Instructions And Forms For Filing The Business And Occupation Tax Return

ADVERTISEMENT

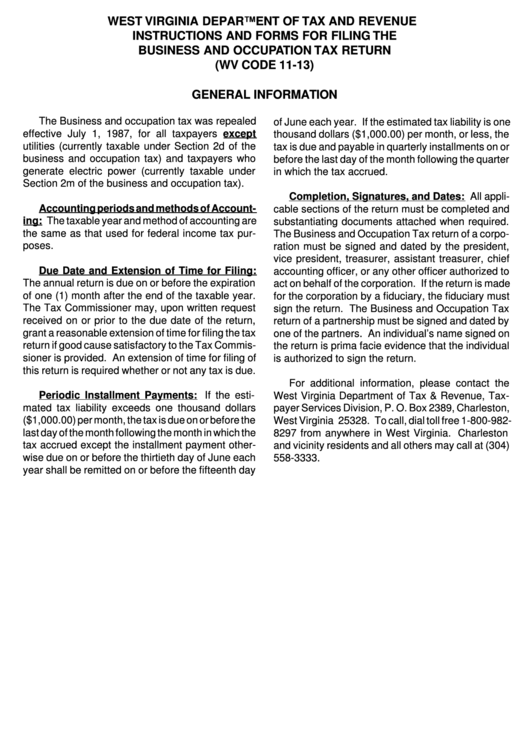

WEST VIRGINIA DEPARTMENT OF TAX AND REVENUE

INSTRUCTIONS AND FORMS FOR FILING THE

BUSINESS AND OCCUPATION TAX RETURN

(WV CODE 11-13)

GENERAL INFORMATION

The Business and occupation tax was repealed

of June each year. If the estimated tax liability is one

effective July 1, 1987, for all taxpayers except

thousand dollars ($1,000.00) per month, or less, the

utilities (currently taxable under Section 2d of the

tax is due and payable in quarterly installments on or

business and occupation tax) and taxpayers who

before the last day of the month following the quarter

generate electric power (currently taxable under

in which the tax accrued.

Section 2m of the business and occupation tax).

Completion, Signatures, and Dates: All appli-

Accounting periods and methods of Account-

cable sections of the return must be completed and

ing: The taxable year and method of accounting are

substantiating documents attached when required.

the same as that used for federal income tax pur-

The Business and Occupation Tax return of a corpo-

poses.

ration must be signed and dated by the president,

vice president, treasurer, assistant treasurer, chief

Due Date and Extension of Time for Filing:

accounting officer, or any other officer authorized to

The annual return is due on or before the expiration

act on behalf of the corporation. If the return is made

of one (1) month after the end of the taxable year.

for the corporation by a fiduciary, the fiduciary must

The Tax Commissioner may, upon written request

sign the return. The Business and Occupation Tax

received on or prior to the due date of the return,

return of a partnership must be signed and dated by

grant a reasonable extension of time for filing the tax

one of the partners. An individual’s name signed on

return if good cause satisfactory to the Tax Commis-

the return is prima facie evidence that the individual

sioner is provided. An extension of time for filing of

is authorized to sign the return.

this return is required whether or not any tax is due.

For additional information, please contact the

Periodic Installment Payments: If the esti-

West Virginia Department of Tax & Revenue, Tax-

mated tax liability exceeds one thousand dollars

payer Services Division, P. O. Box 2389, Charleston,

($1,000.00) per month, the tax is due on or before the

West Virginia 25328. To call, dial toll free 1-800-982-

last day of the month following the month in which the

8297 from anywhere in West Virginia. Charleston

tax accrued except the installment payment other-

and vicinity residents and all others may call at (304)

wise due on or before the thirtieth day of June each

558-3333.

year shall be remitted on or before the fifteenth day

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5