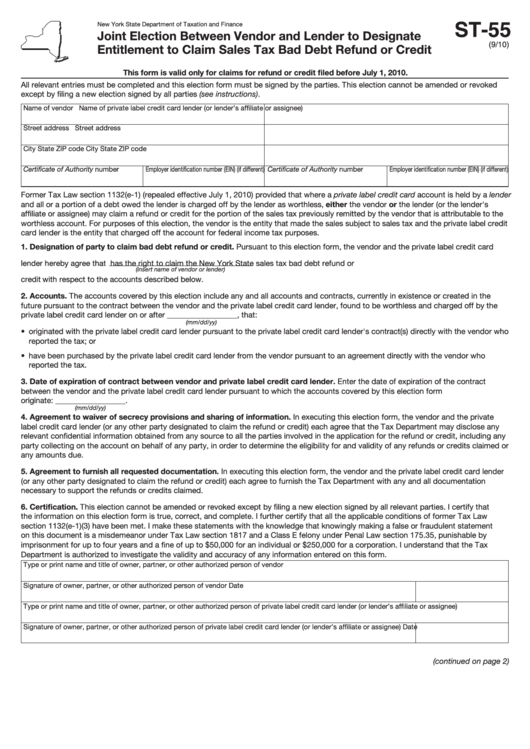

Form St-55 - Joint Election Between Vendor And Lender To Designate Entitlement To Claim Sales Tax Bad Debt Refund Or Credit

ADVERTISEMENT

ST-55

New York State Department of Taxation and Finance

Joint Election Between Vendor and Lender to Designate

(9/10)

Entitlement to Claim Sales Tax Bad Debt Refund or Credit

This form is valid only for claims for refund or credit filed before July 1, 2010.

All relevant entries must be completed and this election form must be signed by the parties. This election cannot be amended or revoked

except by filing a new election signed by all parties (see instructions).

Name of vendor

Name of private label credit card lender (or lender’s affiliate or assignee)

Street address

Street address

City

State

ZIP code

City

State

ZIP code

Certificate of Authority number

Employer identification number (EIN) (if different) Certificate of Authority number

Employer identification number (EIN) (if different)

Former Tax Law section 1132(e-1) (repealed effective July 1, 2010) provided that where a private label credit card account is held by a lender

and all or a portion of a debt owed the lender is charged off by the lender as worthless, either the vendor or the lender (or the lender's

affiliate or assignee) may claim a refund or credit for the portion of the sales tax previously remitted by the vendor that is attributable to the

worthless account. For purposes of this election, the vendor is the entity that made the sales subject to sales tax and the private label credit

card lender is the entity that charged off the account for federal income tax purposes.

1. Designation of party to claim bad debt refund or credit. Pursuant to this election form, the vendor and the private label credit card

lender hereby agree that

has the right to claim the New York State sales tax bad debt refund or

(insert name of vendor or lender)

credit with respect to the accounts described below.

2. Accounts. The accounts covered by this election include any and all accounts and contracts, currently in existence or created in the

future pursuant to the contract between the vendor and the private label credit card lender, found to be worthless and charged off by the

private label credit card lender on or after __________________, that:

(mm/dd/yy)

• originated with the private label credit card lender pursuant to the private label credit card lender's contract(s) directly with the vendor who

reported the tax; or

• have been purchased by the private label credit card lender from the vendor pursuant to an agreement directly with the vendor who

reported the tax.

3. Date of expiration of contract between vendor and private label credit card lender. Enter the date of expiration of the contract

between the vendor and the private label credit card lender pursuant to which the accounts covered by this election form

originate: __________________.

(mm/dd/yy)

4. Agreement to waiver of secrecy provisions and sharing of information. In executing this election form, the vendor and the private

label credit card lender (or any other party designated to claim the refund or credit) each agree that the Tax Department may disclose any

relevant confidential information obtained from any source to all the parties involved in the application for the refund or credit, including any

party collecting on the account on behalf of any party, in order to determine the eligibility for and validity of any refunds or credits claimed or

any amounts due.

5. Agreement to furnish all requested documentation. In executing this election form, the vendor and the private label credit card lender

(or any other party designated to claim the refund or credit) each agree to furnish the Tax Department with any and all documentation

necessary to support the refunds or credits claimed.

6. Certification. This election cannot be amended or revoked except by filing a new election signed by all relevant parties. I certify that

the information on this election form is true, correct, and complete. I further certify that all the applicable conditions of former Tax Law

section 1132(e-1)(3) have been met. I make these statements with the knowledge that knowingly making a false or fraudulent statement

on this document is a misdemeanor under Tax Law section 1817 and a Class E felony under Penal Law section 175.35, punishable by

imprisonment for up to four years and a fine of up to $50,000 for an individual or $250,000 for a corporation. I understand that the Tax

Department is authorized to investigate the validity and accuracy of any information entered on this form.

Type or print name and title of owner, partner, or other authorized person of vendor

Signature of owner, partner, or other authorized person of vendor

Date

Type or print name and title of owner, partner, or other authorized person of private label credit card lender (or lender’s affiliate or assignee)

Signature of owner, partner, or other authorized person of private label credit card lender (or lender’s affiliate or assignee)

Date

(continued on page 2)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2