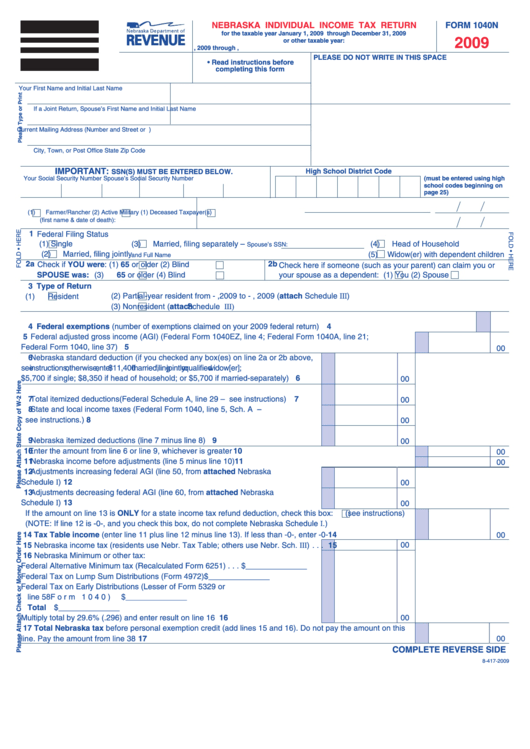

Form 1040n - Nebraska Individual Income Tax Return - 2009

ADVERTISEMENT

NEbRASKA INDIVIDUAL INCOME TAX RETURN

FORM 1040N

for the taxable year January 1, 2009 through December 31, 2009

2009

or other taxable year:

, 2009 through

,

PLEASE DO NOT WRITE IN THIS SPACE

• Read instructions before

completing this form

Your First Name and Initial

Last Name

If a Joint Return, Spouse’s First Name and Initial

Last Name

Current Mailing Address (Number and Street or P .O . Box)

City, Town, or Post Office

State

Zip Code

IMPORTANT:

High School District Code

SSN(S) MUST bE ENTERED bELOW.

(must be entered using high

Your Social Security Number

Spouse’s Social Security Number

school codes beginning on

page 25)

(1)

Farmer/Rancher

(2)

Active Military

(1)

Deceased Taxpayer(s)

(first name & date of death):

1

Federal Filing Status

(1)

Single

(3)

Married, filing separately –

(4)

Head of Household

Spouse’s SSN:

(2)

Married, filing jointly

(5)

Widow(er) with dependent children

and Full Name

2a Check if YOU were:

2b

65 or older

(1)

(2)

Blind

Check here if someone (such as your parent) can claim you or

SPOUSE was:

(3)

65 or older

(4)

Blind

your spouse as a dependent: (1)

You

(2)

Spouse

3 Type of Return

, 2009 (attach Schedule III)

(1)

Resident

(2)

Partial-year resident from

-

,2009 to

-

Nonresident (attach Schedule III)

(3)

4 Federal exemptions (number of exemptions claimed on your 2009 federal return) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

5 Federal adjusted gross income (AGI) (Federal Form 1040EZ, line 4; Federal Form 1040A, line 21;

Federal Form 1040, line 37) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

00

6 Nebraska standard deduction (if you checked any box(es) on line 2a or 2b above,

see instructions; otherwise, enter $11,400 if married, filing jointly or qualified widow[er];

6

$5,700 if single; $8,350 if head of household; or $5,700 if married-separately) . . . .

00

7 Total itemized deductions (Federal Schedule A, line 29 – see instructions) . . . . . . .

7

00

8 State and local income taxes (Federal Form 1040, line 5, Sch. A –

see instructions .) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

00

9 Nebraska itemized deductions (line 7 minus line 8) . . . . . . . . . . . . . . . . . . . . . . . . .

9

00

10 Enter the amount from line 6 or line 9, whichever is greater . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

00

11 Nebraska income before adjustments (line 5 minus line 10) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

00

12 Adjustments increasing federal AGI (line 50, from attached Nebraska

Schedule I) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

00

13 Adjustments decreasing federal AGI (line 60, from attached Nebraska

Schedule I) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

00

If the amount on line 13 is ONLY for a state income tax refund deduction, check this box:

(see instructions)

(NOTE: If line 12 is -0-, and you check this box, do not complete Nebraska Schedule I .)

14 Tax Table income (enter line 11 plus line 12 minus line 13). If less than -0-, enter -0- . . . . . . . . . . . . . . . . . . . 14

00

15 Nebraska income tax (residents use Nebr. Tax Table; others use Nebr. Sch. III) . . . 15

00

16 Nebraska Minimum or other tax:

Federal Alternative Minimum tax (Recalculated Form 6251) . . .$______________

Federal Tax on Lump Sum Distributions (Form 4972) . . . . . . . .$______________

Federal Tax on Early Distributions (Lesser of Form 5329 or

line 58 Form 1040) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$______________

Total

$______________

Multiply total by 29.6% (.296) and enter result on line 16 . . . . . . . . . . . . . . . . . . . . . 16

00

17 Total Nebraska tax before personal exemption credit (add lines 15 and 16). Do not pay the amount on this

line. Pay the amount from line 38 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

00

COMPLETE REVERSE SIDE

8-417-2009

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2