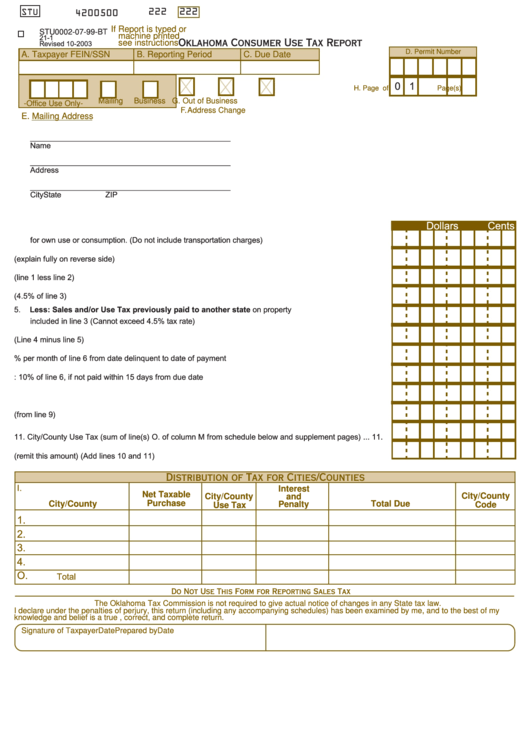

222

222

STU

4200500

If Report is typed or

STU0002-07-99-BT

machine printed

21-1

see instructions

Oklahoma Consumer Use Tax Report

Revised 10-2003

D. Permit Number

A. Taxpayer FEIN/SSN

B. Reporting Period

C. Due Date

0 1

H. Page

of

Page(s)

Mailing

Business G. Out of Business

-Office Use Only-

F.C.

P.T.

F. Address Change

E. Mailing Address

_______________________________________________

Name

_______________________________________________

Address

_______________________________________________

City

State

ZIP

Dollars

Cents

1.

Purchase price of tangible personal property purchased outside and brought into Oklahoma

for own use or consumption. (Do not include transportation charges)................................................. 1.

2.

Total legal deductions (explain fully on reverse side)........................................................................... 2.

3.

Balance on which Use Tax is due (line 1 less line 2)............................................................................ 3.

4.

Amount of tax (4.5% of line 3).............................................................................................................. 4.

5.

Less: Sales and/or Use Tax previously paid to another state on property

included in line 3 (Cannot exceed 4.5% tax rate) ................................................................................ 5.

6.

Subtotal (Line 4 minus line 5) .............................................................................................................. 6.

7.

Interest 1.25% per month of line 6 from date delinquent to date of payment ....................................... 7.

8.

Penalty: 10% of line 6, if not paid within 15 days from due date ......................................................... 8.

9.

Subtotal ................................................................................................................................................ 9.

10. State Tax (from line 9) ......................................................................................................................... 10.

11. City/County Use Tax (sum of line(s) O. of column M from schedule below and supplement pages) ... 11.

12. Total State and City/County due (remit this amount) (Add lines 10 and 11) ........................................ 12.

Distribution of Tax for Cities/Counties

I.

J.

K.

L.

M.

N.

Interest

Net Taxable

City/County

City/County

and

Purchase

Total Due

City/County

Penalty

Code

Use Tax

1.

2.

3.

4.

O.

Total

Do Not Use This Form for Reporting Sales Tax

The Oklahoma Tax Commission is not required to give actual notice of changes in any State tax law.

I declare under the penalties of perjury, this return (including any accompanying schedules) has been examined by me, and to the best of my

knowledge and belief is a true , correct, and complete return.

Signature of Taxpayer

Date

Prepared by

Date

1

1 2

2 3

3