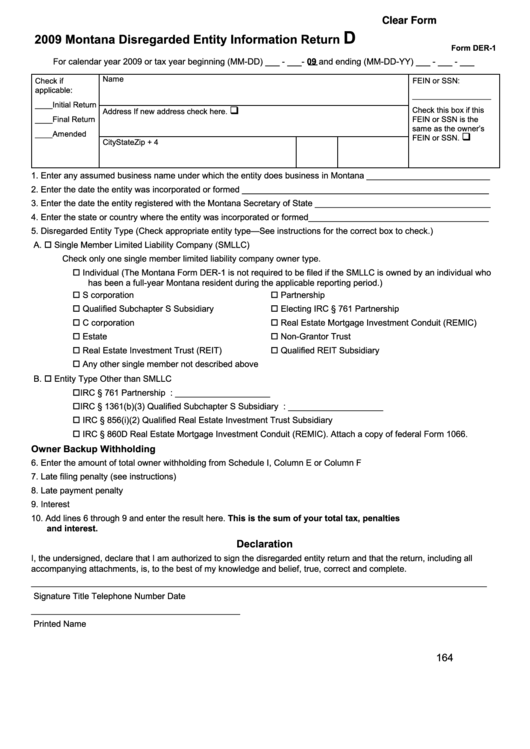

Clear Form

D

2009 Montana Disregarded Entity Information Return

Form DER-1

For calendar year 2009 or tax year beginning (MM-DD) ___ - ___- 09 and ending (MM-DD-YY) ___ - ___ - ___

Name

Check if

FEIN or SSN:

applicable:

__________________

____Initial Return

q

Check this box if this

Address

If new address check here.

____Final Return

FEIN or SSN is the

same as the owner’s

____Amended

q

FEIN or SSN.

City

State

Zip + 4

1. Enter any assumed business name under which the entity does business in Montana __________________________

2. Enter the date the entity was incorporated or formed ____________________________________________________

3. Enter the date the entity registered with the Montana Secretary of State _____________________________________

4. Enter the state or country where the entity was incorporated or formed______________________________________

5. Disregarded Entity Type (Check appropriate entity type—See instructions for the correct box to check.)

A. Single Member Limited Liability Company (SMLLC)

Check only one single member limited liability company owner type.

Individual (The Montana Form DER-1 is not required to be filed if the SMLLC is owned by an individual who

has been a full-year Montana resident during the applicable reporting period.)

S corporation

Partnership

Qualified Subchapter S Subsidiary

Electing IRC § 761 Partnership

C corporation

Real Estate Mortgage Investment Conduit (REMIC)

Estate

Non-Grantor Trust

Real Estate Investment Trust (REIT)

Qualified REIT Subsidiary

Any other single member not described above

B. Entity Type Other than SMLLC

IRC § 761 Partnership ........................................................ Enter date of election: ____________________

IRC § 1361(b)(3) Qualified Subchapter S Subsidiary ......... Enter date of election: ____________________

IRC § 856(i)(2) Qualified Real Estate Investment Trust Subsidiary

IRC § 860D Real Estate Mortgage Investment Conduit (REMIC). Attach a copy of federal Form 1066.

Owner Backup Withholding

6. Enter the amount of total owner withholding from Schedule I, Column E or Column F .................... 6. _____________

7. Late filing penalty (see instructions) .................................................................................................. 7. _____________

8. Late payment penalty ........................................................................................................................ 8. _____________

9. Interest .............................................................................................................................................. 9. _____________

10. Add lines 6 through 9 and enter the result here. This is the sum of your total tax, penalties

and interest. .................................................................................................................................. 10. _____________

Declaration

I, the undersigned, declare that I am authorized to sign the disregarded entity return and that the return, including all

accompanying attachments, is, to the best of my knowledge and belief, true, correct and complete.

________________________________________________________________________________________________

Signature

Title

Telephone Number

Date

____________________________________________

Printed Name

164

1

1 2

2 3

3