

7

.00

8.

West Virginia Capital Company Credit

CCP

8

.00

9.

Non-family Adoption Credit

WV/NFA-1

9

.00

10. Neighborhood Investment Program Credit

WV/NIPA-2

10

.00

11. Historic Rehabilitated Buildings Investment Credit

RBIC

11

.00

12. Qualified Rehabilitated Buildings Investment Credit

RBIC-A

12

.00

13. West Virginia Film Industry Investment Tax Credit

WV/FIIA-TCS

13

.00

14. Apprenticeship Training Tax Credit

WV/ATTC-1

14

.00

15. Solar Energy Tax Credit

WV/SETC

15

.00

16. Non Resident Withholding paid on PTE (passthrough)

16

.00

17. TOTAL CREDITS -add lines 1 through 15. Enter here and

17

.00

on form WV-IT-140 NRC, line 7.

*p31201003W*

5

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1