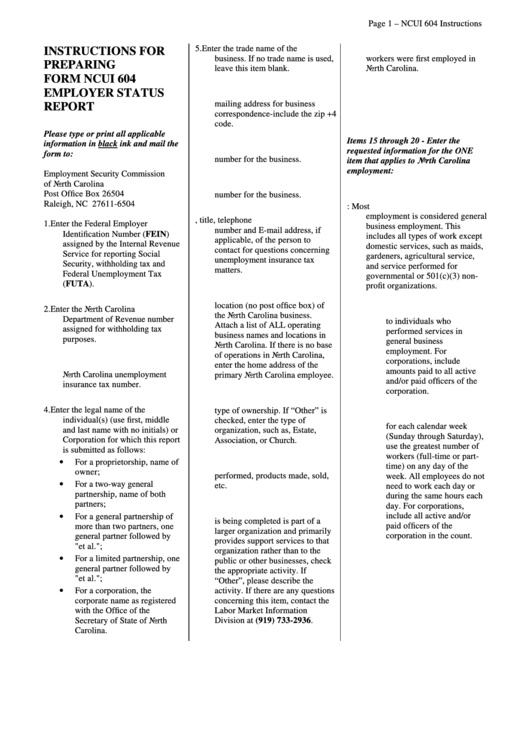

Form Ncui 604 Instructions - Employer Status Report

ADVERTISEMENT

Page 1 – NCUI 604 Instructions

5.

Enter the trade name of the

14. Enter the date one or more

INSTRUCTIONS FOR

business. If no trade name is used,

workers were first employed in

PREPARING

leave this item blank.

North Carolina.

FORM NCUI 604

EMPLOYER STATUS

6.

Enter the complete U. S. postal

mailing address for business

REPORT

correspondence-include the zip +4

code.

Please type or print all applicable

Items 15 through 20 - Enter the

information in black ink and mail the

7.

Enter the area code and telephone

requested information for the ONE

form to:

number for the business.

item that applies to North Carolina

employment:

Employment Security Commission

of North Carolina

8.

Enter the area code and fax

Post Office Box 26504

number for the business.

Raleigh, NC 27611-6504

15. GENERAL EMPLOYERS: Most

employment is considered general

9.

Enter the name, title, telephone

1.

Enter the Federal Employer

business employment. This

number and E-mail address, if

Identification Number (FEIN)

includes all types of work except

applicable, of the person to

assigned by the Internal Revenue

domestic services, such as maids,

contact for questions concerning

Service for reporting Social

gardeners, agricultural service,

unemployment insurance tax

Security, withholding tax and

and service performed for

matters.

Federal Unemployment Tax

governmental or 501(c)(3) non-

(FUTA).

profit organizations.

10. Enter the address of the physical

location (no post office box) of

2.

Enter the North Carolina

a.

Consider all payments made

the North Carolina business.

Department of Revenue number

to individuals who

Attach a list of ALL operating

assigned for withholding tax

performed services in

business names and locations in

purposes.

general business

North Carolina. If there is no base

employment. For

of operations in North Carolina,

corporations, include

3.

Enter any previously assigned

enter the home address of the

amounts paid to all active

North Carolina unemployment

primary North Carolina employee.

and/or paid officers of the

insurance tax number.

corporation.

11. Check the box for the appropriate

4.

Enter the legal name of the

type of ownership. If “Other” is

b.

In determining employment

individual(s) (use first, middle

checked, enter the type of

for each calendar week

and last name with no initials) or

organization, such as, Estate,

(Sunday through Saturday),

Corporation for which this report

Association, or Church.

use the greatest number of

is submitted as follows:

workers (full-time or part-

•

For a proprietorship, name of

12. Describe the type of services

time) on any day of the

owner;

performed, products made, sold,

week. All employees do not

•

For a two-way general

etc.

need to work each day or

partnership, name of both

during the same hours each

partners;

day. For corporations,

13. If the business for which this form

•

include all active and/or

For a general partnership of

is being completed is part of a

paid officers of the

more than two partners, one

larger organization and primarily

corporation in the count.

general partner followed by

provides support services to that

"et al.";

organization rather than to the

•

For a limited partnership, one

public or other businesses, check

general partner followed by

the appropriate activity. If

"et al.";

“Other”, please describe the

•

For a corporation, the

activity. If there are any questions

concerning this item, contact the

corporate name as registered

with the Office of the

Labor Market Information

Secretary of State of North

Division at (919) 733-2936.

Carolina.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2