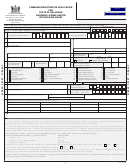

Form Dr-1s - Registration Application For Secondhand Dealers And/or Secondary Metals Recyclers

ADVERTISEMENT

DR-1S

Registration Application for Secondhand Dealers

R. 07/09

and/or Secondary Metals Recyclers

Rule 12A-17.005

Florida Administrative Code

Instructions for Completing Form DR-1S

A secondhand dealer, mail-in secondhand dealer, or secondary

You must complete a separate Registration Application (DR-1S) for

metals recycler must comply with the following before engaging in

each business location. Failure to submit all required forms will delay

business in Florida:

processing of your application.

•

Register with the Department of Revenue by completing a

Note: A business that engages in “pawnbroker” activities or title

Registration Application (DR-1S) for each business location in

loan transactions does not need to register as a secondhand dealer

Florida and paying application fees.

with the Department of Revenue. Pawnbrokers should register with

•

New applicants must send background investigation paperwork

the Florida Department of Agriculture and Consumer Services and

and processing fees for each business owner, officer, and

title loan companies should register with the Florida Department of

partner, including directors with a controlling interest in the

Banking and Finance.

company.

•

Secondhand dealers must register each location where they will

Registration Fees: The registration fee is $6.00 for each location.

purchase, consign, or trade secondhand goods.

For example, if you are registering three business locations, you must

include fees for three registrations (3 x $6.00 = $18.00).

Go to to order a registration package

(GT-200405). Registration packages are typically delivered within

seven to ten business days.

Background Investigation Requirements

Every applicant must use an FBI fingerprint card (provided by the

Every applicant seeking registration as a secondhand dealer, mail-in

Department) and have it completed by a local law enforcement

secondhand dealer, or secondary metals recycler is required to

official. If you did not receive a fingerprint card or need additional

undergo a background investigation. This includes corporations, sole

cards, you can order them from the Department’s Internet site. Go

proprietorships, partnerships, joint ventures, and any other type of

to to order additional FBI fingerprint cards

business entity.

(GT-200406).

Each owner, officer, and partner must provide a completed fingerprint

Background Investigation Fees: A background investigation fee

card and a full-face photograph with this application. Each director

must be paid for each owner, officer, partner, or stockholder or

with the ability to control the business and stockholder with a

director with a controlling interest. For fee amounts, refer to the

controlling interest must also provide a completed fingerprint card

cover letter included in the GT-200405 registration package or call the

and a full-face photograph with this application.

Department. The background investigation fee may be included with

A director with no ability to control the company may submit a

your payment for the registration fee. Make your check payable to

letter signed by an active principal corporate officer (president,

the Florida Department of Revenue.

vice-president, secretary, or treasurer) attesting that the director in

Mail the application, fingerprint cards, full-face photographs, and

question is not required to submit to a background investigation

fees to:

because he or she is not an owner of any interest, financial or

Account Management - Secondhand Dealer Unit

otherwise.

Florida Department of Revenue

Employees of secondhand dealers, mail-in secondhand dealers, and/

PO Box 6480

or secondary metals recyclers with no controlling interest, financial or

Tallahassee FL 32314-6480

otherwise, do not have to undergo background investigations. Do not

submit fees or paperwork to the Department for employees.

For Information and Forms

Information and forms are available on our Internet site at:

Get the Latest Tax Information

Sign up to get e-mail notices automatically when we post:

• Tax Information Publications (TIPs).

To speak with a Department of Revenue representative,

• Facts on Tax, a quarterly publication.

call Taxpayer Services, Monday through Friday, 8 a.m. to

• Proposed rules, notices of rule development workshops,

7 p.m., ET, at 800-352-3671.

and more.

Sign up at:

Persons with hearing or speech impairments may call our

TDD at 800-367-8331 or 850-922-1115.

For a written reply to tax questions, write:

Taxpayer Services

Florida Department of Revenue

5050 W Tennessee St Bldg L

Tallahassee FL 32399-0112

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4