Form Wv/bft-120 - Business Franchise Tax Return - 2001

ADVERTISEMENT

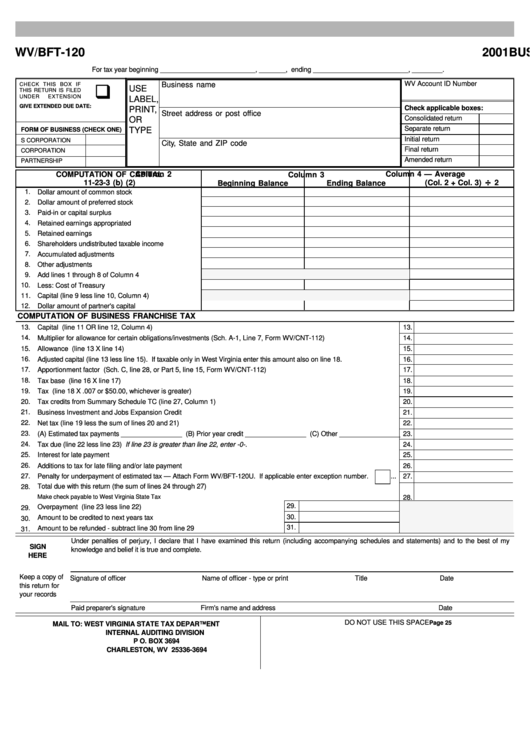

WV/BFT-120

BUSINESS FRANCHISE TAX RETURN

2001

For tax year beginning _________________________, _______, ending _________________________, ________.

WV Account ID Number

q

CHECK THIS BOX IF

Business name

USE

THIS RETURN IS FILED

UNDER

EXTENSION

LABEL,

GIVE EXTENDED DUE DATE:

Check applicable boxes:

PRINT,

Street address or post office

Consolidated return

OR

Separate return

FORM OF BUSINESS (CHECK ONE)

TYPE

Initial return

S CORPORATION

City, State and ZIP code

Final return

CORPORATION

Amended return

PARTNERSHIP

COMPUTATION OF CAPITAL

Column 2

Column 4 — Average

Column 3

÷

11-23-3 (b) (2)

(Col. 2 + Col. 3)

2

Beginning Balance

Ending Balance

1.

Dollar amount of common stock ....................................

2.

Dollar amount of preferred stock ...................................

3.

Paid-in or capital surplus ...............................................

4.

Retained earnings appropriated .....................................

5.

Retained earnings unappropriated..................................

6.

Shareholders undistributed taxable income ...................

7.

Accumulated adjustments account................................

8.

Other adjustments account............................................

9.

Add lines 1 through 8 of Column 4 ................................

10.

Less: Cost of Treasury stock..........................................

11.

Capital (line 9 less line 10, Column 4) ...........................

12.

Dollar amount of partner's capital accounts....................

COMPUTATION OF BUSINESS FRANCHISE TAX

13.

Capital (line 11 OR line 12, Column 4) ...................................................................................................................................

13.

14.

Multiplier for allowance for certain obligations/investments (Sch. A-1, Line 7, Form WV/CNT-112) ......................................

14.

15.

Allowance (line 13 X line 14) ..................................................................................................................................................

15.

16.

Adjusted capital (line 13 less line 15). If taxable only in West Virginia enter this amount also on line 18. .............................

16.

17.

Apportionment factor (Sch. C, line 28, or Part 5, line 15, Form WV/CNT-112) .....................................................................

17.

18.

Tax base (line 16 X line 17) ....................................................................................................................................................

18.

19.

Tax (line 18 X .007 or $50.00, whichever is greater)................................................................................................................

19.

20.

Tax credits from Summary Schedule TC (line 27, Column 1) .................................................................................................

20.

21.

Business Investment and Jobs Expansion Credit ...................................................................................................................

21.

22.

Net tax (line 19 less the sum of lines 20 and 21) ...................................................................................................................

22.

23.

(A) Estimated tax payments ________________ (B) Prior year credit ________________ (C) Other ________________

23.

24.

Tax due (line 22 less line 23) If line 23 is greater than line 22, enter -0-. ...............................................................................

24.

25.

Interest for late payment ..........................................................................................................................................................

25.

26.

Additions to tax for late filing and/or late payment ..................................................................................................................

26.

27.

Penalty for underpayment of estimated tax — Attach Form WV/BFT-120U. If applicable enter exception number.

...

27.

Total due with this return (the sum of lines 24 through 27)

28.

Make check payable to West Virginia State Tax Department.................. ........................................................................................................

28.

29.

Overpayment (line 23 less line 22) ............................................................................

29.

30.

Amount to be credited to next years tax .....................................................................

30.

31.

Amount to be refunded - subtract line 30 from line 29 ................................................

31.

Under penalties of perjury, I declare that I have examined this return (including accompanying schedules and statements) and to the best of my

SIGN

knowledge and belief it is true and complete.

HERE

Keep a copy of

Signature of officer

Name of officer - type or print

Title

Date

this return for

your records

Paid preparer's signature

Firm's name and address

Date

DO NOT USE THIS SPACE

Page 25

MAIL TO: WEST VIRGINIA STATE TAX DEPARTMENT

INTERNAL AUDITING DIVISION

P O. BOX 3694

CHARLESTON, WV 25336-3694

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2