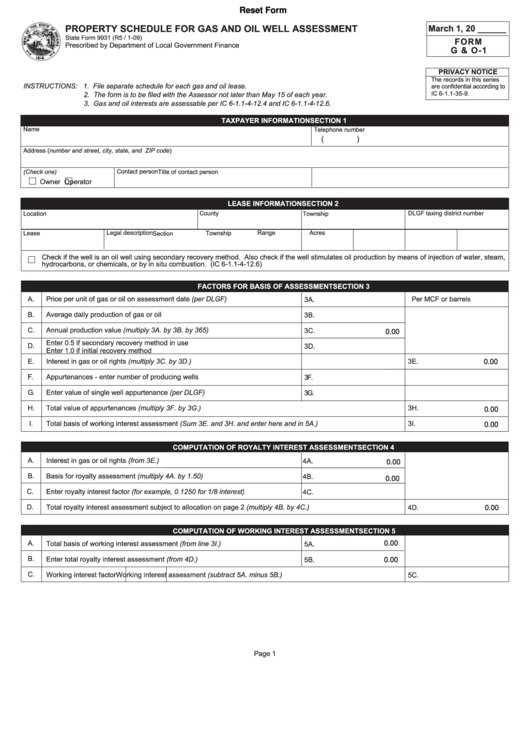

Reset Form

PROPERTY SCHEDULE FOR GAS AND OIL WELL ASSESSMENT

March 1, 20 ______

State Form 9931 (R5 / 1-09)

FORM

Prescribed by Department of Local Government Finance

G & O-1

PRIVACY NOTICE

The records in this series

INSTRUCTIONS: 1. File separate schedule for each gas and oil lease.

are confidential according to

IC 6-1.1-35-9.

2. The form is to be filed with the Assessor not later than May 15 of each year.

3. Gas and oil interests are assessable per IC 6-1.1-4-12.4 and IC 6-1.1-4-12.6.

SECTION 1

TAXPAYER INFORMATION

Name

Telephone number

(

)

Address (number and street, city, state, and ZIP code)

(Check one)

Contact person

Title of contact person

Owner

Operator

SECTION 2

LEASE INFORMATION

Location

County

DLGF taxing district number

Township

Legal description

Range

Acres

Lease

Section

Township

Check if the well is an oil well using secondary recovery method. Also check if the well stimulates oil production by means of injection of water, steam,

hydrocarbons, or chemicals, or by in situ combustion. (IC 6-1.1-4-12.6)

SECTION 3

FACTORS FOR BASIS OF ASSESSMENT

A.

Price per unit of gas or oil on assessment date (per DLGF)

Per MCF or barrels

3A.

B.

Average daily production of gas or oil

3B.

C.

Annual production value (multiply 3A. by 3B. by 365)

3C.

0.00

Enter 0.5 if secondary recovery method in use

D.

3D.

Enter 1.0 if initial recovery method

E.

Interest in gas or oil rights (multiply 3C. by 3D.)

3E.

0.00

F.

Appurtenances - enter number of producing wells

3F.

G.

Enter value of single well appurtenance (per DLGF)

3G.

H.

Total value of appurtenances (multiply 3F. by 3G.)

3H.

0.00

I.

Total basis of working interest assessment (Sum 3E. and 3H. and enter here and in 5A.)

3I.

0.00

SECTION 4

COMPUTATION OF ROYALTY INTEREST ASSESSMENT

A.

Interest in gas or oil rights (from 3E.)

4A.

0.00

B.

Basis for royalty assessment (multiply 4A. by 1.50)

4B.

0.00

C.

Enter royalty interest factor (for example, 0.1250 for 1/8 interest)

4C.

D.

Total royalty interest assessment subject to allocation on page 2 (multiply 4B. by 4C.)

4D.

0.00

SECTION 5

COMPUTATION OF WORKING INTEREST ASSESSMENT

A.

Total basis of working interest assessment (from line 3I.)

5A.

0.00

B.

Enter total royalty interest assessment (from 4D.)

5B.

0.00

C.

Working interest factor

Working interest assessment (subtract 5A. minus 5B.)

5C.

Page 1

1

1 2

2