Form Uc-86 - Waiver Of Employer'S Experience Record - 1991

ADVERTISEMENT

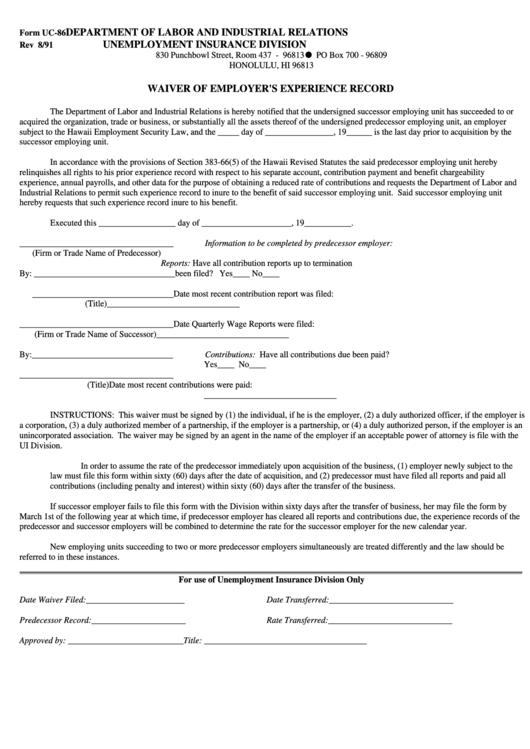

DEPARTMENT OF LABOR AND INDUSTRIAL RELATIONS

Form UC-86

UNEMPLOYMENT INSURANCE DIVISION

Rev 8/91

830 Punchbowl Street, Room 437 - 96813 q PO Box 700 - 96809

HONOLULU, HI 96813

WAIVER OF EMPLOYER'S EXPERIENCE RECORD

The Department of Labor and Industrial Relations is hereby notified that the undersigned successor employing unit has succeeded to or

acquired the organization, trade or business, or substantially all the assets thereof of the undersigned predecessor employing unit, an employer

subject to the Hawaii Employment Security Law, and the _____ day of ________________, 19______ is the last day prior to acquisition by the

successor employing unit.

In accordance with the provisions of Section 383-66(5) of the Hawaii Revised Statutes the said predecessor employing unit hereby

relinquishes all rights to his prior experience record with respect to his separate account, contribution payment and benefit chargeability

experience, annual payrolls, and other data for the purpose of obtaining a reduced rate of contributions and requests the Department of Labor and

Industrial Relations to permit such experience record to inure to the benefit of said successor employing unit. Said successor employing unit

hereby requests that such experience record inure to his benefit.

Executed this __________________ day of _____________________, 19___________.

____________________________________

Information to be completed by predecessor employer:

(Firm or Trade Name of Predecessor)

Reports: Have all contribution reports up to termination

By: _________________________________

been filed? Yes____ No____

_________________________________

Date most recent contribution report was filed:

(Title)

_______________________________

____________________________________

Date Quarterly Wage Reports were filed:

(Firm or Trade Name of Successor)

_______________________________

By:_________________________________

Contributions: Have all contributions due been paid?

Yes____ No____

____________________________________

(Title)

Date most recent contributions were paid:

_______________________________

INSTRUCTIONS: This waiver must be signed by (1) the individual, if he is the employer, (2) a duly authorized officer, if the employer is

a corporation, (3) a duly authorized member of a partnership, if the employer is a partnership, or (4) a duly authorized person, if the employer is an

unincorporated association. The waiver may be signed by an agent in the name of the employer if an acceptable power of attorney is file with the

UI Division.

In order to assume the rate of the predecessor immediately upon acquisition of the business, (1) employer newly subject to the

law must file this form within sixty (60) days after the date of acquisition, and (2) predecessor must have filed all reports and paid all

contributions (including penalty and interest) within sixty (60) days after the transfer of the business.

If successor employer fails to file this form with the Division within sixty days after the transfer of business, her may file the form by

March 1st of the following year at which time, if predecessor employer has cleared all reports and contributions due, the experience records of the

predecessor and successor employers will be combined to determine the rate for the successor employer for the new calendar year.

New employing units succeeding to two or more predecessor employers simultaneously are treated differently and the law should be

referred to in these instances.

For use of Unemployment Insurance Division Only

Date Waiver Filed:_______________________

Date Transferred:_____________________________

Predecessor Record:______________________

Rate Transferred:_____________________________

Approved by: ___________________________

Title: ______________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1