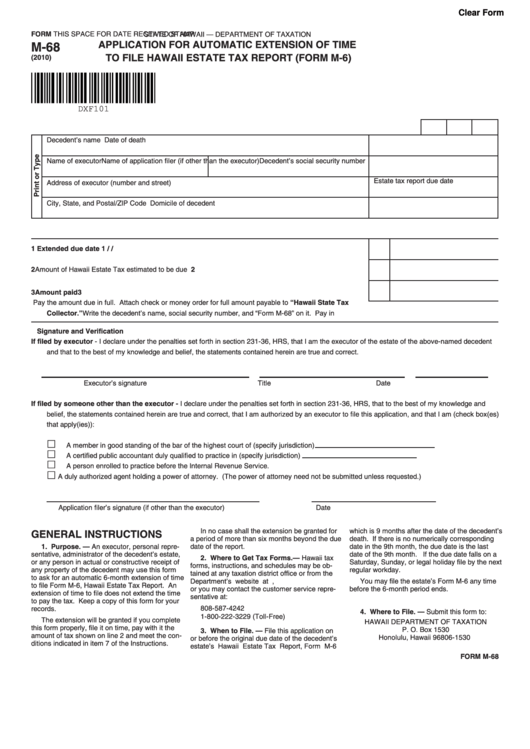

Clear Form

FORM

THIS SPACE FOR DATE RECEIVED STAMP

STATE OF HAWAII — DEPARTMENT OF TAXATION

M-68

APPLICATION FOR AUTOMATIC EXTENSION OF TIME

TO FILE HAWAII ESTATE TAX REPORT (FORM M-6)

(2010)

DXF101

Decedent’s name

Date of death

Name of executor

Name of application filer (if other than the executor) Decedent’s social security number

Estate tax report due date

Address of executor (number and street)

City, State, and Postal/ZIP Code

Domicile of decedent

1

Extended due date .....................................................................................................................................

1

/

/

2

2

Amount of Hawaii Estate Tax estimated to be due .......................................................................................

3

Amount paid ...............................................................................................................................................

3

Pay the amount due in full. Attach check or money order for full amount payable to “Hawaii State Tax

Collector.” Write the decedent’s name, social security number, and “Form M-68” on it. Pay in U.S. dollars. Do not send cash.

Signature and Verification

If filed by executor - I declare under the penalties set forth in section 231-36, HRS, that I am the executor of the estate of the above-named decedent

and that to the best of my knowledge and belief, the statements contained herein are true and correct.

Executor’s signature

Title

Date

If filed by someone other than the executor - I declare under the penalties set forth in section 231-36, HRS, that to the best of my knowledge and

belief, the statements contained herein are true and correct, that I am authorized by an executor to file this application, and that I am (check box(es)

that apply(ies)):

A member in good standing of the bar of the highest court of (specify jurisdiction)

A certified public accountant duly qualified to practice in (specify jurisdiction)

A person enrolled to practice before the Internal Revenue Service.

A duly authorized agent holding a power of attorney. (The power of attorney need not be submitted unless requested.)

Application filer’s signature (if other than the executor)

Date

In no case shall the extension be granted for

which is 9 months after the date of the decedent’s

GENERAL INSTRUCTIONS

a period of more than six months beyond the due

death. If there is no numerically corresponding

1. Purpose. — An executor, personal repre-

date of the report.

date in the 9th month, the due date is the last

sentative, administrator of the decedent’s estate,

date of the 9th month. If the due date falls on a

2. Where to Get Tax Forms. — Hawaii tax

or any person in actual or constructive receipt of

Saturday, Sunday, or legal holiday file by the next

forms, instructions, and schedules may be ob-

any property of the decedent may use this form

regular workday.

tained at any taxation district office or from the

to ask for an automatic 6-month extension of time

Department’s website at ,

You may file the estate’s Form M-6 any time

to file Form M-6, Hawaii Estate Tax Report. An

or you may contact the customer service repre-

before the 6-month period ends.

extension of time to file does not extend the time

sentative at:

to pay the tax. Keep a copy of this form for your

808-587-4242

records.

4. Where to File. — Submit this form to:

1-800-222-3229 (Toll-Free)

The extension will be granted if you complete

HAWAII DEPARTMENT OF TAXATION

this form properly, file it on time, pay with it the

P. O. Box 1530

3. When to File. — File this application on

amount of tax shown on line 2 and meet the con-

Honolulu, Hawaii 96806-1530

or before the original due date of the decedent’s

ditions indicated in item 7 of the Instructions.

estate’s Hawaii Estate Tax Report, Form M-6

FORM M-68

1

1