BOE-267-H (P1) REV. 08 (06-11)

WELFARE EXEMPTION SUPPLEMENTAL AFFIDAVIT,

HOUSING – ELDERLY OR HANDICAPPED FAMILIES

This Claim is Filed for Fiscal Year 20 _____ — 20 _____ .

This is a Supplemental Affidavit filed with

BOE-267, Claim for Welfare Exemption (First Filing)

BOE-267-A, Claim for Welfare Exemption (Annual Filing)

Section 1. Identification of Applicant

Name of Organization

Mailing Address (number and street)

Corporate ID or LLC Number

City, State, Zip Code

Organizational Clearance Certificate (OCC) No. __________________________ (Provide copy of certificate with this claim if first filing). If you do not have

an OCC, have you filed a claim for an OCC with the BOE?

Yes

No

If No, see instructions for information on obtaining an OCC claim form.

Section 2. Identification of Property

Address of property (number and street)

City, County, Zip Code

Date Property Acquired

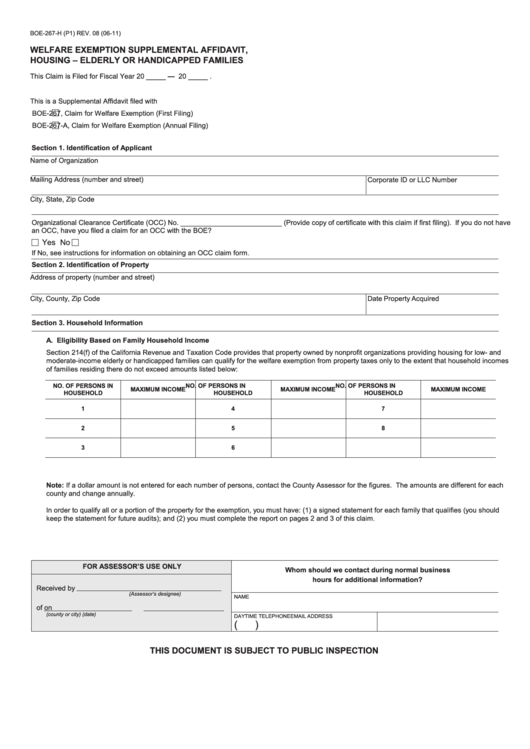

Section 3. Household Information

A. Eligibility Based on Family Household Income

Section 214(f) of the California Revenue and Taxation Code provides that property owned by nonprofit organizations providing housing for low- and

moderate-income elderly or handicapped families can qualify for the welfare exemption from property taxes only to the extent that household incomes

of families residing there do not exceed amounts listed below:

NO. OF PERSONS IN

NO. OF PERSONS IN

NO. OF PERSONS IN

MAXIMUM INCOME

MAXIMUM INCOME

MAXIMUM INCOME

HOUSEHOLD

HOUSEHOLD

HOUSEHOLD

1

4

7

2

5

8

3

6

Note: If a dollar amount is not entered for each number of persons, contact the County Assessor for the figures. The amounts are different for each

county and change annually.

In order to qualify all or a portion of the property for the exemption, you must have: (1) a signed statement for each family that qualifies (you should

keep the statement for future audits); and (2) you must complete the report on pages 2 and 3 of this claim.

FOR ASSESSOR’S USE ONLY

Whom should we contact during normal business

hours for additional information?

Received by

(Assessor’s designee)

NAME

of

on

(county or city)

(date)

DAYTIME TELEPHONE

EMAIL ADDRESS

(

)

THIS DOCUMENT IS SUBJECT TO PUBLIC INSPECTION

1

1 2

2 3

3