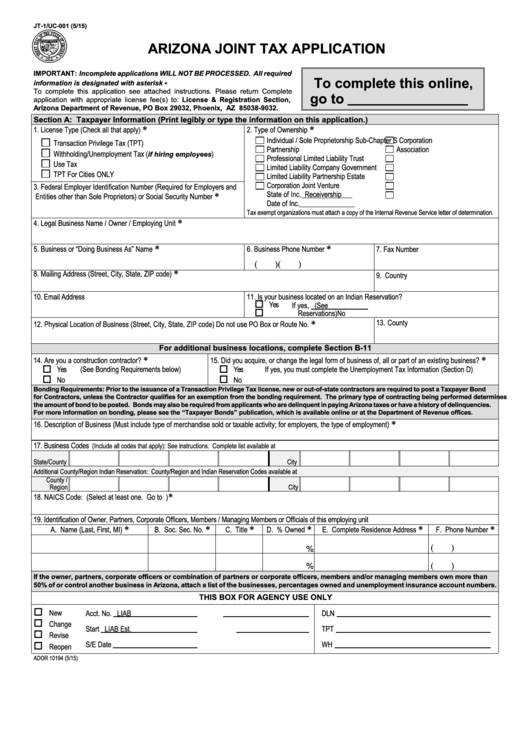

JT-1/UC-001 (5/15)

ARIZONA JOINT TAX APPLICATION

IMPORTANT: Incomplete applications WILL NOT BE PROCESSED. All required

To complete this online,

information is designated with asterisk *

To complete this application see attached instructions. Please return Complete

go to

application with appropriate license fee(s) to: License & Registration Section,

Arizona Department of Revenue, PO Box 29032, Phoenix, AZ 85038-9032.

Section A: Taxpayer Information (Print legibly or type the information on this application.)

*

*

1. License Type (Check all that apply)

2. Type of Ownership

Individual / Sole Proprietorship

Sub-Chapter S Corporation

Transaction Privilege Tax (TPT)

Partnership

Association

Withholding/Unemployment Tax (

)

if hiring employees

Professional Limited Liability

Trust

Use Tax

Limited Liability Company

Government

TPT For Cities ONLY

Limited Liability Partnership

Estate

Corporation

Joint Venture

3. Federal Employer Identification Number (Required for Employers and

State of Inc.

Receivership

*

Entities other than Sole Proprietors) or Social Security Number

Date of Inc.

Tax exempt organizations must attach a copy of the Internal Revenue Service letter of determination.

*

4. Legal Business Name / Owner / Employing Unit

*

*

5. Business or “Doing Business As” Name

6. Business Phone Number

7. Fax Number

(

)

(

)

*

8. Mailing Address (Street, City, State, ZIP code)

9. Country

10. Email Address

11. Is your business located on an Indian Reservation?

o

Yes

If yes,

(See for listing of

o

No

Reservations)

13. County

*

12. Physical Location of Business (Street, City, State, ZIP code) Do not use PO Box or Route No.

For additional business locations, complete Section B-11

*

*

14. Are you a construction contractor?

15. Did you acquire, or change the legal form of business of, all or part of an existing business?

o

Yes

(See Bonding Requirements below)

o

Yes

If yes, you must complete the Unemployment Tax Information (Section D)

o

o

No

No

Bonding Requirements: Prior to the issuance of a Transaction Privilege Tax license, new or out-of-state contractors are required to post a Taxpayer Bond

for Contractors, unless the Contractor qualifies for an exemption from the bonding requirement. The primary type of contracting being performed determines

the amount of bond to be posted. Bonds may also be required from applicants who are delinquent in paying Arizona taxes or have a history of delinquencies.

For more information on bonding, please see the “Taxpayer Bonds” publication, which is available online or at the Department of Revenue offices.

*

16. Description of Business (Must include type of merchandise sold or taxable activity; for employers, the type of employment)

17. Business Codes

(Include all codes that apply):

See instructions. Complete list available at

State/County

City

Additional County/Region Indian Reservation: County/Region and Indian Reservation Codes available at

County /

Region

City

*

18. NAICS Code: (Select at least one. Go to for a listing of codes)

19. Identification of Owner, Partners, Corporate Officers, Members / Managing Members or Officials of this employing unit

*

*

*

*

*

*

A. Name (Last, First, MI)

B. Soc. Sec. No.

C. Title

D. % Owned

E. Complete Residence Address

F. Phone Number

(

)

%

(

)

%

If the owner, partners, corporate officers or combination of partners or corporate officers, members and/or managing members own more than

50% of or control another business in Arizona, attach a list of the businesses, percentages owned and unemployment insurance account numbers.

THIS BOX FOR AGENCY USE ONLY

o

New

Acct. No.

LIAB

DLN

o

Change

Start

LIAB Est.

TPT

o

Revise

S/E Date

WH

o

Reopen

ADOR 10194 (5/15)

1

1 2

2 3

3 4

4