Reset Form

Print Form

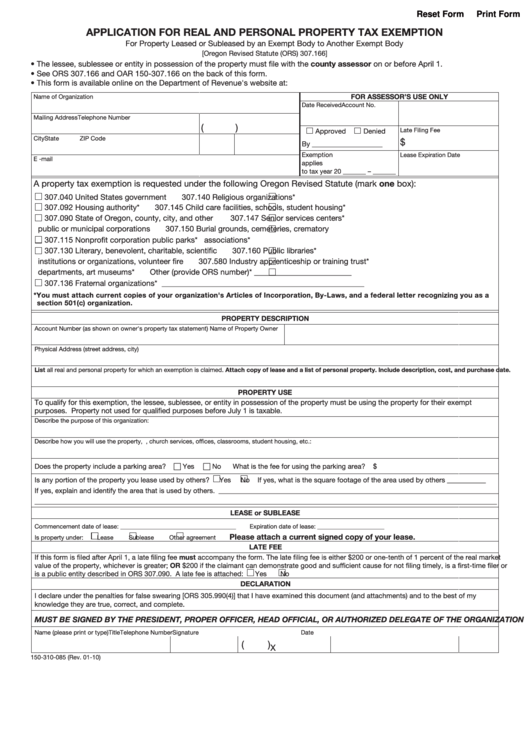

APPLICATION FOR REAL AND PERSONAL PROPERTY TAX EXEMPTION

For Property Leased or Subleased by an Exempt Body to Another Exempt Body

[Oregon Revised Statute (ORS) 307.166]

• The lessee, sublessee or entity in possession of the property must file with the county assessor on or before April 1.

• See ORS 307.166 and OAR 150-307.166 on the back of this form.

• This form is available online on the Department of Revenue's website at:

FOR ASSESSOR’S USE ONLY

Name of Organization

Date Received

Account No.

Mailing Address

Telephone Number

(

)

Late Filing Fee

Approved

Denied

City

State

ZIP Code

$

By ____________________

Exemption

Lease Expiration Date

E -mail

applies

to tax year 20 _______ – _______

A property tax exemption is requested under the following Oregon Revised Statute (mark one box):

307.040 United States government

307.140 Religious organizations*

307.092 Housing authority*

307.145 Child care facilities, schools, student housing*

307.090 State of Oregon, county, city, and other

307.147 Senior services centers*

public or municipal corporations

307.150 Burial grounds, cemeteries, crematory

307.115 Nonprofit corporation public parks*

associations*

307.130 Literary, benevolent, charitable, scientific

307.160 Public libraries*

institutions or organizations, volunteer fire

307.580 Industry apprenticeship or training trust*

departments, art museums*

Other (provide ORS number)* _________________________

307.136 Fraternal organizations*

____________________________________________________

*You must attach current copies of your organization's Articles of Incorporation, By-Laws, and a federal letter recognizing you as a

section 501(c) organization.

PROPERTY DESCRIPTION

Account Number (as shown on owner's property tax statement)

Name of Property Owner

Physical Address (street address, city)

List all real and personal property for which an exemption is claimed. Attach copy of lease and a list of personal property. Include description, cost, and purchase date.

PROPERTY USE

To qualify for this exemption, the lessee, sublessee, or entity in possession of the property must be using the property for their exempt

purposes. Property not used for qualified purposes before July 1 is taxable.

Describe the purpose of this organization:

Describe how you will use the property, e.g., church services, offices, classrooms, student housing, etc.:

Does the property include a parking area?

c Yes

c No

What is the fee for using the parking area?

$

Is any portion of the property you lease used by others?

Yes

No

If yes, what is the square footage of the area used by others ___________

If yes, explain and identify the area that is used by others.

____________________________________________________________________________________________

________________________________________________________________________________________________________________________________________________________

LEASE or SUBLEASE

Commencement date of lease: ______________________________________

Expiration date of lease: ______________________

Please attach a current signed copy of your lease.

Is property under:

Lease

Sublease

Other agreement

LATE FEE

If this form is filed after April 1, a late filing fee must accompany the form. The late filing fee is either $200 or one-tenth of 1 percent of the real market

value of the property, whichever is greater; OR $200 if the claimant can demonstrate good and sufficient cause for not filing timely, is a first-time filer or

is a public entity described in ORS 307.090. A late fee is attached:

Yes

No

DECLARATION

I declare under the penalties for false swearing [ORS 305.990(4)] that I have examined this document (and attachments) and to the best of my

knowledge they are true, correct, and complete.

MUST BE SIGNED BY THE PRESIDENT, PROPER OFFICER, HEAD OFFICIAL, OR AUTHORIZED DELEGATE OF THE ORGANIZATION

Name (please print or type)

Title

Telephone Number

Signature

Date

(

)

X

150-310-085 (Rev. 01-10)

1

1